There are many critical lessons to be learned from the financial crisis that began in the fall of 2008 and how it has since been handled. The federal government responded aggressively – at a huge cost – but nearly two years later little progress has been seen in the country's economic health. If the nation's financial services industry is to be revived, the system needs to be restructured and rebuilt from the ground up.

The Financial System Is Fragile. It is clear that the current financial system is incredibly fragile, and politicians are fully prepared to publicly advertise its fragility in order to score political points. Moreover, the federal government is, to a large extent, a wholly-owned subsidiary of the financial sector. Simon Johnson, the Ronald A. Kurtz Professor of Entrepreneurship at the Massachusetts Institute of Technology Sloan School of Business, puts it this way: "Banks have control of the state. They got the bailout, they got the money they needed to stay in business, they got a vast line of credit from the taxpayer. If the economy turns around, even if we get a recovery that's not completely convincing but we sort of feel like we're not falling, the pressure will come off the banks. They know this."

The Financial System Is Fragile. It is clear that the current financial system is incredibly fragile, and politicians are fully prepared to publicly advertise its fragility in order to score political points. Moreover, the federal government is, to a large extent, a wholly-owned subsidiary of the financial sector. Simon Johnson, the Ronald A. Kurtz Professor of Entrepreneurship at the Massachusetts Institute of Technology Sloan School of Business, puts it this way: "Banks have control of the state. They got the bailout, they got the money they needed to stay in business, they got a vast line of credit from the taxpayer. If the economy turns around, even if we get a recovery that's not completely convincing but we sort of feel like we're not falling, the pressure will come off the banks. They know this."

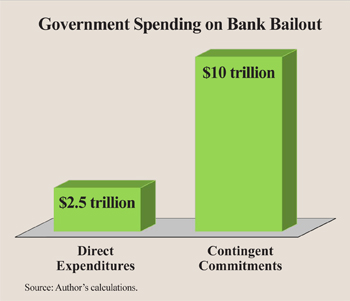

The Federal Government Is Making Promises It Cannot Keep. The federal government is willing to explicitly and implicitly guarantee large bailouts that it is in no position to guarantee. Its financial commitments far exceed its capacity to pay them. Indeed:

- Around $12.5 trillion has been pledged by the federal government ($2.5 trillion in direct expenditures and roughly $10 trillion in contingent commitments) to keep the financial sector afloat. [See the figure.]

- The fiscal gap in the United States (the difference between the government's official debt plus its discretionary spending and the amount of taxes current and future citizens will pay) is currently estimated by Jagadeesh Gokhale of the Cato Institute and Kent Smetters of the University of Pennsylvania at $77 trillion.

- This is more than five times the United States' present gross domestic product.

The rescue effort was meant to convince the American public that the slow response to the financial collapse that occurred in the 1930s would not be repeated, and that the economy and financial markets would quickly return to normal. However, the U.S. economy is still in trouble and people are still losing jobs. After almost two years, there is increasing concern that the Bush-Obama economic rescue effort has failed and will instead spell massive tax hikes, hyperinflation and high interest rates.

Keynesian Economics Is Not the Answer. Decades of research by economists on macroeconomic coordination failures – showing that expectations of bad (good) times can produce bad (good) times – has been entirely ignored in favor of 1960s-style Keynesian economics. Keynesian economics is predicated to a large extent on assumptions about price and wage rigidity.

The Keynesian prescription for major economic downturns is to both spend and print money like mad. The federal government has done both in hopes of stimulating the economy without clear success. However, rather than admit the strategy is not working (or not working very well), many Keynesian economists are claiming the government needs to spend and print even more money.

What proponents of Keynesian economics are missing is that beliefs about the economy's underperformance can be self-fulfilling. Prices and wages can adjust to clear markets at different levels of economic activity – ones in which there is full employment and ones in which there is massive unemployment. In fact, today's multiple equilibria mathematical models show that confident economies can have functioning markets and scared economies can also have functioning, albeit poorly-performing, markets. The U.S. economy is down because distrust is high. The models also show there is nothing that ensures the country ends up with a confident economy, especially when politicians, as they did in fall 2008, try to score points by claiming that the sky is falling.

How to Avoid Future Financial Crises. The underlying cause of crises in our financial system is not people taking risks. It is people risking other people's money without their knowledge, understanding and consent – in investments that are backed by implicit government guarantees. In the latest crisis, bankers invested depositors' and other creditors' money in risky instruments, including collateralized debt obligations, many of which were, themselves, invested in fundamentally fraudulent securities. When the investments failed, financial institutions and corporations that were too large to fail were propped up, bailed out or bought out by the federal government.

The way to avoid these recurring crises and restore trust is to return the financial system to its principal function: bringing together suppliers and demanders of funds. This could be done by requiring all financial corporations, including insurance companies, to adopt the pass-through model of asset ownership used by mutual funds. Financial corporations' mutual funds would be owned solely by their customers (the public). Hence, the public (investors) would take risks, not the financial industry.

This would eliminate the need for government guarantees and a host of regulatory agencies. The federal government would create transparency by certifying and disclosing all the financial statements in all financial securities purchased by the mutual funds and also by arranging for independent ratings and appraisals of these securities. It would not tell anyone how much they could borrow or how much risk they could take. Individuals would decide what mutual funds to buy, but they would do so knowing, to the maximum extent possible, what it is they are buying.

Laurence J. Kotlikoff is a professor of economics at Boston University and a senior fellow with the National Center for Policy Analysis. This article is adapted from his forthcoming book, Jimmy Stewart Is Dead: Ending the World's Ongoing Financial Plague with Limited Purpose Banking.