Most proposals to address Social Security's looming insolvency would integrate a private investment component into the current system, allowing younger workers to fund part of their own future benefits by investing a portion of their Social Security taxes today.

Opponents of personal retirement accounts suggest other ways to address Social Security's long-term insolvency. One of the most common alternatives would raise or eliminate the Social Security payroll tax cap on wages. While removing the cap would somewhat reduce the program's long-term debt, it would create significant unintended consequences for taxpayers and the economy.

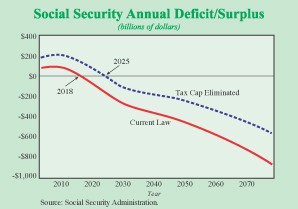

Social Security's Pay-As-You-Go Funding. Social Security pays benefits to today's retirees with tax payments from today's workers. When current workers retire, their benefits will be paid by future workers. This system works as long as there are enough people working to pay the bills. But when the 77 million baby boomers retire, the amount the rest of us contribute won't cover all the new retirement checks. In 2018 Social Security will begin paying more than it will collect in taxes, and the deficits begin to grow larger over time.

What is the Social Security Tax Cap? The Social Security payroll tax is 12.4 percent of wages – half from the employee, half from the employer. The wage cap establishes the maximum earnings to which the Social Security payroll tax applies. The level is currently set at $87,900, and it automatically rises with inflation each year. Because of the cap, the maximum Social Security payroll tax is about $10,900 per year. (Note: An additional payroll tax of 2.9 percent is collected on all wages for Medicare.)

Two Ways to Eliminate the Payroll Tax Cap. The payroll tax cap could be eliminated in one of two ways:

- The payroll tax cap could be eliminated and workers would earn benefits from the new payments;

- Or the cap could be eliminated and workers would not accumulate new benefits.

Both options would increase Social Security tax collections. The first option would also increase Social Security's cost in later years as higher-wage workers retire and collect larger benefits. The second option would break the link between contributions and benefits, making Social Security more like a welfare program than a social insurance program.

Effects of Eliminating the Payroll Tax Cap. A new Social Security Administration report estimates the effect of removing the payroll tax cap. It assumes wages subject to the tax will decline as many workers shift their incomes from covered wages to income sources not covered by the tax like stock options or other benefits. According to author calculations based on the report's findings, removing the cap would:

- Push back the date of Social Security's cash-flow deficit from 2018 until 2025 – giving Social Security only seven additional years of surpluses.

- Increase the Treasury bonds deposited in the Trust Fund by $3 trillion, up to $7 trillion at its peak.

- Increase Social Security's income by $14 trillion over the next 75 years, reducing Social Security's 75-year debt from $27 trillion to near $14 trillion, but still leaving a significant debt.

Eliminating the payroll tax cap immediately affects the 9.2 million Americans who earn more than $87,900, raising their marginal tax rate – the tax paid on each additional dollar of wage income – by 12.4 percent. As a result, earners in the top income tax bracket (35 percent) would pay more than half of each additional dollar they earn in taxes. For example:

- A family earning $100,000 would pay $1,500 more per year ($100,000 less $87,900 times the 12.4 percent payroll tax).

- A family earning a million dollars a year would face new Social Security taxes of $113,100.

Problem: Economic Costs of Raising the Tax Cap. Increasing the marginal tax rate will have adverse economic consequences. The Social Security payroll tax already has an economic cost. According to a recent NCPA study by economists Liqun Liu and Dr. Andrew J. Rettenmaier of the Private Enterprise Research Center at Texas A&M University , the current system encourages people to work fewer hours and produce fewer goods and services, relative to an efficient tax system:

- The cost to society as a whole from the Social Security payroll tax alone is 11 cents to 18 cents for every dollar of tax revenue collected.

- This loss amounted to $49 billion to $82 billion in 2001, or as much as $804 for every household in America .

Increasing the payroll tax will exacerbate these already existing losses. According to the Heritage Foundation's Center for Data Analysis:

- Eliminating the cap would constitute the largest tax increase in American history – some $461 billion over the first five years alone.

- Over the first 10 years, it would cost the economy nearly $136 billion in lost growth and cause the loss of more than 1.1 million new jobs.

Problem: The Social Security Trust Fund Can't Save the New Money. For the next 14 years, Social Security is projected to run a small, declining annual surplus, which is supposedly saved in the Trust Fund. By 2018, under current law, the Social Security Trust Fund will be credited with some $5 trillion.

But there is no cash in the Trust Fund. Every dollar collected by the Trust Fund is immediately "borrowed" by the U.S. Treasury and used to fund other programs or pay down debt. Meanwhile, the Trust Fund's cash is replaced with special U.S. Treasury bonds. Benefits cannot be paid unless the bonds are cashed in, and the only way to cash in the bonds is for the U.S. Treasury to increase income taxes, cut spending on other programs or borrow. Thus, every dollar put in the Trust Fund will have to be raised again in the year the fund's bonds are needed to pay benefits. That requires a significant commitment of resources from future taxpayers. For this reason, the date on which Social Security begins paying more in benefits than it collects in taxes (currently 2018) is more important than the Social Security Trust Fund exhaustion date (currently 2042).

As noted above, elimination of the payroll tax cap pushes back Social Security's first negative cash flow year for only seven years, and increases the Social Security trust fund's bonds by some $3 trillion. But like the holdings of the current trust fund, every dollar is spent and must be raised again when the bills are due.

Personal Retirement Accounts Improve the Tax Cap Increase. As noted earlier, one of the problems with raising the Social Security tax cap is that there is no way to save the newly-generated revenues. Any cash collected will be spent on other government priorities and replaced with IOUs, as occurs under current law. If the payroll tax cap must be eliminated, personal retirement accounts could capture the new revenues and ensure the new funds are saved for retirement spending.

Conclusion. While eliminating the Social Security payroll tax cap would reduce the funding gap somewhat, it has only a marginal effect and comes with a huge economic cost.

Matt Moore is a Senior Policy Analyst with the National Center for Policy Analysis.