President Bush has barnstormed across the country promoting Social Security reform. So far, the president has proposed two primary ideas: 1) Allow younger workers to prefund a portion of their retirement benefits by creating personal retirement accounts equal to 4 percent of wages, and 2) Use "progressive indexing" to reduce the growth in benefits for higher earners.

These two measures combined, if structured and administered properly, can provide retirement benefits equal to what workers are scheduled to receive from the current system, while significantly reducing Social Security's long-term debt.

Progressive Indexing. Social Security benefits for all new retirees are determined by averaging a worker's 35 highest-earning years and putting his or her average wage through a benefit formula. Since the purchasing power of a dollar earned 35 years ago is not equal to the purchasing power of today's dollars, the worker's earnings are adjusted, or indexed, to the annual increase in average wages nationwide. Given that wages typically rise faster than prices, the real purchasing power of the average Social Security benefit paid to new retirees will increase more than 60 percent over the next 50 years.

Unfortunately, under current law, Social Security cannot afford to pay what is scheduled. Robert Pozen, a member of President Bush's 2001 Commission to Strengthen Social Security, has proposed progressive indexing as part of a reform that results in a sustainable program in the long run. Under the Pozen approach:

- Benefit calculations would not change for current retirees, near retirees, or income earners in the bottom 30 percent (about $25,000 a year or less). These workers would receive the same Social Security benefits scheduled under current law.

- However, starting in 2012, initial benefits for the highest earners would be determined by the growth in prices, rather than wages.

- The growth each year in initial benefits for workers between $25,000 and the maximum would be set by a progressive mix of prices and wages.

Thus, with progressive price indexing, Social Security benefits for the highest earners would not receive the additional boost from real wage growth, but the Social Security benefits of lower earning workers would be the same as those currently scheduled. The Bush administration's framework combines progressive indexing with personal retirement accounts to supplement the revised Social Security benefits.

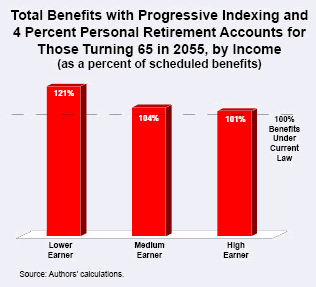

Progressive Indexing and Personal Retirement Accounts. In keeping with the president's framework, we have analyzed how personal retirement accounts combined with Pozen-inspired progressive indexing would work for low, medium and high income earners. For most retirees, the combined payments from the personal accounts and the reformed defined benefits are comparable to currently scheduled Social Security benefits. Those with lower lifetime earnings would actually receive higher total benefits.

The personal account balance is accumulated by depositing 4 percentage points of a worker's payroll taxes in his or her account – up to $1,000 annually – starting in 2009. After 2009, the maximum contribution rises each year by $100 plus wage growth, resulting in 4 percent accounts for all workers, including those who earn the taxable maximum, within about 40 years. At retirement, a worker's account balance would be used to purchase an inflation-protected lifetime annuity.

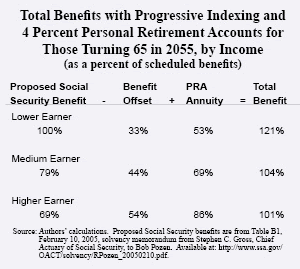

The figure shows total retirement benefits as a percent of scheduled benefits under current law for workers who reach age 65 in 2055. The table shows that low earners' reformed Social Security benefits equal 100 percent of currently scheduled benefits. For medium earners, the reformed Social Security benefits will equal 79 percent of currently scheduled benefits and for high earners, 69 percent.

The second and third columns in the table present the benefit offset (explained below) and the annuity payment as a percent of currently scheduled benefits. Total benefits equal the reformed Social Security benefit less the benefit offset plus the annuity.

How does the benefit offset work? Workers who open a personal account must accept a reduction in their reformed Social Security retirement benefit. The amount of the reduction is determined by the monthly annuity that could be purchased with the account balance if it were invested at the government's borrowing rate. The benefit offset allows the reformed program to repay taxpayers for the costs of the transition to a new system, which in the absence of new taxes, must be funded through borrowing. However, the combination of the new current debt and the ultimate offset repays all the borrowing with interest and thus implies no net change in the government's total debt position. And, the progressively indexed benefits will reduce the government's implied debts.

The table shows that the difference between the offset and the annuity produces a net benefit that, when added to the reformed Social Security benefit, results in the total retirement benefit. Low earners receive total benefits that are as much as 21 percent higher than currently scheduled benefits. For example, a medium earner retiring in 2055 will receive a taxpayer-funded benefit equal to 79 percent of scheduled benefits due to the program's price indexing. The benefit offset as a result of opening a personal retirement account leads to a reduction equal to 44 percent of scheduled benefits. The worker's personal account annuity benefit equals 69 percent of scheduled benefits.

Depending on their year of retirement from 2015 to 2075, total benefits for medium earners range from 4 percent lower to 4 percent higher than currently scheduled benefits. High earners, whose reformed defined benefits are almost entirely based on price-indexed wages, would receive total benefits that are 89 percent to 101 percent of currently scheduled benefits.

Conclusion.A reform that includes 4 percent contributions, a rising contribution limit and progressive indexing will produce, for most workers, average total benefits comparable to currently scheduled benefits. Progressive indexing ensures that the Social Security benefits of lower income workers will be unaffected by reform while simultaneously giving them increased retirement savings through their personal retirement accounts.

| Year turn 65 | Proposed Social Security Benefit | – | Benefit Offset | + | Annuity | = | Total Benefit |

|---|---|---|---|---|---|---|---|

| Low Earner | |||||||

| 2015 | 100% | 3% | 3% | 100% | |||

| 2025 | 100% | 11% | 13% | 102% | |||

| 2035 | 100% | 20% | 27% | 107% | |||

| 2045 | 100% | 30% | 45% | 115% | |||

| 2055 | 100% | 33% | 53% | 121% | |||

| 2065 | 100% | 32% | 52% | 120% | |||

| 2075 | 100% | 31% | 50% | 119% | |||

| Medium Earner | |||||||

| 2015 | 99% | 4% | 5% | 100% | |||

| 2025 | 94% | 14% | 16% | 96% | |||

| 2035 | 89% | 27% | 35% | 97% | |||

| 2045 | 84% | 40% | 60% | 104% | |||

| 2055 | 79% | 44% | 69% | 104% | |||

| 2065 | 76% | 42% | 67% | 101% | |||

| 2075 | 72% | 42% | 66% | 96% | |||

| High Earner | |||||||

| 2015 | 99% | 5% | 5% | 99% | |||

| 2025 | 90% | 15% | 17% | 92% | |||

| 2035 | 83% | 28% | 36% | 91% | |||

| 2045 | 76% | 44% | 65% | 97% | |||

| 2055 | 69% | 54% | 86% | 101% | |||

| 2065 | 64% | 53% | 84% | 95% | |||

| 2075 | 58% | 51% | 82% | 89% | |||

|

Notes: Percentages are rounded. Earnings projections for low, medium, and high earners are based on male earners with less than high school, high school and college educations, respectively. The accounts are invested in 60 percent stocks, 24 percent corporate bonds, and 16 percent government bonds. The returns assumed are 6.5, 3.5, and 3.0 percent, respectively. The share of stocks begins to decline at age 57, reaching 20 percent by age 62. Total benefits for high income workers decline as a share of scheduled benefits after 2055 due to the continued decline in the reformed defined benefit as well as increased longevity, which implies a longer annuity period. In later years costs fall below projected revenues. Source: Authors' calculations. Reformed Social Security Benefits are from Table B1 in the February 10, 2005, solvency memorandum from Stephen C. Goss, Chief Actuary of Social Security, to Bob Pozen. |

|||||||

Dr. Andrew J. Rettenmaier and Dr. Thomas R. Saving are NCPA senior fellows and executive associate director and director, respectively, of the Private Enterprise Research Center at Texas A&M University.