Rising oil and gasoline prices have many causes that are beyond the control of the U.S. government. However, government policies have contributed to higher prices by reducing domestic refining capacity, which has limited the supply of gasoline. No new oil refineries have been built in the United States for almost 30 years, and many refineries have closed. Building new oil refineries or expanding existing ones is among the most affordable, effective and reliable ways to increase supplies of gasoline and diesel fuels and to lower prices.

Unfortunately, environmental regulations, requirements for so-called boutique fuels and mandates for ethanol have raised the cost of building new refineries. Increasingly, it is cheaper to import refined petroleum products instead of producing fuel here. The energy bills currently being considered by Congress are likely to discourage new refinery construction rather than encourage it. These policies will not lower prices at the pump or increase energy security.

Fewer, More Efficient Refineries. The domestic oil refining industry has become much more efficient since the deregulation of oil and gas prices. From 1959 to 1981, the federal government subsidized smaller refineries with quotas and preferred access to imported oil. When the subsidies were abolished in 1981, these refineries shut down. As a result:

- The number of refineries fell from 324 in 1981 to 223 in 1985, and domestic refining capacity dropped by almost three million barrels per day (b/d).

- By 2006 the number of U.S. refineries had slipped to 149.

Total refining capacity fell as small refineries closed, but the capacity of the remaining refineries has grown due to expansions and improvements in efficiency. For example, due to efficiency improvements refineries that operated at 78 percent of their maximum capacity in the 1980s, on the average, have produced more than 90 percent of their potential output since 1993. However, higher utilization rates increase the seasonal volatility of gasoline prices. Refineries cannot pick up the slack caused by shortages which arise when capacity is taken off-line because of maintenance or natural disaster. Thus, outages cause supply to fall and prices to rise. In the summer of 2007, for example, the loss of output from two refineries led to a gasoline price increase of 24 cents in the Midwest.

Unfortunately, for reasons discussed below, the older, inefficient plants were not replaced with new, more efficient plants, and the increased capacity and efficiency gains at existing plants have not kept pace with growing demand. As a result, over the past few decades the United States has increased imports of gasoline refined in other countries. The Federal Trade Commission notes that from 1992 to 2004, the U.S. annual average of weekly gasoline imports more than doubled from 4.7 percent to 9.7 percent of gasoline used.

Gasoline demand has increasingly outstripped domestic supply:

- In 1981, the 18.6 million barrels per day (b/d) capacity of U.S. refineries exceeded the nation's daily consumption of slightly more than 16 million barrels.

- Between 1981 and 2005, U.S. oil consumption grew 29.7 percent to nearly 21 million b/d.

- But refinery capacity in 2005 was 17.1 million b/d — 8.1 percent less than in 1981.

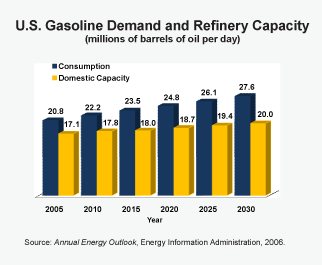

The gap between refinery capacity and consumption is expected to grow [see Figure I]. The Energy Information Agency estimates consumption will increase 19.2 percent to 24.8 million b/d by 2020. Refinery capacity will rise only 9.4 percent. This means refining capacity will only be 100,000 barrels a day more in 2020 than it was in 1981.

Regulations Inhibiting the Construction of New Refineries. Emissions controls, mandates for gasoline blends and alternative fuel requirements have forced many refineries to close and have made building new oil refineries extremely difficult.

Regulations Inhibiting the Construction of New Refineries. Emissions controls, mandates for gasoline blends and alternative fuel requirements have forced many refineries to close and have made building new oil refineries extremely difficult.

Clean Air Regulations. Clean Air Act amendments in 1990 and 1997 required refineries to limit emissions of air pollutants and to make cleaner reformulated fuel. This forced refiners to install expensive pollution-control technology when they modified existing plants. These air quality gains carried a high price tag:

- Throughout the 1990s, nearly 25 percent of the capital investment in refineries was to comply with environmental regulations.

- Between 1992 and 2001, the oil industry spent more than $100 billion to bring oil refineries into compliance with environmental regulations.

This has led to the closure of additional refineries. For instance, Premcor, an oil producer and refiner, was compelled to close down two of its Illinois oil refineries because it could not afford the upgrades necessary to meet specifications for new refined products. Modifications in one refinery alone would have cost $70 million.

Clean air regulations have also discouraged the construction of new facilities. For example, construction of a new refinery in Arizona has been delayed for almost 10 years. When developers initially planned to begin construction in 1997 it would have been the first new refinery built in 20 years. But concerns regarding its impact on air quality and the proposed site of the plant have delayed construction even after the plant received the required air permits. Now, even under the best circumstances, construction will not start until 2008 and the plant will not be operational until 2011.

Arguably, the trade-off between air quality and higher costs for domestic refineries was worthwhile. However, air quality has improved enough that air pollution doesn't threaten public health — even in the most polluted cities and regions. Despite this, the EPA is considering imposing a stricter ozone standard that would be lower than the natural background level of ozone in some areas. The new standard would make it almost impossible to expand capacity at existing refineries or to build refineries in new locations without violating the ozone standard.

Boutique fuels. In order to fulfill various air pollution reduction plans, gasoline sold in the United States has been fractionated into about 17 different boutique fuels. With three grades of gasoline per fuel, refiners are producing over 50 separate blends.

The U.S. Government Accountability Office notes that producing these gasoline blends requires the installation of expensive equipment and the different blends must be transported separately, which limits pipeline and storage capacity. Furthermore, it is difficult to replace supplies when there are disruptions, since there are few alternatives sources of the required blends. In addition, refining capacity is taken off-line to clean tanks and pipelines when switching from required winter blends to summer blends and back again. As a result, refinery capacity becomes severely constrained seasonally, resulting in gas price spikes.

Ethanol Mandates. Congress is pushing ethanol as a way to curtail demand for gasoline by 20 percent over the next decade. Accordingly, the 2005 energy bill mandated the annual use of 8 billion gallons of ethanol in gasoline blends, and an energy bill recently passed by the U.S. Senate would increase the mandate to 36 billion gallons. Since ethanol produces 35 percent less energy per volume than gasoline, it would take much more than 36 billion gallons of production to displace 20 percent of current gasoline demand of 385 million gallons per day — an amount much lower than the one third-increase in gasoline use estimated to occur over the next 20 years.

Petroleum refiners have responded to existing and proposed expanded ethanol mandates by cancelling 40 percent of planned expansions in capacity, reducing potential new output from 1.6 million b/d to less than one million b/d.

Conclusion. A variety of government policies have reduced domestic refining capacity and threaten to limit future expansion, despite growing demand and significantly higher fuel prices. Absent government intervention in the market, refinery capacity would be expected to expand, reducing consumer prices. More economical and secure energy supplies are available if government will get out of the way.

H. Sterling Burnett is a senior fellow and D. Sean Shurtleff is a student fellow with the National Center for Policy Analysis.