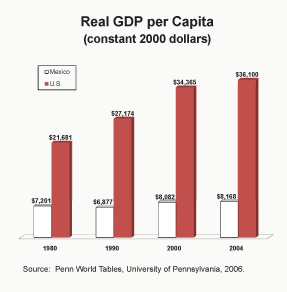

Over the last 25 years, the wage gap between Mexico and the United States has grown progressively wider, making U.S. jobs increasingly attractive. This is a major reason for the increasing influx of immigrants from Mexico to the United States. As the figure shows, after adjusting for inflation:

- America's real gross domestic product (GDP) per capita grew from roughly $21,700 in 1980 to $36,100 in 2004, while Mexico's rose only slightly from $7,200 to almost $8,200.

- Wage rates closely track per capita GDP; this means that average pay in America rose from being 3.0 times higher than Mexico's in 1980 to nearly 4.5 times higher in 2004.

Wage levels are determined by the growth of a country's economy and population. Although Mexico's population has grown faster than the United States', most of the increasing disparity is due to faster economic growth in the United States.

Growth and Economic Freedom. A number of studies have shown that an economy's growth rate is positively related to the degree of economic freedom in that country. Economic freedom, which is a prerequisite for economic growth, means institutions that are characterized by personal choice, voluntary exchange, freedom to compete and protection of person and property. It requires such public policies as open markets, limited government, stable monetary growth, free trade and a strong rule of law. For example, an NCPA study by economists James Gwartney and Robert Lawson found that:

- From 1993 to 2002, the top fifth of countries (those with the most economic freedom) grew considerably faster than others, whereas the bottom fifth of countries (those with the least economic freedom) experienced negative growth.

- Over the decade, the freest nations averaged annual economic growth of 2.4 percent, while the economies of the least-free nations contracted by 0.5 percent a year.

In Mexico, factors that have limited economic freedom for decades include unsound monetary policy, government corruption and insecure property rights. Improvement in these and other areas have increased economic freedom in recent years.

Unsound Monetary Policy. NAFTA's Promise and Reality, a study from the Carnegie Endowment for International Peace, describes two particular monetary episodes in Mexico that stifled capital investment and suppressed wages. First, during the 1980s, Mexico expanded its money supply to meet the government's debt payments and underwent price inflation as high as 132 percent per year. This discouraged foreign capital investment and reduced real wages from $7,200 in 1980 to approximately $6,900 in 1990.

Second, Mexico drastically devalued the peso in 1994-1995 as foreign investors pulled their money out of Mexico's capital markets. Sadly, this once again destroyed foreign investors' trust in Mexico's monetary policy and reduced any gains in real wages achieved since the early 1990s.

Government Corruption. Although Mexico's economy is more open to trade and has freer markets, it still has very high levels of corruption. For instance, on Transparency International's Corruption Perceptions Index, a survey of international businessmen that ranks countries from least to most corrupt, Mexico is tied for 72nd place out of 179 countries. This is even lower than such notoriously corrupt countries as drug-ridden Colombia.

Corruption undercuts economic freedom in many ways. In places like Mexico, where the judicial system shows political favoritism and the police force is known for accepting bribes, foreign and domestic investors are afraid to invest in capital projects or businesses because their investments are not well protected from criminals and political instability. A survey by the Center for the Study of Private Sector Economics (Centro de Estudios Economicos del Sector Privado), a Mexican research firm, estimates that 79 percent of companies in Mexico believe “illegal transactions” are a serious obstacle to business development. At the same time, corruption increases the cost of doing business as domestic and foreign firms are required to pay bribes to obtain business permits or access public utility services. According to Global Integrity's 2006 Mexico Country Report, corruption costs the Mexican economy as much as $60 billion a year.

Insecure Property Rights. Limited property rights also impede Mexico's economic development. Under the ejido system implemented in 1917, the Mexican government distributed public lands to peasants for agricultural use but disallowed private ownership. According to the U.S. Department of State, this severely inhibited capital growth because the peasant-stewards could not use the land as collateral to borrow money. Also, Latin expert Alvaro Vargas Llosa, director of the Center on Global Prosperity at the Independent Institute, claims that because peasants had no property rights over the land, local political-party bosses and crime cartels were able to wrest control of the land away from communities and dictate its uses, ensuring a life of poverty for most farmers.

Even though Mexico liberalized its economy in the early 1990s, the lack of capital infrastructure and the communal land system continued to suppress investment. Thus, Vargas Llosa concludes that when the Mexican government did finally allow peasants to sell their land in the 1990s, many farmers did just that in order to immigrate to America, where wages were (and still are) much higher.

Recent Rise in Economic Freedom. The Economic Freedom of the World 2007 Annual Report (EFW) shows that Mexico's economy has become freer in recent years. The EFW report measures economic freedom based on the "size of a country's government, the legal structure and security of property rights, access to sound money, freedom to trade internationally and regulation of credit, labor and business." All these factors are scored individually on a scale of 0 to 10, with 10 being the most free and 0 the least free, and they are then averaged to derive a country's overall economic freedom score, which also ranges from 0 to 10.

From 1980 to 2005, Mexico's level of economic freedom score rose from 5.5 to 7.1. Part of the rise can be attributed to reining in inflation and pursuing better monetary policy. In 1985, when inflation was near its worst, Mexico had a sound money score of 3.3, but by 2005 that score had risen to 8.1. This was the largest increase among all the five major components of economic freedom previously listed.

Another way Mexico has recently expanded its economic freedom is by opening its economy to international trade. In 1994, Mexico, the United States and Canada enacted the North American Free Trade Agreement (NAFTA), which reduced tariffs and quotas on most imports. NAFTA has lowered prices and increased foreign direct investment. All three trading partners benefited from the increased ability to exploit their comparative advantages — exporting those products they are especially efficient in making while importing products that could be made more cheaply by their regional neighbors. Mexico has benefited greatly:

- Mexican exports to the United States increased five-fold, from $39.9 billion in 1993 to $198.3 billion in 2006.

- Foreign direct investment in Mexico rose from an average of $4 billion per year between 1990 and 1993 to $16 billion per year from 1994 to 2005.

Conclusion. Wages in Mexico will not improve markedly until further reforms are made in property rights and rule of law. These two problems hamper economic growth and cripple Mexico's ability to compete in global markets and attract foreign investment. Economic growth, in turn, would give workers more incentives to stay in Mexico, thereby curbing the massive immigration drain and raising living standards.

D. Sean Shurtleff is a student fellow with the National Center for Policy Analysis.