Signs of an economic slowdown, or recession, have prompted the Federal Reserve to lower interest rates. The Fed reduces interest rates by increasing the supply of money available to borrow. This additional money is distributed to banks and loaned to consumers. Assuming a constant demand for money, an increase in the quantity of money will cause interest rates to drop. But how does the Fed increase the money supply?

The Creation of Money by Banks and the Fed. First, consider what happens when you, as an individual, borrow money. Suppose you go to the bank and obtain a loan:

- The bank gets a new asset (your note) and a new liability (additional funds in your checking account).

- You have new money to spend, and the balance in your checking account, which is part of the nation's money supply, is raised by the amount of the deposit.

Banks are required to keep a percentage of their deposit liabilities as reserves, either on deposit at the Fed or in vault cash. When you spend the money and your check clears, your bank loses reserve deposits at the Fed and the other banks gain new reserve deposits at the Fed. Thus, reserves as well as deposits are redistributed among banks. The amount of money a bank can create by lending is limited by the amount of its excess reserves.

Creating Money through Open Market Operations. Unlike your bank, the Fed can create new bank reserves as well as money. The primary way the Fed does so is by buying and selling U.S. Treasury securities on the open market. For example:

- When the Fed buys $10 million of Treasury bills on the open market, it credits the selling banks' reserve accounts for $10 million.

- Since the reserves didn't come from another bank, one could say they were created out of “thin air.”

- The initial expansion of deposits and reserves will lead to an expansion of 10 times $10 million because each dollar of reserves will support roughly 10 times that amount in deposits.

The Federal Funds Market. At any given time, some banks will have more reserves than they currently need to fund loans and to invest while still meeting their reserve requirements. Other banks will need more reserves. This has resulted in an interbank market in reserve deposits at the Fed, where banks with excess reserves lend (sell) reserves to banks with a potential reserve deficiency. The interest rate that clears this market daily is called the Federal Funds rate. When the Federal Reserve wishes to affect short-term interest rates, it does so by raising or lowering its target for the Federal Funds rate. A lower target is usually associated with faster money growth; a higher target generally means slower money growth.

Creating Money through Repurchase Agreements. In the course of its open market operations, the Fed makes temporary (as well as permanent) changes in its reserves. To expand reserves temporarily, the Fed might buy bank-owned bonds for a day, or up to several days, with the banks' agreement to repurchase them. Through such repurchase agreements, banks get a temporary addition to their reserve balance, which goes toward meeting their reserve requirements over a 14-day reserve maintenance period.

During the early days of the credit crunch, the Fed's repo activity tripped up some television commentators, who overstated the quantity of funds injected into the banking system. If the Fed does a one-day, $1 billion repo to inject reserves today, another one tomorrow and an additional one the next day, $3 billion will have been injected, but $2 billion will have expired. Bank reserves are only $1 billion above previous levels, since the first repurchase agreement expired on the second day, the second one expired on the third day and so on.

During the early days of the credit crunch, the Fed's repo activity tripped up some television commentators, who overstated the quantity of funds injected into the banking system. If the Fed does a one-day, $1 billion repo to inject reserves today, another one tomorrow and an additional one the next day, $3 billion will have been injected, but $2 billion will have expired. Bank reserves are only $1 billion above previous levels, since the first repurchase agreement expired on the second day, the second one expired on the third day and so on.

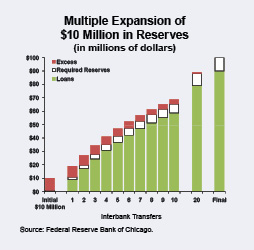

Multiple Expansions of Money through the Reserve Multiplier. As noted earlier, when the Fed purchases $10 million in Treasury bonds on the market and the bond sellers deposit the money, their banks have $10 million in new deposit liabilities and reserve assets. But the process of money creation doesn't end there. The Fed's purchase ultimately results in the creation of, say, $100 million in new money. Banks are required to hold a portion of their deposit liabilities at the Fed or in cash (the required reserve ratio). The reserve ratio is currently 10 percent, so the bond sellers' banks now have $9 million in additional excess reserves. As those funds are loaned out, the borrowers deposit the loan proceeds in their banks. The banks will keep lending their excess reserves until $90 million of new loans and deposits are added to the banking system. [See the figure.] The $90 million, plus the original $10 million, total $100 million of new money. (Withdrawals of cash during this process will reduce the multiplier effect.)

Creating Money through the Discount Window. When a bank needs new reserves to support loans and investments it has already made or anticipates making, it ordinarily borrows from other banks at the Federal Funds rate. But during times of stress, which are reflected by a shortage of liquidity in many banks, the whole banking system needs new reserves — hence the Fed's discount window.

When a bank borrows funds overnight from the Fed's discount window (at an interest rate the Fed sets, called the discount rate), the bank's reserve account at the Fed is credited with the amount borrowed (and the Fed adds to its assets the additional amount owed to it by the borrowing bank). Since the borrowing bank gets new reserves and no other bank lost reserves, net new reserves have been created for the banking system as a whole. If the amount is also $10 million, the banking system as a whole has a new capacity to expand loans and deposits by as much as $100 million. Thus, the Fed's open market purchases and discount window loans have the same ultimate impact on the money supply, at least until the discount window loans are repaid.

Creating Money through the Term Auction Facility (TAF). The discount window is an effective mechanism for directing new money where it is needed; however, borrowing from the discount window may carry a stigma, especially in times of stress. A few months ago, the Fed authorized a Term Auction Facility (TAF), which allows banks to bid on funds from the Fed for longer periods at interest rates determined by auction. For instance, one auction in December released a total of $20 billion to 93 different institutions at an interest rate lower than the discount rate. Whether new money is created by this process depends on whether or not the Fed sterilizes it — that is, offsets it on its balance sheet with open market operations.

Which Is Better during a Banking Crisis? While the potential for monetary expansion is similar, there are important differences between the Fed's open market operations and lending at the discount window:

- Open market operations are done at the Fed's initiative to affect the aggregate reserves of the banking system and/or to influence the federal funds rate — the price of those reserves.

- Loans from the discount window are done at the initiative of the borrowing banks; thus, reserves are injected into the system at the point of need.

- In this way the discount window may be more useful in times of stress or crisis than open market operations.

Moreover, the key difference between the Fed's ability to create money and any individual bank's ability to do so is that since almost all banks have accounts at the Fed, new Fed lending does not lead to a loss of funds from the banking system.

Bob McTeer is a distinguished fellow and Pamela Villarreal is a policy analyst with the National Center for Policy Analysis.