Nationwide, average retail gasoline prices are nearing the all-time inflation-adjusted high of $3.40 a gallon reached in 1981, lending urgency to renewed calls for U.S. energy independence. Analysts often tout Brazil as the epitome of energy self-sufficiency. Brazil imported more than 80 percent of its oil in the 1970s, but it likely reached energy independence by the end of 2007, according to projections from the U.S. Energy Information Administration (EIA). Brazil's success is commonly attributed to its thriving ethanol market, but this is at most only a small part of the story. More critical to Brazil's energy independence is its significant increase in domestic oil production.

In December, President Bush signed into law the Energy Independence and Security Act of 2007, which mandated that refiners increase the amount of ethanol blended into gasoline from 5.4 billion gallons in 2005 to 9 billion gallons in 2008 and 36 billion gallons by 2022. This policy seeks to emulate Brazil by increasing the use of ethanol, but in many respects it is misguided because Brazil's energy situation is so different from that of the United States.

Brazil's Ethanol Program. In 1975, primarily in reaction to skyrocketing oil prices, Brazil launched its National Alcohol Program, ProAlcool. The Brazilian government created new infrastructure to produce ethanol from sugarcane as a replacement for gasoline and subsidized the sugar industry in response to a precipitous drop in sugar prices in 1974. It provided credit guarantees and low-interest loans to finance the construction of new refineries and required Petrobras, the state-owned oil company, to install ethanol pumps at gas stations and sell ethanol at prices significantly lower than gasoline. In 1979, the government began subsidizing the production of ethanol-powered automobiles through tax breaks.

Huge budget and trade deficits and high inflation in the mid-1980s forced Brazil to scale back ethanol subsidies. In 1988, rising international sugar prices and Brazil's liberalization of the sugar export market prompted refiners to dedicate more resources to sugar exports than to ethanol production. Massive ethanol shortages followed, forcing Brazil to become a net ethanol importer.

As Brazil continued to reduce ethanol price supports and subsidies in the 1990s, demand for ethanol declined. By mid-decade the only ethanol-powered vehicles being sold were rental cars and taxis. Nevertheless, the government continued to require that 20 percent of the fuel supply consist of ethanol. The introduction of flex-fuel vehicles in recent years sparked a resurgence in Brazil's ethanol industry. By 2006, these vehicles captured 73 percent of the market for new cars.

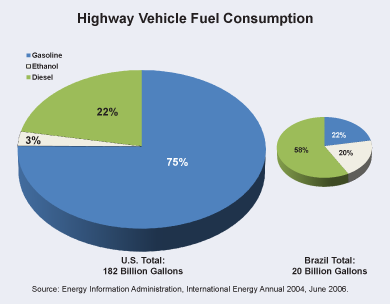

Ethanol: Less than Meets the Gas Tank. Advocates of energy independence cite Brazil as an example when calling for increased ethanol production mandates in the United States, but they often misrepresent or misunderstand the facts concerning Brazil's energy make-up. In August 2006, the Washington Post reported that ethanol in Brazil “has replaced about 40 percent of the country's gasoline consumption,” a figure commonly cited by newspaper outlets. But this is misleading, as EIA data show:

- In 2006, ethanol made up about 48 percent of the fuel used by gasoline-powered passenger vehicles in Brazil.

- But including both gasoline-and-diesel-powered vehicles, ethanol supplied only 20 percent of the total fuel consumed by automobiles and trucks on Brazilian highways.

Oil: The Sheep in Wolf's Clothing. After the 1980s' ethanol shortages, Brazil began to recognize that ethanol production alone would not lead to energy independence. Instead, it started promoting policies to boost domestic oil production. Indeed, increased production and new oil discoveries played the biggest role in liberating Brazil from dependence on foreign energy sources. According to the EIA:

- Brazil increased domestic crude oil production an average of more than 9 percent a year from 1980 to 2005, to 1.6 million barrels of oil per day.

- Most notably, in 2007, Brazil announced a huge oil discovery off its coast that could increase its 14.4 billion barrels of oil reserves by 5 billion to 8 billion barrels, or 40 percent.

By contrast, from 1980 to 2005, U.S. crude oil production fell an average of about 2 percent a year, or 40 percent overall, from 8.6 million barrels of oil per day to 5.2 million.

Why the Brazil-U.S. Analogy Fails. Policy analysts who want to replicate Brazil's success ignore the significant differences between energy markets in Brazil and the United States. First, Brazil is depicted as having the largest ethanol industry, but that is no longer the case. According to the Renewable Fuels Association, the United States produced 4.8 billion gallons in 2006 compared to 4.5 billion gallons in Brazil.

Why the Brazil-U.S. Analogy Fails. Policy analysts who want to replicate Brazil's success ignore the significant differences between energy markets in Brazil and the United States. First, Brazil is depicted as having the largest ethanol industry, but that is no longer the case. According to the Renewable Fuels Association, the United States produced 4.8 billion gallons in 2006 compared to 4.5 billion gallons in Brazil.

Second, ethanol advocates wrongly assume America's ethanol industry can displace the same percentage of oil as Brazil's. But while Brazil consumes 20 billion gallons of fuel a year (ethanol, gasoline and diesel) to fuel highway vehicles, of which 4 billion is ethanol, the United States uses 182 billion gallons a year — over 9 times as much [see figure]. Thus:

- It would take more than 36 billion gallons of ethanol just to replace 20 percent of current U.S. highway fuel consumption.

- That is almost double the total amount of fuel Brazilian highway vehicles use in a single year and almost triple the entire world's production of ethanol in 2006.

- Furthermore, U.S. fuel consumption for highway vehicles is expected to increase by more than one-third in the next 20 years.

In addition, researchers Max Borders and H. Sterling Burnett note that it would take 97 percent of all U.S. land to produce enough ethanol to replace 100 percent of gasoline.

Third, Brazil has a major comparative advantage over the United States in producing ethanol. Its climate is suited to growing sugarcane, which requires half as much land as corn per gallon of ethanol produced. Also, Brazil's sugarcane-based ethanol provides eight times the energy of the fossil fuel used to make it, while America's corn-derived ethanol provides only 1.3 times as much energy. Further, production costs in Brazil are far lower than in the United States because labor is cheaper and Brazil's ethanol infrastructure is more developed.

The higher production costs for corn-based U.S. ethanol means that it cannot compete with Brazilian ethanol imports. Thus, the U.S. government imposes a 54 cent per gallon duty, 2.5 percent tariff and 7 percent quota on Brazilian ethanol imports (as a percentage of the U.S. ethanol market). Of course, although it might be cheaper, imported ethanol would not help achieve the goal of literal energy independence.

The fact is that ethanol derived from corn cannot compete with gasoline on price. Ethanol only produces about 70 percent as much energy as gasoline by volume; therefore, it can't compete with gasoline unless its price is less than 70 percent as high. Corn ethanol prices in the United States are consistently higher than this, despite government subsidies:

- The United States currently subsidizes corn ethanol production twice, through crop subsidies and a 51-cent-per-gallon tax credit.

- Without the tax credits, estimates based on EIA data show that the average wholesale price of U.S. ethanol from 2003 to 2006 would have been 35 cents per gallon higher than gasoline.

Conclusion. There is one lesson that U.S. policymakers should learn from Brazil's path to energy independence: make oil production a priority. This can be accomplished by removing barriers to oil exploration in Alaska and on the Outer Continental Shelf, which government estimates indicate could contain more than 100 billion barrels of oil combined — more than four times as much as current U.S. reserves. New domestic oil production will do far more to alleviate America's dependence on foreign oil supplies than even the most efficient production of ethanol.

D. Sean Shurtleff is a graduate student fellow with the National Center for Policy Analysis.