The most significant economic and sociological change of the past half-century has been the entry of women into the labor market. Public policies that govern the workplace have not kept pace with this demographic shift, however. For the most part, tax law, labor law and employee benefits law were designed decades ago on the assumption that the typical household would have a full-time working husband and a homemaker wife.

These anachronistic public policies are not only out of step with the way most Americans are living their lives, they are causing considerable harm. To remedy these problems we need to bring public policy institutions into the 21st century. What follows are five ideas.

1. Make Employee Benefits More Flexible. Employee benefits law tends to be very rigid. In general, employees are not allowed to choose between taxable wages and nontaxed benefits. For example, an employee who is covered through a spouse's health insurance at another place of work is not allowed to opt for higher wages instead of duplicate benefits. Also, part-time workers who need health insurance cannot choose to take less pay in exchange for inclusion in an employer's health plan. The same restrictions apply to pensions, day care services and other employee benefits.

The solution: federal law should allow employers the opportunity to give their employees options. Ideally, employees should be able to trade taxable wages for nontaxed benefits — particularly for such socially desirable benefits as health insurance and retirement pensions.

2. Make Employee Benefits Portable. Most nonelderly Americans obtain health insurance through their employer or through a spouse's employer. As a result, a change of jobs invariably leads to a change of health plans. Since the new health plan may not have the same benefits or the same network of providers, job switching often means there is no continuity of care. A change of jobs also can mean a loss of pension benefits or a loss of employer-matching contributions to a 401(k) plan. This particularly affects women, who are more likely to switch jobs or exit the workforce in order to care for family members. Women ages 18 to 36 have held an average of 9.3 jobs and have spent 27 percent of their time out of the labor force.

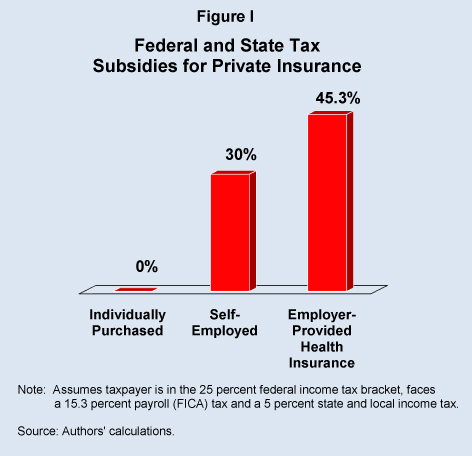

Individually-owned health insurance is portable and, in principle, it could travel with an employee from job to job. But employers cannot pay premiums for individually-owned insurance for their employees with untaxed dollars. If employees pay their own premiums, they must pay with after-tax dollars. The result: portable insurance costs one-third to one-half more than employer-specific insurance on an after-tax basis. [See Figure I.]

The solution: At a minimum, the tax treatment of group and individual health policies should be equalized. Also, ways should be explored to allow employers to pay premiums for individually owned insurance. Additionally, other steps should be taken to make employer benefits personal and portable — especially health and pension benefits.

3. Make Wage and Hour Laws More Flexible. In general, hourly workers have very little flexibility with respect to work hours. For example, a working mother who takes off an afternoon to attend a child's soccer game cannot make up the time by working additional hours in the next pay period. Instead, federal law forces her to receive less pay and fewer benefits in the week of the game, and forces the employer to pay overtime in the week when she makes up the time. Women are particularly affected by these restrictions. About 63 percent of women are hourly workers, totaling over 37 million women.

Interestingly, federal law allows employees of the federal and state governments to do what the private sector cannot do. Government workers can choose between overtime pay and comp time. In 2001, 30 percent of state employees and 34 percent of federal employees opted for comp time instead of overtime pay.

The solution: At a minimum, allow hourly employees in the private sector to have the same choices as employees in the public sector.

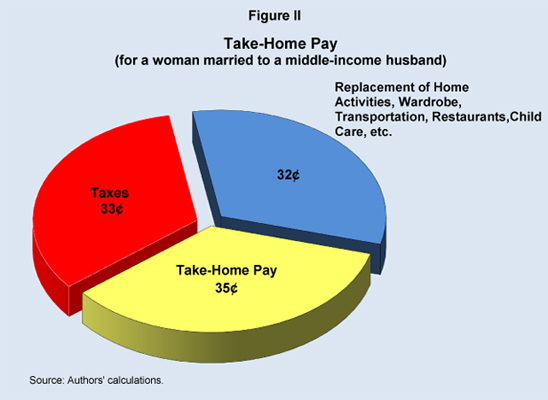

4. Tax Fairness for Working Spouses. In more than half of all working-age married couples, both spouses work. Yet the current tax code severely penalizes the second earner when he or she enters the labor market. For example:

- When a second earner enters the labor market, she is taxed at her spouse's marginal tax rate — even if she earns only the minimum wage.

- When all taxes and costs are considered — including child care and other services the spouse previously provided — the second worker in a middle-income family typically keeps only 35 cents out of each dollar earned. [See Figure II.]

Unmarried couples do not face this problem because they file separate tax returns as singles. Married couples, however, do not have that option and must file taxes jointly or as married, filing separately — which is less desirable than completely separate returns.

The solution: Married couples should be allowed to file jointly or as singles, so that workers with similar incomes pay comparable taxes.

5. Tax Fairness for Stay-at-Home Parents. In general, federal tax law is far more generous to people at work than people at home — with respect to retirement savings and health insurance and even day care. Employees can save for retirement through tax-advantaged 401(k) plans. Contributions to a pension plan as well as premiums for employer-sponsored health coverage are not counted as taxable income. Self-employed workers receive some tax relief for their health insurance costs and have additional options for tax deferred savings. By contrast, the amount of tax-preferred savings a couple can make toward the retirement of a stay-at-home spouse is less than one-third the amount an employee can save in an employer-sponsored plan. Furthermore, health insurance that is purchased individually receives virtually no tax relief. Families who receive day care services through an employer or who purchase them pretax through a "cafeteria plan" receive much more tax relief than families who purchase services outside the place of work.

As women move into and out of the labor market (say, to have and raise children), they are particularly disadvantaged by this arbitrary, two-tier tax and regulatory system.

The solution: Allow stay-at-home spouses who save for retirement or purchase health insurance or day care services to receive just as much tax relief as people who obtain these benefits at work.

Conclusion. Public policies and institutions have not kept pace with the changing role of women in the workforce. As a result, women and their families are penalized when they enter the labor market. The solution to these problems is not policies that favor women, but rather policies that increase the flexibility and fairness of the system — benefitting both men and women, and their families.

Terry Neese is a distinguished fellow and John Goodman is president of the National Center for Policy Analysis.