The current Social Security system allows individuals to claim reduced, early retirement benefits beginning at age 62. Individuals who wait until the full retirement age to collect receive about 30 percent more in monthly benefits. If they wait until age 70 to collect, their benefits will be about 60 percent larger than at age 62. So what choice should people make?

Assuming a normal life expectancy and using the interest rate on government bonds, the actuarial present value of lifetime benefits are the same for those taking early retirement as for those waiting to take benefits at a later age. Of course, if one's life expectancy is not normal (either because of illness or particularly good genes), one retirement age will look more attractive than another. Fortunately, you can have the best of both worlds: You can retire at age 62, then pay back and reapply for Social Security benefits at age 70 if you come to regret your earlier decision.

Opportunity to Change Your Retirement Date. A Social Security provision allows retirees to reapply for their benefits. Form 521 (Request for Withdrawal of Application) as well as IRS provisions permit an individual to:

- Repay the Social Security retirement benefits received with no interest charged;

- Claim an income tax credit for past Social Security benefit taxes paid; or

- Deduct the amount of the benefits that have been taxed from taxable income (if itemizing).

(The deduction is useful for individuals subject to the Social Security benefits tax, which requires middle- and high-income seniors to include some of their Social Security benefits in taxable income.) Once you repay what you owe, you can immediately reapply for higher benefits. Along the way you will have benefited from an interest-free loan!

How Reapplying Works. Consider retirees Peter and Kate, both of whom are now 70. Peter and Kate claimed their Social Security benefits at age 62 and are now each receiving a reduced benefit of $13,250 each year (in 2008 dollars). Had they waited until their normal retirement age (65 in their case) to collect benefits, Peter and Kate would now each receive $18,928 a year. Had they waited until age 70 (this year) to apply, their benefit this year would have been $20,693, thanks to the delayed benefit credit.

Peter and Kate now have a choice. They can choose to pay back the Social Security benefits they have received over the past eight years. In return they will each receive the much higher benefit for the rest of their lives. If they take this option:

- Each would repay $94,556 to Social Security.

- They would then each begin receiving $20,693 a year — the same as if they had waited until age 70 to begin receiving benefits.

- As a result they would have approximately 56 percent more in real Social Security benefits every year for the rest of their lives.

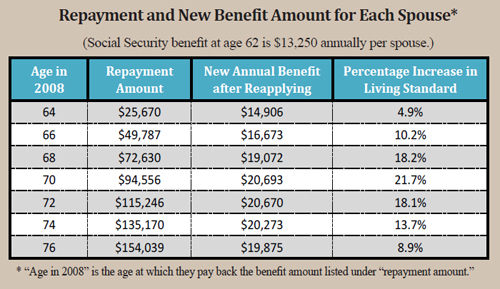

How Double-Dipping Affects Household Living Standards. The above scenario simply measures the amount of Social Security benefits Peter and Kate will have if they reapply. However, this also affects their standard of living. My company's financial planning software, Economic Security Planner or ESPlanner (see www.esplanner.com), can be used to determine Peter and Kate's standard of living in terms of discretionary spending power. Assuming that Peter and Kate have other asset income to supplement their benefits, the table shows:

- If Peter and Kate don't repay their benefits and continue receiving their reduced benefits, their annual consumption (discretionary spending) will be $42,774.

- However, if Peter and Kate pay back and reapply for retirement at age 70 (this year), their sustainable consumption rises by 21.7 percent!

Which age groups stand to gain from repaying and reapplying? It depends. Using the same assumptions as Peter and Kate, those in their mid-60s to mid-70s would reap substantial benefits. The table shows how much, based on their age when they reapply in 2008. For instance:

- At age 68, the increase in their living standard is 18.2 percent, compared to early retirement benefits from age 62 without repayment.

- By age 76, however, the increase in living standard is only 9 percent; at this age, households have to pay back more benefits and have fewer remaining years to enjoy the higher level of benefits when they reapply.

Anyone now age 63 to roughly age 75 who took Social Security benefits early is likely to be able to raise his sustainable living standard. How much depends on the individual's other economic resources, which ESPlanner can determine. Of course, some households will not have the liquidity to repay and reapply for benefits.

Double-Dipping versus an Annuity. For our 70-year-old couple Peter and Kate, one can compare the repayment of their benefits to the price they would pay for an inflation-indexed annuity of $7,443 per year (the difference in Social Security benefits each receives by repaying and reapplying at age 70):

Double-Dipping versus an Annuity. For our 70-year-old couple Peter and Kate, one can compare the repayment of their benefits to the price they would pay for an inflation-indexed annuity of $7,443 per year (the difference in Social Security benefits each receives by repaying and reapplying at age 70):

- By repaying and reapplying for Social Security, Peter and Kate are essentially buying this increase in benefits for $94,556 each.

- The best and, indeed, quite well-priced inflation-indexed annuity on the market, offered by the Principal Insurance Co. at www.elmannuity.com, would cost about 40 percent more!

Were Peter and Kate to buy the same $7,443 in additional inflation-indexed income via elmannuity.com, they could increase their living standard by approximately 10 percent. However, their example shows that repaying and reapplying for Social Security benefits can increase their living standard even more.

Is Double-Dipping Legitimate? Yes. Older Americans around the country have repaid their old benefits and are now receiving higher new ones. (I've talked to people who have done this.) An individual can go to the Social Security Administration office, fill out the form and repay previous benefits, then reapply and start receiving the higher benefit. The SSA considers this a legitimate option for people to consider.

Repaying Social Security and reapplying for a higher benefit does, of course, entail the risk of not living long enough to recoup the amount of the benefit repayment. But an even bigger risk is living longer than one expects and running out of money.

Should younger retirees consider taking their benefits early, banking the money, repaying at age 70, and reapplying at age 70? There is some advantage to doing this provided the government doesn't close down the option, and provided you have the liquidity to pay the extra taxes you'll be assessed from ages 62 to 69 because of the receipt of benefits during these years.

Conclusion. We all have the choice of taking Uncle Sam's best offer. And when it comes to Social Security, Uncle Sam is making lots of offers. Fortunately, economics-based software can now determine in a matter of seconds how our living standards are affected by our choices. In so doing, it can guide us to higher living standards and better lives.

Laurence J. Kotlikoff is a senior fellow with the National Center for Policy Analysis and a professor of economics at Boston University.