Despite claims that there is a health insurance crisis in the United States, the number of U.S. residents without health insurance actually fell in 2007, according to new Census Bureau numbers. The Census says the number of uninsured fell from 47.0 million to 45.7 million. Furthermore, the proportion of uninsured fell half a percentage-point, from 15.8 percent to 15.3 percent.

In fact, the proportion of people without health insurance was a percentage-point lower in 2007 than a decade earlier (16.3 percent in 1998). The slight increase in the number of uninsured over the past decade is largely due to immigration and population growth — and to individual choice.

How Big Is the Problem? In 2007, according to Census Bureau data:

- Nearly 85 percent (253.5 million) of U.S. residents were privately insured or enrolled in a government health program, such as Medicare, Medicaid and the State Children's Health Insurance Programs (S-CHIP).

- Nearly 18 million of the uninsured lived in households with annual incomes above $50,000 and could likely afford health insurance.

- Up to 14 million uninsured adults and children qualified for government programs in 2004 but had not enrolled, according to the BlueCross BlueShield Association.

In theory, therefore, about 32 million people, or 70 percent of the uninsured, could easily obtain coverage but have chosen to forgo insurance. That means that about 95 percent of United States residents either have health coverage or access to it. The remaining 5 percent live in households that earn less than $50,000 annually. This group does not qualify for Medicaid and (arguably) earns too little to easily afford expensive family plans costing more than $12,106 per year. A uniform tax credit would go a long way toward helping this group afford coverage.

How Serious Is the Problem? During the past 10 years the number of people with health coverage rose nearly 26 million, while the number without health coverage only increased about 1.4 million. Both increases are largely due to population growth. Typically, those who lack insurance are uninsured for only a short period of time. The Congressional Budget Office estimated that 21 million to 31 million people had been uninsured for a year or more in 2002 — far short of the 45.7 million figure cited by proponents of universal health care. Of all the people who are uninsured today, less than half will still be uninsured 12 months from now.

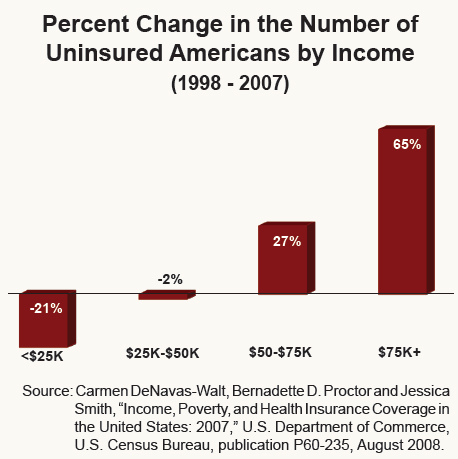

Who Are the Uninsured? It is often assumed that the uninsured are all low-income families. But among households earning less than $25,000, the number of uninsured actually fell by about 21 percent over the past 10 years. [See the figure.] The uninsured include diverse groups, each uninsured for a different reason:

Immigrants. About 12.4 million foreign-born residents lack health coverage — accounting for 27 percent of the uninsured. In 2007, 44 percent of foreign-born noncitizen residents were uninsured. According to a recent Employee Benefits Research Institute report, immigrants accounted for 55 percent of the increased in the uninsured since 1994. Income may be a factor — but not the only one. A partial explanation for this disparity is that many immigrants come from cultures without a strong history of paying premiums for private health insurance. In addition, immigrants do not qualify for public coverage until they have been legal residents for more than five years.

The Young and Healthy. About 18 million 18-to-34-year olds are uninsured. Most of them are healthy and know they can pay incidental expenses out of pocket. Using hard-earned dollars to pay for health care they don't expect to need is a low priority for them.

The Young and Healthy. About 18 million 18-to-34-year olds are uninsured. Most of them are healthy and know they can pay incidental expenses out of pocket. Using hard-earned dollars to pay for health care they don't expect to need is a low priority for them.

Higher-Income Workers. As the figure shows, the fastest-growing segment of the uninsured population over the past 10 years has been middle- and upper-income families. From 1998 to 2007, the number of uninsured among households earning more than $50,000 annually actually increased by more than five million. The ranks of the uninsured in households earning $50,000 to $75,000 increased 27 percent, while the number of uninsured households earning above $75,000 increased 65 percent.

Why the Poor Are Uninsured: The "Free Care" Alternative. Many people do not enroll in government health insurance programs because they know that free health care is available once they get sick. Federal law forbids hospital emergency rooms from turning away critical care patients regardless of insurance coverage or ability to pay. A recent Urban Institute study estimates full-year uninsured individuals receive $1,686 in medical care each year. Of this, $583 is paid out-of-pocket while the remaining $1,103 is public and private charity care. This does not include the more than $300 billion the federal and state governments spend annually on such "free" public health insurance as Medicaid and S-CHIP. Furthermore, there is little incentive to enroll in public programs because families can always sign up when the need arises.

Why the Nonpoor Are Uninsured: State Mandates. Government policies that drive up the cost of private health insurance may partly explain why millions of people forgo coverage. Many states try to make it easy for a person to obtain insurance after becoming sick by requiring insurance companies to offer immediate coverage for pre-existing conditions with no waiting period. Thus, when people are healthy they have little incentive to participate and tend to avoid paying for coverage until they need care.

How to Reduce the Number of Uninsured: Uniform Tax Credit. According to the Lewin Group, a private health-care consulting firm, families earning more than $100,000 a year get four times as much tax relief as families earning $25,000. In other words, the biggest subsidy goes to those who least need it, and who probably would have purchased insurance anyway. With a uniform tax credit, low- and moderate-income families would get as much tax relief as the wealthy when they purchase health insurance.

How to Increase the Number of Insured: Allow Competition. A bill introduced by Arizona Rep. John Shadegg (R), called the Health Care Choice Act, would allow the residents of any state to purchase lower cost health insurance sold in other states. This would make coverage more affordable by injecting competition into the local market and by allowing residents to purchase insurance without expensive mandates. Consumers could shop for individual insurance on the Internet, over the telephone or through a local agent. The policies would be regulated by the insurer's home state. Consumers would be more likely to find a policy that fits their budget — giving more people access to affordable insurance. Moreover, competition across state lines would encourage state lawmakers to reduce costly insurance regulations. Economist Steve Parente and his colleagues at the University of Minnesota estimate that this change would insure an additional 12 million people.

Conclusion. Although the proportion of people without insurance coverage has changed little in recent years, much can be done to reduce the number of uninsured. This could also include a uniform tax credit like the one that has been proposed by Sen. McCain.

Devon Herrick, Ph.D. is a senior fellow with the National Center for Policy Analysis.