A free trade agreement commits two or more countries to reduce mutual trade barriers — tariffs, quotas and so forth. Such agreements give both countries' products an advantage in each other's markets relative to imports from other countries.

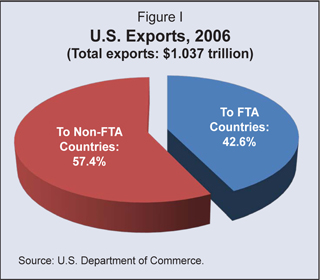

Since 2001, the United States has ratified nine free trade agreements (FTAs), for a total of 11 encompassing 17 countries . Due, in part, to freer trade from FTAs, U.S. exports have grown an average of 11.1 percent annually since 2000, and trade with FTA partners now accounts for almost 43 percent of total exports [see Figure I]. In fact, the United States now has a surplus in manufactured goods with the trade-pact countries, meaning they import more manufactured U.S. goods than Americans purchase from them.

However, current congressional leaders have refused to allow a vote on the U.S.-Colombia Free Trade Agreement (COLFTA), arguing that it would hurt the U.S. economy. COLFTA is one of three FTAs that have been signed by President Bush but not ratified by Congress (the other two are with Panama and South Korea). The delay is unfortunate, because it denies the benefits of trade liberalization to workers and consumers in both countries. Furthermore, with the collapse of the Doha round of World Trade Organization talks that would have generally lowered tariff barriers worldwide, the Colombia agreement is one of the few current opportunities to improve U.S. international trade.

However, current congressional leaders have refused to allow a vote on the U.S.-Colombia Free Trade Agreement (COLFTA), arguing that it would hurt the U.S. economy. COLFTA is one of three FTAs that have been signed by President Bush but not ratified by Congress (the other two are with Panama and South Korea). The delay is unfortunate, because it denies the benefits of trade liberalization to workers and consumers in both countries. Furthermore, with the collapse of the Doha round of World Trade Organization talks that would have generally lowered tariff barriers worldwide, the Colombia agreement is one of the few current opportunities to improve U.S. international trade.

Trade Liberalization. Trade liberalization — opening markets to foreign competition — stimulates growth and increases efficiency. Economic theory shows us why.

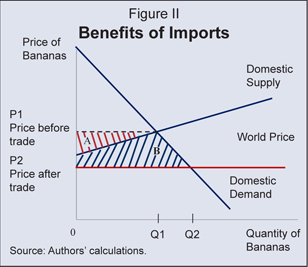

Assume for a moment that the United States did not allow banana imports and that domestic banana production costs were above the world price. In this case, the domestic price would be P1 and the producer surplus (revenue earned above production costs) would be area A [see Figure II]. If the United States opened its banana market to foreign imports, the price of bananas would decline to the world price (P2) as Americans imported cheaper foreign bananas. The producer surplus would be eliminated (-A), but consumers would gain (by A+B) because they would pay less for bananas. Overall, domestic producers lose but consumers gain — and the gain to consumers exceeds the losses of producers by the amount shown as area B. Although this example is overly simplistic, it shows the gains from trade.

Trade Diversion. Unfortunately, FTAs are usually less than ideal, and therefore the benefits of increased trade are limited. FTAs only liberalize trade between a few countries and there are often exceptions to the goods and services that receive tariff relief. Because FTAs have these limitations, to some extent they divert trade from one country to another, rather than creating new trade.

Suppose, for example, that the United States levied a 2 cent per pound tariff on bananas imported from any country, and that Americans imported bananas from Ecuador rather than Colombia because Ecuador was a more efficient producer and sold bananas for 1 cent less per pound. Then, imagine for a moment that the United States and Colombia concluded a FTA that removed the tariff on Colombian bananas. Although Colombia is the less efficient producer, their bananas now cost 1 cent less than Ecuadorian bananas because they aren't taxed 2 cents per pound. Obviously, the banana trade would be diverted from Ecuador to Colombia.

Although U.S. consumers would save 1 cent per pound — the U.S. government (that is, U.S. taxpayers) would lose the 2 cent tariff in the diverted exports. The United States as a whole would thus lose as a result of the trade diversion.

Competition Improves Efficiency. In areas where the partner country competes with U.S. producers, an FTA will likely operate to stimulate real cost reduction for domestic producers, which increases economic efficiency. This works because it shocks lazy firms into a serious search for ways to reduce real costs. When they are protected by ample tariff and nontariff barriers, firms tend to pursue a comfortable way of life. Competition from the world marketplace can shock owners and managers, making them work harder to reduce real costs than they would under the umbrella of protection.

FTAs involve some cumbersome regulations, such as country of origin rules (requiring proof that the goods were made in the exporting country, rather than simply being imported from a third country and then exported to the United States). However, by opening an economy to competition, an FTA does part of the job of a general program of economic liberalization. It encourages new competition, even if it does not bring all the new competition that would be stimulated by free trade with all countries.

Benefits of the Colombian Trade Agreement. Both the United States and Colombia will benefit from the competition and economic efficiencies gained from a free trade agreement.

Almost 90 percent of Colombian exports have enjoyed tariff-free access to U.S. markets since 1991, due to the Andean Trade Promotion Act. But American exports do not get the same privileges. Thus, ratifying the Colombia trade agreement would mostly benefit the United States by making 80 percent of U.S. exports to Colombia duty free immediately and by phasing out the remaining tariffs over 10 years. According to the U.S. International Trade Commission, the Colombia trade pact would:

- Increase U.S. exports to Colombia by $1.1 billion (or 13.7 percent);

- Increase Colombian exports to the United States by $487 million (5.5 percent).

On the other hand, failing to pass COLFTA would have devastating effects on the Colombian economy, because the Andean Trade Promotion Act is set to expire at the end of 2008. According to estimates from the University of Antioquia cited in a 2008 Cato Institute study: - Investment in Colombia would decrease by 4.5 percent.

- Unemployment would rise by 1.8 percentage points, a loss of 460,000 jobs.

- Gross domestic product would fall 4.5 percent, and poverty would climb 1.4 points.

However, if the United States fails to ratify the trade agreement with Colombia, other countries are ready to step in. Canada, for instance, signed an agreement with Colombia in June 2008.

Conclusion. Due to political realities, full trade liberalization will only happen through incremental changes. Well-designed free trade agreements serve this function. Although imperfect, they create trade and foster an environment for economic growth by exposing firms to greater competition.

Arnold C. Harberger is a professor of economics at the University of California, Los Angeles and D. Sean Shurtleff is a policy analyst with the National Center for Policy Analysis.