Policy experts expect the next administration to make major changes in the way the federal government measures poverty. The current poverty standard is an outmoded, 40-year-old measure that is adjusted each year for inflation. It does not account for all of a family's income or living expenses. Many poverty experts support changing the poverty standard. But how should that be done?

How the Government Measures Poverty. The current poverty standard was developed in the 1960s by Mollie Orshansky, an economist with the Social Security Administration. Orshansky relied on 1955 U.S. Department of Agriculture research that concluded families spent approximately one-third of their budget on food. Borrowing the U.S.D.A.'s estimated cost for a basic diet (called the Thrifty Food Plan), she tripled it to arrive at the federal poverty threshold – theoretically, the amount of money an average four – person family needs for food, clothing and shelter. The threshold is adjusted annually for inflation.

Better U.S. Living Standards. A country's poverty rate should decline as real incomes rise and living standards increase, but the U.S. poverty rate has remained stagnant. Census Bureau household data show:

- In 1968, the official poverty rate was 12.8 percent, meaning 25.4 million people were considered poor.

- In 2007, the poverty rate was 12.5 percent, and 37.3 million people were considered poor.

However, household consumption indicates that basic living standards have improved significantly. For instance:

- In 1970, only 36 percent of the entire U.S. population had air conditioning, compared to nearly 80 percent of poor households in 2005, according to a 2007 Heritage Foundation study.

- In 1980, only 27 percent of the poor had microwave ovens compared to 85 percent in 2005, according to University of Chicago Prof. Bruce D. Meyer.

This increased consumption shows that the living standards of low-income families have improved. In fact, according to the U.S. Department of Labor, the poor actually consume about $2 for every $1 dollar of reported income. How is that possible? The discrepancy is due to unreported or underreported income, savings, credit and welfare benefits.

The current poverty standard only measures families' gross income, which includes before-tax wages, but not capital gains. Gross income also includes cash welfare assistance, but excludes more valuable noncash benefits, such as Medicaid and public housing. According to Cato Institute scholar Michael Tanner, the federal government spent an estimated $12,892 per poor person on antipoverty programs in 2005. The Heritage Foundation estimates that the federal government spent $8.29 trillion on antipoverty programs from 1965 to 2000, mostly in the form of noncash benefits. These benefits raise the living standards of millions of low-income people, but do not count as income; therefore, they do not reduce measured poverty. This is the main reason the poverty rate has remained stagnant.

A Relative Poverty Standard. Many scholars support two fundamental reforms to the poverty standard proposed by the National Academy of Sciences (NAS). In its 1995 report, "Measuring Poverty," the NAS proposed adjusting the income data by adding any government welfare benefits received and subtracting taxes, health care spending and work-related expenses. These adjustments would improve the accuracy of the poverty standard.

The NAS also recommended linking U.S. poverty thresholds to approximately 80 percent of the median (average) amount families spend on food, clothing and shelter, adjusted for geographic differences in expenditures for these goods. However, tying the poverty standard to spending would change it from an absolute measure to a measure of relative consumption.

This would have several negative impacts. First, the poverty rate would rise immediately:

- Data from a 2005 Census Bureau report show that the NAS model would have raised the 2002 poverty rate by 1.1 percentage points, or 3.1 million people.

- Classifying 3.1 million more people as poor would cost the government an extra $40 billion every year, according to Tanner's estimates.

Second, the revised poverty rate would continue to rise because family incomes, and therefore consumption spending, grow faster than inflation. For instance, consumer spending grew an average of 44 percent faster than inflation from 2000 to 2007.

Finally, a relative measure would always classify a percentage of the population as poor, encouraging further efforts to redistribute income.

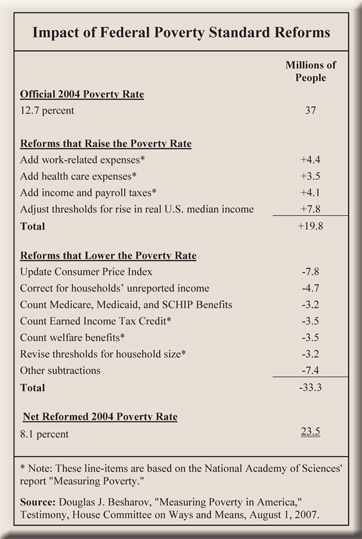

Better Absolute Standards. American Enterprise Institute scholar Douglas J. Besharov has outlined a more accurate, absolute poverty standard. He does not endorse tying the poverty threshold to relative spending, but he would increase it 15 percent to account for the increase in real median income since 1978. He also proposes a few other adjustments [see the figure]:

- In 1995, the federal government determined that the old Consumer Price Index (CPI) overstated inflation by as much as 23 percent. Using newer CPI measurements for the poverty standard would lower the number of Americans considered poor by 7.8 million people.

- In 2001, according to Besharov, $804 billion of income was not reported by households or counted by the Internal Revenue Service. Accounting for this unreported income would reduce the number of poor by 4.7 million people.

- In 2004, says Besharov, the federal government spent almost $7,500 per poor person on their health care. Counting these expenditures as income to the poor would cut their ranks by 3.2 million.

With all these adjustments, under Besharov's model the poverty rate in 2004 would have been only 8.1 percent, rather than the official rate of 12.7 percent.

Conclusion. Two things hold true about the U.S. poverty standard. First, if policymakers agree that living standards have improved since the 1960s, as the evidence shows, that should be reflected in a lower poverty rate. Second, relative poverty thresholds distort the true number of people in absolute deprivation.

If it takes a more modest approach to refining its poverty measure, Congress can develop a more accurate poverty standard without increasing the cost of welfare benefits or the burden on taxpayers.

D. Sean Shurtleff is a policy analyst with the National Center for Policy Analysis.