Small business employees are much less likely to have access to employer-sponsored health coverage than the employees of larger firms. According to the Kaiser Family Foundation:

-

Of the 45.7 million U. S. residents without health insurance, 20 million are employees – or in the families of employees – of businesses with 50 or fewer employees.

- Among companies with more than 50 employees, 95.6 percent of workers have health insurance, compared to 42.6 percent of individuals working for small businesses.

Undoubtedly there are many reasons why small businesses are less apt to offer health coverage to their workers than larger firms. However, one likely reason is that small businesses encounter a host of costly state regulations and mandated-benefit laws not faced by larger employers that self-insure.

Small Businesses Face Higher Costs. Since 1999, the cost of employer-provided health insurance has risen 120 percent, or four times faster than prices generally, according to the 2008 Kaiser Family Foundation Employee Health Benefits Survey. The Commonwealth Fund estimates that small businesses face higher than average costs:

- Insurance premiums for small businesses are 18 percent greater than those paid by large companies.

- Administrative costs account for up to 25 percent of the cost of premiums for some small business health plans, compared to 10 percent for large firms.

Continuing medical cost inflation only exacerbates the problems faced by small businesses. Health care costs are expected to rise 10 percent in 2009, according to the consulting firm Pricewaterhouse Coopers.

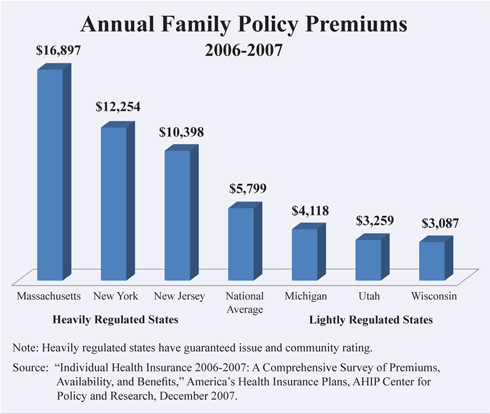

Why Costs Are Higher for Small Businesses. Costs are higher for small-group insurance because states require small-group health policies to cover certain conditions, treatments and providers. Large employers often self-insure. Their plans are governed by federal law rather than state regulations, and federal government mandates fewer benefits. Small group premiums vary widely by state, and the highest premiums are in the most heavily regulated states [see the figure].

According to the Council on Affordable Health Insurance, there are more than 1,961 state-mandated benefits that insurance companies are required to offer in their health plans, adding to the cost of small group health insurance.

- Mental health parity is one of the most expensive and pervasive mandates – 47 states require insurers to cover mental health conditions, adding 3 percent to 5 percent to premiums, according to CAHI estimates.

- Forty-six states require coverage for chiropractors, 11 states mandate acupuncturists and four require coverage for massage therapy.

- Four states require coverage of naturopaths, who utilize food and herbal remedies to complement (and sometimes in place of) surgery or drugs.

In Massachusetts, the Division of Health Care Finance and Policy reported that 13 cents of every dollar spent on health care goes to cover mandated benefits. CAHI estimates that these mandates add 20 to 50 percent more to the cost of insurance, depending on the state.

Why Costs Are Lower for Large Employers. The Employee Retirement Income Security Act of 1974 (ERISA) exempts self-funded employer plans from state regulations. In self-funded plans, the firm pays employees' medical bills and a third party processes claims. Large employers (and trade unions) do not face costly state mandates, but do enjoy economies of scale. Therefore, their costs are lower. In firms with 5,000 or more employees, 89 percent of workers were covered by self-insured arrangements in 2006, up from 62 percent in 1999, reports the Kaiser Family Foundation.

Solution: Allow Insurance To Be Sold to Associations. There are some 16,000 associations in the United States, and six million people are already insured through such organizations as the National Association for the Self-Employed. Association health plans (AHP) allow small business owners to pool resources, negotiate with insurers and purchase insurance plans for members. However, the existence of 50 sets of state regulations is a barrier to low-cost AHP health insurance, according to NCPA Senior Fellow Donald Westerfield. If small firms could buy AHP insurance with uniform federal regulations, they could enjoy the same lower administrative costs and greater bargaining power as large firms.

A Congressional Budget Office analysis found that AHPs would save 5 percent by avoiding state benefit mandates, and would reduce premiums 13 percent if associations could purchase insurance across state lines.

Solution: Let Businesses Purchase Health Insurance from Insurers in Other States. Protection from interstate competition allows politicians to impose expensive mandates and costly regulations. Allowing businesses to purchase coverage across state lines would create more competitive insurance markets. Interstate competition would give more people access to affordable insurance. Steve Parente and Roger Feldman of the University of Minnesota found that purchasing across state lines would potentially insure 12 million previously uninsured people.

Solution: Let Businesses Contribute to the Cost of Employee-Owned Insurance. Health insurance in the United States is largely tied to employment because employer contributions for health insurance are tax deductible business expenses and do not count as taxable income for employees. Premiums for employer-paid health benefits avoid all income taxes and the (FICA) payroll tax. By contrast, employees of small businesses without employer-provided health benefits get no tax relief.

Small business employers should be able to contribute to the cost of health policies purchased by their employees. Their workers would get portability (a characteristic of individual insurance), but at premiums closer to the cost of group insurance. As a result, insurance coverage would follow people from job to job and workers would not face a disruption in benefits when their employment changes.

Conclusion. People should be able to purchase, with pretax dollars, health plans that are portable from one job to the next, just as group plans do. Employers should be able to help pay the premiums on those individual plans. To avoid costly state mandates, small businesses should be allowed to purchase plans similar to those purchased by large companies that self-insure. If sections of ERISA are rewritten or association health plans allowed, small businesses could create a national marketplace where insurance companies and care providers compete for individuals on price and quality.

Daniel Wityk is a legislative assistant at the National Center for Policy Analysis.