Claims that human-caused global warming will raise average temperatures by 2oC to 5oC over the next 100 years and cause serious harm to society are controversial. However, assuming that global warming will be a big problem, there are two important questions: (1) What should be done about it? and (2) When should it be done?

The two main approaches are to make major adjustments now or gradually through time to reduce warming or mitigate its effects. Thus, thinking about efforts to combat global warming requires comparing costs today with potential benefits 100 years or more in the future.

Immediate Action versus Waiting. Acting now might slow global warming so that major adjustments will not be needed later. But there are two huge disadvantages. First, actions today will be based on current technology. Because technology will almost certainly improve, solutions implemented in the future are likely to be more efficient – more effective per unit of cost. By comparison, solutions implemented today would use cruder, more expensive technology.

Second, money spent now to offset global warming could instead be invested in ways that would increase national income and wealth, creating more options to deal with any future negative effects of a warmer world. Future generations will likely be wealthier than present generations, just as the people living today are wealthier than past generations. Imposing large costs today to create environmental benefits for future generations would sacrifice current potential consumption for people in the future who will almost certainly have higher living standards.

Comparing Today’s Costs to Tomorrow’s Benefits. Economists use discount rates to compare costs and benefits that occur at various points in time. A discount rate converts a future cost or benefit into a present cost or benefit. Discount rates reflect the fact that a dollar received today is more desirable than a dollar received in the future. For example, $10 invested today in the capital market, earning a 10 percent rate of return, will grow to $25.94 at the end of 10 years. Thus, $25.94 received in 10 years is worth $10 today when discounted at a rate of 10 percent. Discount rates make explicit the tradeoff between a dollar’s worth of services consumed now and future consumption that would be possible if the same amount were invested and allowed to grow.

Choosing the Right Discount Rate. There is much debate about what discount rate to use when comparing environmental costs and benefits. Generally, the more one values today’s dollars over tomorrow’s, the higher is one’s discount rate. At one extreme, an infinitely high discount rate would imply that we place almost no value on future consumption. Conversely, using a discount rate of zero means that benefits today are no more valuable than benefits 100 years from now.

Some philosophers and ethicists argue that present generations have a moral obligation to protect the interests of future generations because they are as yet unborn and cannot express their future preferences. Economist Nicholas Stern argues that the welfare of future generations shouldn’t be discounted. In the Stern Review on the Economics of Climate Change, an influential report for the British government, he uses a discount rate of almost zero (0.1 percent per year) to discount the costs of acting in the future to slow global warming. At exactly 0 percent, $1 billion today is worth $1 billion 100 years from now.

However, the choice of which discount rate to use is not about the weight given to the well-being of future generations but about opportunity costs. Investments people make today are likely to increase the wealth of their descendants, giving future generations greater resources to exercise their preferences regarding environmental protection. The higher the rate of return that can be earned by investing a dollar today, the more wealth future generations are deprived of if the money is spent now. Thus, Kevin Murphy of the University of Chicago argues that we should use the market interest rate as the discount rate because that is the opportunity cost of climate mitigation. Interestingly, even Stern’s own model assumes that people 200 years from now will have real incomes that are more than 10 times incomes today. This means that if the government taxes people today explicitly or through regulations to reduce climate change 200 years from now, the government will be taxing the poor to help the rich.

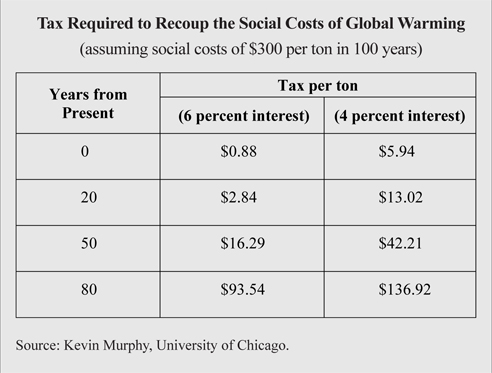

Adopting Optimal Climate Policy. How does using the interest rate as the discount rate work in practice? Imagine that the damage from continued use of CO2-emitting fossil fuels is $300 per ton of emissions 100 years from now. In 100 years, a $300 per ton tax on carbon emissions would reflect their social cost. What this tax should be in the intervening years depends upon the interest rate that could be earned if money were invested. [See the table.]

Thus, beginning today, at a 6 percent interest rate, a tax of 88 cents per ton would pay the social costs of one ton of emissions in a century. If the tax were implemented 80 years from now, the rate would be $93.54 per ton. To put these numbers in perspective, a $1.00 tax per ton of carbon translates into a one-third cent per gallon tax on gasoline. On that basis:

- A $300 per ton carbon tax 100 years from now would be equivalent to a tax of three-tenths cents per gallon today at an interest rate of 6 percent.

- It would be two cents per gallon at an interest rate of 4 percent.

Today, the actual federal tax is 18.4 cents per gallon. Thus, if the correct carbon tax 100 years from now is $300, this implies that the gasoline tax today is much higher than the rate required to reflect the social costs of global warming, regardless of whether the right interest rate is 6 percent or 4 percent.

Conclusion. If the government limits carbon emissions now through taxes or direct caps, it is taxing the poor today to benefit wealthier future generations. Perversely, such limits would also deprive future generations of the additional capital that would accumulate if the money were invested in the market instead of being used to combat climate change.

*Based, in part, on a presentation by Kevin M. Murphy, University of Chicago, before the Mont Pelerin Society in Tokyo, September 2008, and on the author’s own reasoning and computations.

David R. Henderson isa research fellow with the Hoover Institution.