To counteract the recession that began in December 2007, Congress has passed foreclosure assistance, tax rebates, bank bailouts and $787 billion of stimulus. This spending will result in massive federal budget deficits and increasing government debt – projected to rise to $23 trillion by 2019. This amount of debt will hurt economic growth and burden future generations.

However, just as there are steps consumers can follow to eliminate household debt, there are six steps government can follow to reduce the public debt burden.

Step One: Stop Digging a Deeper Hole. Personal financial advisers say that the first step to getting out of debt is to stop increasing it. This principle also applies to governments. Lawmakers should stop running perennial deficits that make the problem worse:

- If the government raises taxes in the future, it will slow economic growth by taking money that businesses would have invested.

- If the government prints more money, it will cause inflation and devalue the dollar, leading to lower real disposable incomes.

- If the government drastically cuts its consumption spending in order to meet debt payments, it will have to reduce such services as national defense, infrastructure, education and so forth.

For instance, a March 2009 Congressional Budget Office (CBO) analysis of the stimulus bill found that increased government debt will crowd out private investment and reduce the rate of economic growth in 10 years.

Step Two: Assess the Size of the Problem. Once an individual stops adding debt, the next step is to assess how much has accumulated. One way to judge the sustainability of the U.S. national debt is to compare it to standards for other developed countries. Countries in the European Monetary Union, which use the euro as their national currency, have recently struggled to rein in debt, but they originally agreed to meet two fiscal "sustainability" criteria: 1) annual public deficits could not exceed 3 percent of gross domestic product (GDP), and 2) total public debt could not exceed 60 percent of GDP.

Judged by these standards, U.S. deficits and federal debt are highly unsustainable. According to the CBO analysis of President Obama's 2010 budget:

- The U.S. budget deficit will grow from $459 billion in 2008 to $1.85 trillion in 2010.

- Over the period 2010 to 2019, the deficit will average 5.3 percent of GDP.

- The U.S. public debt – government securities and bonds owned by individuals, corporations, Federal Reserve Banks and foreign governments – will grow from 40.8 percent of GDP in 2008 to 82.4 percent of GDP in 2019; that is, from $5.8 trillion to $17.3 trillion.

Even more perilous are the government's unfunded obligations – promises to pay more benefits in the future than the government expects to receive in revenues dedicated to funding those benefits. The unfunded obligation for Social Security and Medicare is $101.7 trillion in today's dollars. That is more than seven times 2008 GDP and will grow every year that the programs are not reformed to bring projected spending into balance with expected revenues.

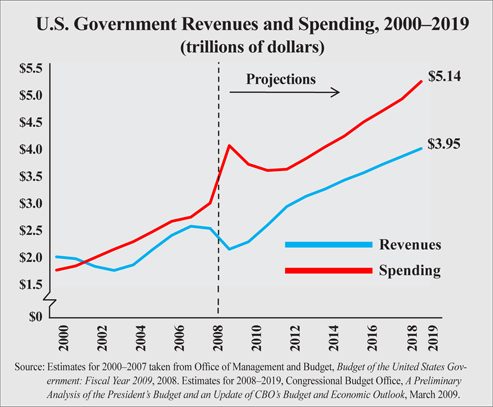

Step Three: Cut Spending to Free Up Funds. The third step in an individual's battle against indebtedness is to cut other spending in order to pay down debt. For the federal government this involves balancing the budget and reforming entitlements. Over the next decade, under President Obama's budget, federal spending will increase 25 percent faster than revenue, according to the CBO [see the figure]:

- From 2008 to 2019, federal spending will rise an average of 5.5 percent per year, from $2.98 trillion to $5.14 trillion.

- Revenue, however, will grow 4.4 percent per year, from $2.53 trillion to $3.95 trillion.

In the long run, the bigger problem is entitlement spending. If the federal government doesn't reform Social Security and Medicare in the near future, it will have to pay for these obligations by raising taxes or reducing other spending.

Step Four: Become More Productive. Some individuals increase their productivity through higher education or vocational training. With additional skills, they obtain better-paying jobs and, thus, generate more income to pay down debt. For the federal government, this means increasing investment in human and technological capital in order to increase labor productivity.

One of the best ways for government to invest in worker productivity is to free the market to innovate and create jobs by reducing corporate taxes. Lowering the corporate tax rate from 35 percent to 25 percent, for example, would free companies to invest more in productivity-enhancing plants and equipment, worker training, and research and development.

Step Five: Sell Unused Assets. Families often pay down debt by selling unneeded household items. In addition to garage sales, online services such as eBay and craigslist have made selling used goods popular and convenient. Likewise, the federal government could auction off the billions of dollars' worth of land and buildings that it no longer uses. Citizens Against Government Waste (CAGW) recently estimated the value of unused or underutilized federal property at about $1.2 trillion.

Purchasing government assets is as simple as placing a bid on the Internet (such as the Web site www.govsales.gov). Unfortunately, many unused federal properties and buildings are not listed because politicians want to keep them off the market for purposes of historical preservation or future economic development in their communities. But the marketplace does a better job of deciding what should be sold and for how much. For example, private groups or foundations could bid on federal buildings they value for historical preservation.

Step Six: Communicate with Creditors. Individual debtors must communicate to creditors their intention to pay down debt. This reassures creditors that they will be paid, and could mean the difference between solvency and bankruptcy. Currently the federal government is sending the wrong message. The Brookings Institution estimates the government could run an average annual budget deficit of $1 trillion from 2009 through 2019 – not including President Obama's health care or environmental plans, and assuming that stimulus spending expires in two years.

Conclusion. The best economic stimulus policy would be to reduce long-term government debt, including current public debt and unfunded liabilities. This type of responsible debt policy would strengthen the dollar and spark consumer and investor confidence. If it can work for an individual, why wouldn't it work for government?

D. Sean Shurtleff is a policy analyst and Pamela Villarreal is a senior policy analyst at the National Center for Policy Analysis.