Many of the nearly 46 million uninsured say they are unable to afford health insurance. Advocates of various state regulations claim their proposals would make health coverage more affordable. These regulations include mandates that employers offer their employees health insurance or that individuals obtain health coverage, and requirements that health plans and insurers cover specified benefits or accept anyone who applies for insurance.

However, rather than make coverage more affordable, these regulations drive up the cost of insurance.

Employer Mandates. Legislation has been proposed in several states to impose a play-or-pay mandate – requiring employers either to offer group health insurance or to pay into a government fund that subsidizes health coverage. Thus far, the city of San Francisco and the state of Hawaii are the only governments that have imposed such mandates – San Francisco, because of a favorable appeals court ruling, and Hawaii because of an exemption from federal law (discussed below).

Problem: Employer Mandates Are a Tax on Employees. Benefits substitute for cash wages in a worker's compensation package. If their workers are unwilling to forgo wages in return for health insurance, firms are unlikely to offer coverage. Forcing employers to provide health benefits to workers who are unwilling to bear the premium costs themselves is tantamount to a tax on labor, forcing employees to accept a health insurance fringe benefit in lieu of wages. This doesn't make coverage more affordable. Instead it forces employees to bear the cost – whether they like it or not.

Problem: Employer Mandates Are Limited by Federal Law. Another problem with play-or-pay mandates is that most large employers are exempt. The mandate can be imposed on businesses that purchase health insurance coverage in the small group market. However, the federal Employee Retirement Income Security Act (ERISA) precludes state and local governments from regulating the health plans of employers who self-insure – that is, pay their employees' health claims themselves. ERISA is the basis for an ongoing court challenge to San Francisco's employer mandate. Hawaii is exempt from ERISA because its employer mandate was enacted before the federal law. However, Hawaii still has a significant percentage of uninsured residents, and health insurance is just as expensive as in other states.

Individual Mandates. An alternative to an employer mandate is an individual mandate compelling people to obtain health coverage. Massachusetts is the first state to require most adults and children to have health insurance. The state subsidizes coverage for employees of firms that do not offer their own plans. Similar proposals have been debated in California, Illinois, Colorado, Pennsylvania and now New Jersey. New Jersey recently passed a mandate to cover "all kids" and is expected to debate requiring adult coverage during the next General Assembly.

Problem: Individual Mandates Are Difficult to Enforce. Nationally, the percentage of motorists who lack automobile insurance is similar to the portion who lack health coverage. All but three states have an auto insurance mandate – but in many states the proportion of people who lack auto liability coverage is similar to those who lack health coverage. It may well be many of the same people. Considering how little success states have had enforcing relatively inexpensive auto liability coverage, it would be much more difficult to enforce a costly health coverage mandate.

Problem: Individual Mandates Are Vulnerable to Special Interests. Another problem with mandated coverage is that legislatures must appoint an oversight board which decides when the mandate is met. Massachusetts and Hawaii both have such boards. These groups are typically stacked with public health advocates, union officials, and representatives from medical societies, hospital associations and other so-called "stakeholders," all of whom dislike lower-cost plans that include employee cost-sharing and self-insurance for small medical expenses. They tend to qualify only expensive, comprehensive plans with lavish benefits, low deductibles and high lifetime payment caps.

Furthermore, state boards and legislatures are lobbied by special interests to mandate coverage of their industry's services. In fact, across all 50 states there are nearly 2,000 benefits and providers that health insurers are required to cover in individual and small group policies. These include everything from in vitro fertilization to pastoral counselors. Supporters often claim their particular mandate costs little. Indeed, individually, most mandated services increase the cost of premiums less than one percent. But they add up. In fact, several studies have estimated that about one-quarter of the uninsured have been priced out of the market by costly mandates.

Mandated Acceptance. If individuals and small businesses are compelled to have health coverage, many argue it is only fair to force insurers to accept all people who apply, and charge them tightly banded rates. These regulations are known as guaranteed issue and community rating. Banded rates are supposed to ensure the sickest pay premiums that aren't much greater than the healthiest enrollees.

Problem: Mandated Acceptance Raises Premiums. In every state where guaranteed issue and community rating is in effect, health insurance premiums are two to three times the national average. If insurers cannot charge premiums that reflect the expected costs of the person insured, others must be charged higher rates to subsidize them. And if insurers must cover all who apply, people tend to wait until they are sick to enroll since there is no penalty for waiting.

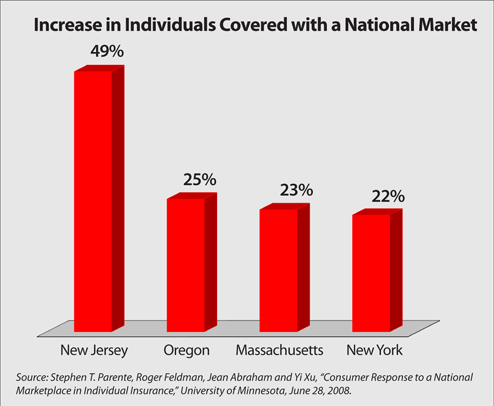

Right Solution: A National Insurance Market. Protection from interstate competition allows politicians to impose expensive mandates and costly regulations. Allowing individuals and businesses to purchase coverage across state lines would create more competitive insurance markets. Interstate competition would allow consumers to find policies that fit their budgets, giving more people access to affordable insurance. According to a University of Minnesota study, in New Jersey the individual and small group market would insure 49 percent more people than it currently does. The number in Massachusetts is 23 percent. [See the figure.] Rep. John Shadegg (R-Ariz.) has proposed interstate competition at the federal level, and Assemblyman Jay Webber has proposed a similar bill in New Jersey.

Devon Herrick, Ph.D., is a senior fellow with the National Center for Policy Analysis.