Congress and President Obama appear intent on pursuing two conflicting goals for public and private health care: reining in rising costs while also increasing spending in order to expand insurance coverage to more people.

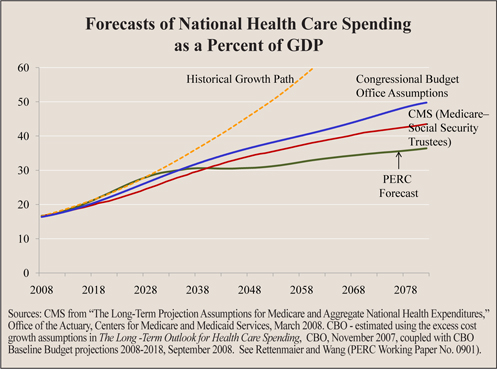

Health care spending is a growing share of the economy and forecasts by the Congressional Budget Office (CBO) and the Office of the Actuary at the Centers for Medicare and Medicaid Services (CMS) suggest that it will continue to grow well into the future.

- Over the past four decades, the share of gross domestic product (GDP) spent on health care has more than tripled from 5 percent to 16 percent.

- Recent CBO and CMS forecasts suggest that health care spending will top 30 percent by 2040.

- The CBO's projections show that health care spending may grow to as much as 50 percent of GDP by 2082.

Given that 45 percent of health care spending is currently funded by government payers, future budget implications are staggering. For example, in addition to dedicated payroll taxes and premium payments, federal spending on Medicare will:

- Require funding equal to 36 percent of federal income taxes by 2030, based on the CMS forecast; and

- Require funding equal to almost 70 percent of federal income taxes by midcentury, based on the CBO forecast.

The CBO and CMS forecasts assume that health care growth will moderate. But what will cause this moderation? Will health care be rationed? Will additional constraints be placed on providers? Will patients choose between health care and other uses of money? In other words, these forecasts assume tough choices will be made. How these choices are made will frame public policies in coming years.

The CBO and CMS base their health care forecasts on the relationship between projected per capita GDP growth and per capita health care spending growth.

- Both the CBO and CMS forecasts assume that health care spending will initially outpace GDP growth but that this excess cost growth will eventually decline.

- Both forecasts assume that despite health care accounting for up to half of the economy, GDP will continue to grow.

A New Way of Forecasting the Path We Are On. Logically, if health care spending rises as a percentage of GDP, other sectors of the economy shrink. For instance, over the 33-year period from 1975 to 2008, the greatest growth in total personal consumption expenditures was in the health care component:

- The share of GDP accounted for by personal consumption of medical care services more than doubled, from 5.8 percent of GDP in 1975 to 12.5 percent in 2008.

- However, personal consumption of other services rose by almost the same amount as a percent of GDP, from 23.5 to 30 percent.

- Consumption of durable goods declined slightly as a share of GDP, from 8.1 percent to 7.2 percent, and nondurable goods declined from 25.7 to 20.8 percent.

- At the same time, total personal consumption grew from 63.1 percent of GDP to 70.4 percent, while the savings rate declined.

Forecasting the Future of Health Care Spending. We have developed an economic model to project health care spending, along with other personal consumption spending, investment and government consumption. The model assumes GDP will grow in the future as it has in the past and incorporates projections of population aging. It assumes no major public policy change. Instead, the components of spending are forced to compete against each other in the future for income shares based on past relationships. The model forecasts:

- Personal consumption of nondurable goods will decline as a share of GDP from 20.8 percent in 2008 to 17.6 percent in 2085.

- Durable goods will increase from 7.2 percent to 7.9 percent of GDP over the period.

- Consumption of other services will rise from 30.1 percent to 34.9 percent.

- Personal consumption of medical care services will rise from 12.5 percent of GDP to 27.6 percent.

Personal consumption of medical care services is a subset of national health expenditures, which include some government consumption spending and other personal health consumption that isn't included in medical services. The economy-wide model projects that total national health expenditures will consume 36 percent of GDP by the 2080s. This is lower than the CMS estimate of 44 percent and CBO estimate of about 50 percent of GDP. [See the figure.]

Implication of the Forecast: Crowding Out Other Government Programs. Over the 33-year period from 1975 to 2008, the components of GDP other than personal consumption declined. The shares of GDP for investment, net exports and government consumption spending (nonentitlement spending) fell from 36.9 to 29.6 percent. Our model projects a continuation of that trend. By 2040, the economy-wide forecast indicates that the share of the economy represented by everything other than personal consumption will decline by two-thirds, to less than 10 percent of GDP. This 10 percent share of GDP will be all that is available for government spending on such programs as defense, transportation, investment and net exports.

Implication of the Forecast: Crowding Out of Saving and Investment. The model predicts a dramatic decline in investment after 10 to 12 years: from 14 percent of GDP in 2008, investment will fall to less than 1 percent of GDP before 2030. However, this drop in investment implies a major reduction in the rate of economic growth. Thus, the forecast undercuts the assumption of income growth upon which the model is based. One implication: If health care spending is not constrained in any other way, eventually it will be constrained by stagnant income.

Conclusion. If health care spending and personal consumption continue to grow as they have in the past, investment will decline, and economic growth will slow and maybe even grind to a halt. We can instead move to a more rational system in which people make their own choices. It is critical that the realignment of the health care system be based on market-driven incentives.

Andrew J. Rettenmaier is the Executive Associate Director of the Private Enterprise Research Center at Texas A&M University and a senior fellow with the National Center for Policy Analysis.