Every year the Social Security Trustees publish a report on the fiscal solvency of the program. It details the program's unfunded liabilities, which is what the government will still owe after it uses current and future tax receipts to pay for current and future retiree benefits.

In 2005, the Social Security Trustees estimated that the program's unfunded liabilities were $8.5 trillion. This means that even after accounting for payroll tax revenues the federal government would have to have this much money in the bank today, accruing interest, in order to pay promises to future retirees.

However, the Trustees appear to be underestimating the value of Social Security's unfunded liabilities because they are failing to take into account the riskiness of tax payments that have not yet been received and of benefits that have not yet been accrued and the certainty of those benefits that have been established. In effect, the Trustees are understating the market value of Social Security's net liabilities – what the government would have to pay a private party or investor to take the obligation off its hands. As I showed in a recent paper with Alex Blocker and Steve Ross, to mark to market Social Security one needs to treat future government payments (Social Security benefits) and receipts (payroll taxes) as nontradable financial assets.

Underestimating Social Security Net Benefits to Current Workers by Not Adjusting for Real Wage Growth. According to our study, the trustees have made two valuation mistakes in calculating Social Security's unfunded liabilities. The first mistake involves failing to account for risk with respect to initial benefit awards as well as future tax payments.

Underestimating Social Security Net Benefits to Current Workers by Not Adjusting for Real Wage Growth. According to our study, the trustees have made two valuation mistakes in calculating Social Security's unfunded liabilities. The first mistake involves failing to account for risk with respect to initial benefit awards as well as future tax payments.

The trustees' calculations assume that wage growth will be fairly constant from year to year. Social Security benefits are based on a worker's covered earnings history with an adjustment for economy-wide average wage growth. Payroll taxes are collected as a percentage of an individual's earnings (up to a limit on taxable wages). Thus, the system's liabilities and tax receipts are largely dependent on wage growth. The problem with the Trustees Report is that wage growth is assumed to be constant at 1.1 percent a year. However, wage growth is highly variable, so there is no counting on it being 1.1 percent per year in the future. Data from 1951 to 2005 shows that wages grew by as much as 6.4 percent in a single year and declined by as much as 4.6 percent in a single year. In financial terms, when something is hard to predict it is considered a risk. Thus, in addition to Social Security's assumed interest rate of 2.9 percent, a "risk premium" must be included that compensates for the uncertainty in tax revenues and benefit payments resulting from variable wage growth.

Undervaluing Social Security Benefits Once They Begin. The second mistake is the failure to account for the safety of the stream of Social Security benefits to a retiree once they commence. Social Security benefits are paid out as inflation-indexed annuities. Ignoring uncertainty in future mortality probabilities, as we do in our analysis, Social Security's benefit obligations to specific cohorts of workers – once they begin – are definite, real (inflation-adjusted) annual amounts. Such streams need to be discounted using the rate of returns on comparable securities, which in this case are inflation-indexed bonds. But the returns on Treasury Inflation Projected Securities for 2005 – the year we analyzed – were at least one-third less than the discount rate used by the Trustees. In using too high a discount rate, Social Security understates the market value of these obligations; that is, Social Security is mispricing safe as well as risky streams of payments and receipts.

- In 2005 the average annual real yields on Treasury Inflation Protected Securities (TIPS) were 1.50 percent, 1.63 percent, 1.81 percent, and 1.97 percent for 5, 7, 10, and 20 year maturities, respectively.

- Each of these yields is considerably lower than the 2.9 percent real (inflation-adjusted) yield used by the trustees in their 2005 unfunded liability calculations.

- Using the TIPS term structure, the value of a $1 single-life real annuity for a 62-year-old male in 2005 is $15.40; this is 8.8 percent higher than SSA's $14.18 valuation.

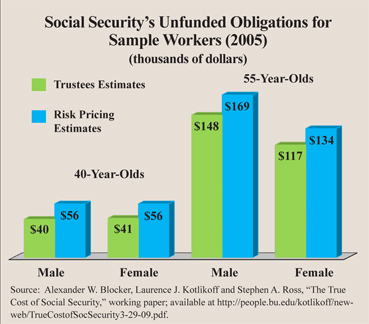

Net Liabilities to Retirees. An illustration of how these calculation errors affect the value of Social Security taxes and benefits is to compare the differences in net liabilities -present value of lifetime taxes paid minus lifetime benefits paid – between the trustees' estimates and the risk-pricing method for workers who retire at age 62. For example [see the figure]:

- For a 40-year- old college graduate male, the lifetime present value of unfunded liabilities is about $40,401 using the trustees' calculations, compared to $56,196 using the risk-pricing method.

- For a 40-year- old college graduate female, the trustees' calculation is about $40,567, compared to the risk-adjusted price of $55,896.

- For a 55-year-old college graduate male, the trustees' calculation is about $148,188, compared to a risk-adjusted $169,102.

- For a 55-year-old college graduate female, it is about $117,479, compared to a risk-adjusted $134,341.

According to the Trustees, in 2005 the unfunded liability of Social Security equaled $8.5 trillion. But when it is priced for risk, the value of the unfunded obligations is $10.4 trillion, a difference of 23 percent. This means the U.S. government would have to pay $10.4 trillion to private parties or foreign governments in order to retire this liability.

Furthermore, since the government doesn't have $10.4 trillion with which to pay the risk-adjusted unfunded obligations of the Social Security, that debt will continue to increase, unless the program is changed in a way that closes the gap between benefits and revenues.

Conclusion. No one would suggest that the prices of financial securities are independent of risk. Such a proposition would deny fact, let alone theory. The same financial laws that determine the prices of marketed securities govern the pricing of Social Security liabilities. Unfortunately, the standard U.S. practice has been to ignore this relationship.

Were the trustees to price Social Security's implicit liabilities and assets based on risk as well as safety, they would show a net liability that is higher by almost one-fourth. Of course, Social Security's net retirement liability to working-age Americans is only part of its overall implicit debt. And Social Security is only one part of a much broader set of future U.S. government receipts and payments, whose market values need to be assessed. The ultimate goal, in this regard, is to evaluate all entitlement programs using techniques similar to those considered here.

Laurence J. Kotlikoff is a professor of economics at Boston University and a senior fellow with the National Center for Policy Analysis.