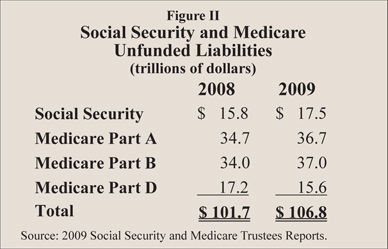

The 2009 Social Security and Medicare Trustees Reports show the combined unfunded liability of these two programs has reached nearly $107 trillion in today's dollars! That is about seven times the size of the U.S. economy and 10 times the size of the outstanding national debt.

The unfunded liability is the difference between the benefits that have been promised to current and future retirees and what will be collected in dedicated taxes and Medicare premiums. Last year alone, this debt rose by $5 trillion. If no other reform is enacted, this funding gap can only be closed in future years by substantial tax increases, large benefit cuts or both.

Social Security versus Medicare. Politicians and the media focus on Social Security's financial health, but Medicare's future liabilities are far more ominous, at more than $89 trillion. Medicare's total unfunded liability is more than five times larger than that of Social Security. In fact, the new Medicare prescription drug benefit enacted in 2006 (Part D) alone adds some $17 trillion to the projected Medicare shortfall – an amount greater than all of Social Security's unfunded obligations.

Future Payroll Tax Burdens. Currently, a 12.4 percent payroll tax on wages funds Social Security and a 2.9 percent payroll tax funds Medicare Part A (Hospital Insurance). But if payroll tax rates rise to meet unfunded obligations:

- When today's college students reach retirement (about 2054), Social Security alone will require a 16.6 percent payroll tax, one-third greater than today's rate.

- When Medicare Part A is included, the payroll tax burden will rise to 25.7 percent – more than one of every four dollars workers will earn that year.

- If Medicare Part B (physician services) and Part D are included, the total Social Security/Medicare burden will climb to 37 percent of payroll by 2054 – one in three dollars of taxable payroll, and twice the size of today's payroll tax burden!

Thus, more than one-third of the wages workers earn in 2054 will need to be committed to pay benefits promised under current law. That is before any bridges or highways are built and before any teachers' or police officers' salaries are paid.

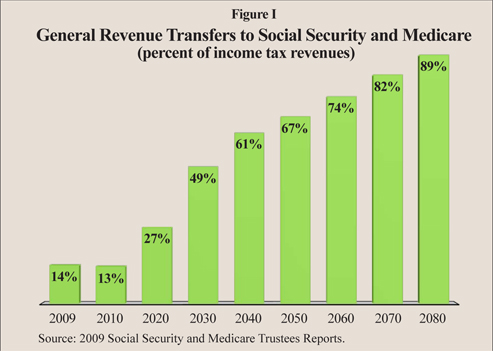

Impact on the Federal Budget. The combined deficits of both programs now require about 14 percent of general income tax revenues [see Figure I]. As baby boomers begin to retire, however, that number will soar, and it will be increasingly difficult for the government to continue spending on other activities. In the absence of a tax increase, if the federal government keeps its promises to seniors and balances its budget:

- By 2020, in addition to payroll taxes and premiums, Social Security and Medicare will require more than one in four federal income tax dollars.

- By 2030, about the midpoint of the baby boomer retirement years, the programs will require nearly half of all income tax dollars.

- By 2060, they will require nearly three out of four income tax dollars.

Impact on Federal Revenues. On average, every year since 1970, Medicare and Medicaid spending per beneficiary has grown 2.5 percentage points faster than per capita Gross Domestic Product (GDP). In the future, Medicare spending may rise even faster than the Trustees estimate. According to the Congressional Budget Office (CBO), if Medicare and Medicaid spending continues growing annually at 2.5 percentage points above GDP growth:

- By 2050, Social Security, Medicare and Medicaid (health care for the poor) will consume nearly the entire federal budget.

- By 2082, Medicare spending alone will consume nearly the entire federal budget.

Can Higher Taxes Solve the Problem? The CBO also found that if federal income tax rates are adjusted to allow the government to continue its current level of activity and balance its budget:

- The lowest marginal income tax rate of 10 percent would have to rise to 26 percent.

- The 25 percent marginal tax rate would increase to 66 percent.

- The current highest marginal tax rate (35 percent) would rise to 92 percent!

Additionally, the top corporate income tax rate of 35 percent would increase to 92 percent.

Pay-As-You-Go. Social Security and Medicare are in trouble precisely because they are based on pay-as-you-go financing. Every dollar of payroll taxes is spent. Nothing is saved, and nothing is invested. The payroll taxes contributed by today's workers pay the benefits of today's retirees. However, when today's workers retire, their benefits will be paid only if the next generation of workers agrees to pay even higher taxes.

What about the Trust Funds? The Social Security and Medicare Trust Funds exist purely for accounting purposes: to keep track of surpluses and deficits in the inflow and outflow of money. The accumulated Social Security surplus actually consists of paper certificates (non-negotiable bonds) kept in a filing cabinet in a government office in West Virginia. These bonds cannot be sold on Wall Street or to foreign investors. They can only be returned to the Treasury. In essence, they are little more than IOUs the government writes to itself.

Conclusion. The Social Security and Medicare deficits are on a course to engulf the entire federal budget. If our policymakers wait to address these growing debts until they are out of control, the solutions will be drastic and painful.

Pamela Villarreal is a senior policy analyst with the National Center for Policy Analysis.