As soon as 2010, small businesses could face three simultaneous tax hikes that would raise their marginal tax rate as high as 66.9 percent. Democrats in Congress plan to raise taxes on top earners by allowing some of the Bush tax cuts to expire. Draft legislation in the House of Representatives to overhaul the health care system contains two additional proposals that aim to soak the rich. However, these tax hikes will drench small businesses.

Small businesses are particularly vulnerable to the proposed tax hikes because they typically pay taxes via "flow-through" entities, such as sole proprietorships, partnerships, LLCs/PLLCs and S-Corporations. These entities are taxed through the individual income tax system, with their revenues "flowing through" to their owners' tax returns. This allows small businesses to avoid the corporate income tax system, but can put self-employed small business owners in the top tax bracket.

According to the U.S. Treasury, flow-through small businesses account for 93 percent of all businesses in the United States. If taxes are raised on the top tax brackets, more than half of reported small business income would be hit with a tax increase.

The Expiring Bush Tax Cuts. The 2003 Bush tax cuts will expire in 2010 and President Obama does not want to renew them. Accordingly, the top two rates will return to their pre-2001 levels:

- The top marginal personal income tax rate will increase from 35 percent to 39.6 percent.

- The second highest rate will increase from 33 percent to 36 percent.

Data from the Joint Committee on Taxation shows that at least 55 percent of the revenue raised by increasing the top two rates would come from small business income. That amounts to an estimated $8.69 billion increase in small business taxes in 2011 alone.

In addition to federal taxes, states impose income, property and other taxes that raise the total tax burden on small business. As a result of these state levies, if the Bush tax cuts expire:

- A small business in Texas would pay a maximum marginal tax rate of 42.5 percent (the lowest in the nation).

- A small business in Oregon would pay a maximum marginal tax rate of 53.5 percent (the highest in the nation).

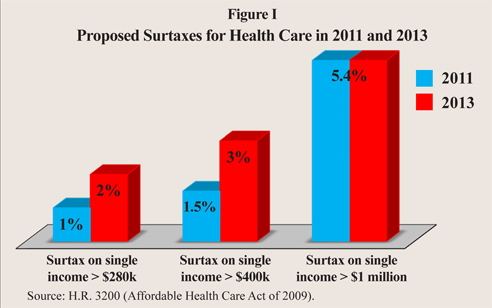

The New Surtax. According to a recent House version of the health care bill currently working its way through Congress [see Figure I]:

- Individuals with adjusted gross incomes above $280,000 ($350,000 for families) will pay a surtax of 1 percent on their income tax bills.

- Individuals with incomes above $400,000 ($500,000 for families) will pay a surtax of 1.5 percent.

- Individuals above $1,000,000 will pay a surtax of 5.4 percent.

The surtax would rise even higher in 2013 if these rates fail to generate the revenue necessary to fund new health care spending.

With the surtax and state taxes:

- A small business in Texas would pay a maximum marginal tax rate of 47.9 percent (the lowest in the nation).

- A small business in Oregon would pay a maximum marginal tax rate of 58.9 percent (the highest in the nation).

About 33.5 million workers are employed by the small businesses that would pay these higher tax rates, according to the National Federation of Independent Business.

New Tax Penalties for Small Businesses. Under the health care reform bill proposed in the House, small businesses would also face financial penalties if they don't provide health insurance to their employees. Employers will be required to offer qualifying coverage and pay at least 72.5 percent of each worker's individual premiums and at least 65 percent of family premiums. Except for the smallest businesses, penalties will be imposed for noncompliance:

- Businesses with annual payrolls of $250,000 to $300,000 would pay a penalty equal to 2 percent of their payrolls if they do not provide qualifying employee insurance.

- Businesses with $300,000 to $350,000 payrolls would be penalized 4 percent.

- Businesses with $350,000 to $400,000 payrolls face a 6 percent penalty.

- Businesses with annual payrolls exceeding $400,000 would pay 8 percent.

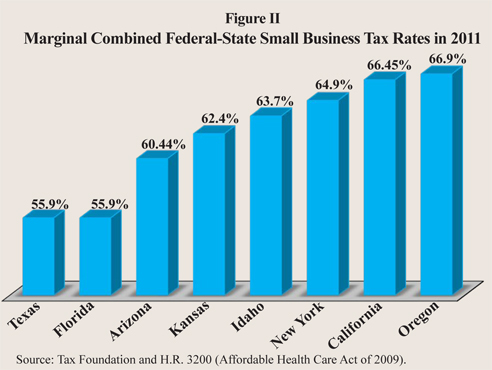

Adding the health insurance penalty, surtaxes and return to pre-Bush tax rates to state tax burdens [see Figure II]:

- A small business in Texas would pay up to 55.9 percent of the last dollar earned to the government (the lowest rate in the nation).

- A small business in Oregon would pay up to 66.9 percent (the highest rate in the nation).

Effect of Marginal Tax Rates. The surtax and other tax hikes would raise the top effective marginal income tax rate to a higher level than it has been since before the 1986 tax reforms.

The Tax Foundation estimates that the average tax return with business income will report adjusted gross income of $948,414 in 2011. This average-income business could face a total tax increase of $66,979, bringing their federal tax burden to more than $293,000. Higher overhead costs lead to lower profits, fewer dollars for reinvestment and less money for payroll. Thus, millions of workers could be harmed by tax hikes aimed at the rich.

Biff Jones is a graduate fellow and Pamela Villarreal is a senior policy analyst with the National Center for Policy Analysis.