The landmark health reform law signed by President Obama will require small businesses to provide health insurance to their employees. This burden will be offset by a tax credit for each employee covered. However, the credit is arbitrarily reduced as firms grow, penalizing employers that hire more workers or increase their salaries. Thus, the credit may discourage firms from hiring more workers or higher-paid workers.

How the Tax Credit for Small Firms Will Work. From 2010 to 2014, businesses in some industries that employ 25 workers or fewer will qualify for a tax credit worth up to 35 percent of the employer's contribution to workers' health coverage. Beginning in 2014:

How the Tax Credit for Small Firms Will Work. From 2010 to 2014, businesses in some industries that employ 25 workers or fewer will qualify for a tax credit worth up to 35 percent of the employer's contribution to workers' health coverage. Beginning in 2014:

- Employers will be eligible for a 50 percent health insurance tax credit for their contributions to employees' coverage for two years, but they must pay at least half the cost.

- Employers must obtain insurance through newly formed health insurance exchanges in order to qualify.

- Employers must have no more than 10 workers, earning an average of $25,000 or less, to obtain the full tax credit.

The credit is not available to sole proprietorships and their families.

As a firm's average pay rises above $25,000, the tax credit is slowly withdrawn at a rate of 4 percentage points for every additional $1,000 in average pay, and it is completely withdrawn once average pay reaches $50,000. Independently of workers' pay, the tax credit is also incrementally withdrawn for each increase in the size of the firm beyond 10 workers, and is completely withdrawn once the firm reaches 25 workers.

Thus, the marginal cost for hiring an additional worker could be substantially increased due to the withdrawal of the credit. For example, by 2016, the Congressional Budget Office (CBO) estimates the cost of an employer-sponsored plan covering 70 percent of health expenses will be $15,200 for a family. The following cases assume that the employer pays half of the premium of family coverage for each worker ($7,600) and also receives a 50 percent tax credit.

Case No. 1: The Penalty for Raising Average Pay. It would take a substantial increase in the pay of all workers to raise average pay significantly; therefore, a large increase in average pay is more likely to come from the addition of a more highly paid worker than from pay raises. Suppose, for example, that a firm with 13 workers hires an additional worker, which raises the average pay for all employees:

- If the addition of a more highly paid worker, such as a supervisor, raises the firm's average wage 10 percent to $27,500, the total tax credit the firm receives falls from $36,400 to $32,760, making the marginal cost of adding the supervisor $3,640.

- If the addition of the supervisor raises the firm's average wage 20 percent to $30,000, the total tax credit the firm receives falls from $36,400 to $27,300, making the marginal cost of the supervisor $9,100.

- If the firm's average wage increases 50 percent to $37,500, the total tax credit it receives falls from $36,400 to $14,560, making the marginal cost of the supervisor $23,660.

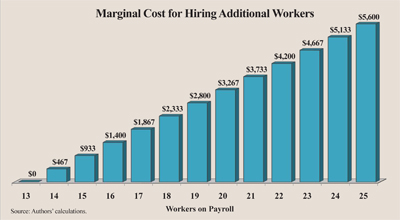

Case No. 2: The Penalty for Hiring Additional Workers. The overall tax credit falls by 6.7 percentage points for each additional employee beyond 10 workers. The firm's total subsidy will peak at $36,400 with the hiring of the 13th worker. (It does not peak at the 10th worker because the tax credit received for the additional workers still outweighs the reduction in the credit among all workers.) Thus, a firm employing 11 workers would get a total tax credit of $35,933 while a firm employing 24 workers would receive a total credit of only $5,600. Assuming an additional worker has the same salary and premium costs as the other workers [see the figure]:

- If an employer has 15 workers, the loss in tax credits for hiring an additional worker is $1,400.

- At 20 workers, the loss in tax credits for hiring the 21st worker is $3,733.

- The marginal cost to hire the 25th worker is $5,600, at which point the tax credit is completely phased out.

High Marginal Tax on Labor. The legislation presents firms with the biggest obstacle to job growth when they want to expand beyond a certain size. Firms with 50 or fewer employees are exempt from the employer "play or pay" penalties if they do not offer coverage and their workers receive a subsidy in the exchange. If a firm does not provide health benefits, hiring the 51st worker triggers a penalty of $2,000 per worker multiplied by the entire workforce, after subtracting the first 30 workers. In this case the fine would be $42,000 [(51-30)*$2,000]. Under these conditions many firms could not afford to increase beyond 50 workers and would not expand.

Conclusion. The employer mandate for low wage workers will cause some employers to substitute capital for labor and more highly skilled workers for less skilled ones. Thus, instead of hiring ditch diggers and giving each one a shovel, an employer might buy a backhoe and hire a more highly skilled operator. An unintended consequence of the law is that some low wage workers will be unemployed who otherwise would not be.

Devon Herrick is a senior fellow and Pamela Villarreal is a senior policy analyst at the National Center for Policy Analysis.