Each year, foreign governments and investors increase their holdings of U.S. debt. In effect, they are lending the United States money to finance its excess of imports over exports. However, continued excessive deficits could make U.S. trading partners reluctant to continue the process. Reluctance to buy or efforts to sell dollar holdings by foreign investors would cause U.S. equities to decline, interest rates to spike and the dollar to plunge.

Problem: Not Enough Domestic Saving. Economists often refer to the U.S. trade deficit (when more goods and services are imported than exported) and the federal budget deficit (when government spends more than it receives in tax revenues) as problems of inadequate domestic saving (income minus consumption). The trade deficit, the budget deficit and the balance between domestic saving and investment (output not consumed) are all closely related. For example, tax incentives to encourage saving would likely stimulate investment, lower both the budget and trade deficits ($1.4 trillion and $381 billion, respectively, in 2009), and reduce reliance on foreign investment.

In an economy with no external trade and no government, market forces – such as interest rates, incomes and prices – will adjust until actual saving and investment balance. If planned saving exceeds investment, interest rates will tend to fall until saving and investment balance. Likewise, if planned investment is greater than saving, interest rates and income will rise and pull up saving.

In an economy with no external trade and no government, market forces – such as interest rates, incomes and prices – will adjust until actual saving and investment balance. If planned saving exceeds investment, interest rates will tend to fall until saving and investment balance. Likewise, if planned investment is greater than saving, interest rates and income will rise and pull up saving.

Introducing government into the equation, a budget deficit (negative saving) exacerbates the shortage of domestic saving to finance domestic investment. More foreign saving will be needed to supplement domestic saving, which in turn allows the United States to consume more goods and services than it produces.

Problem: Rising Government Spending. Government budget deficits and inadequate private saving are causing the federal government to become ever more reliant on foreign funding for federal programs, especially retirement and health care entitlement programs.

The 2009 Social Security and Medicare Trustees Report shows the combined unfunded liability of these two programs has reached nearly $107 trillion in today's dollars. The unfunded liability is the difference between the benefits that have been promised to current and future retirees, and what will be collected in dedicated taxes and Medicare premiums. The amount is expected to increase further as baby boomers retire.

The United States' unfunded obligations under Social Security and Medicare, combined with rising public debt, are a source of concern for foreign investors. In March 2009, Chinese Premier Wen Jiabao noted he was "a little worried" about the safety of China's U.S. holdings. This unease was reinforced in October 2009 when the rating agency Moody's warned that the United States could lose its AAA credit rating (the top rating possible) if expanding deficits are not tamed.

If other countries lose their appetite for U.S. debt over economic concerns, they would likely only purchase more of it at higher interest rates. Their reluctance would also put downward pressure on the external value of the dollar. Both of these effects would reduce U.S. living standards.

Problem: Too Reliant on Foreign Investors. Public debt – about $12.4 trillion – consists of debt held in government accounts (such as the Social Security and Medicare trust funds) and debt held by public, private and foreign investors. Debt held in government accounts is basically a loan from one part of the government to the other; therefore it is a future burden on taxpayers but not an immediate concern. It accounts for about 36 percent ($4.5 trillion) of public debt. Debt held outside the federal government is referred to as publicly held debt and accounts for about 64 percent ($7.9 trillion) of total public debt.

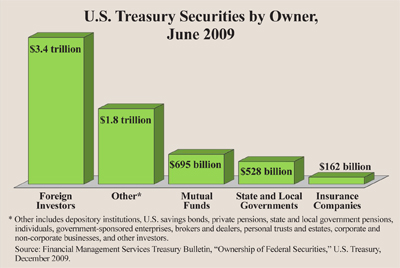

U.S. Treasury securities are the main way the federal government finances its deficits – much of which is owned by foreign entities:

- China was the top foreign investor in 2008 and most of 2009, but by December 2009 its security holdings ($755 billion) were slightly less than Japan's ($769 billion).

- Of the U.S. Treasury securities held in June 2009, 52 percent ($3.4 trillion) were owned by foreign investors. [See the figure.]

This makes the U.S. economy vulnerable to the actions of foreign central banks and, possibly, sovereign wealth funds (investment funds owned by foreign governments, such as China) – especially if any large foreign investor suddenly tries to liquidate its holdings. However, a sudden withdrawal is unlikely. U.S. and foreign economies are so intertwined that it would be economically unwise for a country like China to call in its debt all at once. In fact, according to some estimates, about a quarter of 2008 Chinese exports went to the United States, closely tying its economic health (and employment) to America's. As a matter of arithmetic, U.S. trading partners have no choice but to extend more credit if they are to continue selling the United States more goods and services than they buy.

Solution: Reduce the Deficits. While the United States' status as a debtor nation is unlikely to pose a severe threat in the near future, it would still be wise to reduce the nation's vulnerability sooner rather than later. There are multiple ways to do so:

- Permanent tax incentives to encourage domestic saving would likely lower both the budget deficit and trade deficit.

- Cuts in marginal tax rates reinforced by slower government spending growth might reduce the budget deficit, increase the domestic capital sock and encourage exports.

- Reducing the budget deficit would reduce the vulnerability of the U.S. economy to foreign creditors.

Entitlement programs should also be reformed to partially prefund health care and retirement spending. This would put the government on a different spending path, increasing job creation and domestic investment. As a result, the U.S. economy would be more productive and competitive with the rest of the world.

Robert McTeer is a distinguished fellow with the National Center for Policy Analysis.