In October 2008 Congress passed the Emergency Economic Stabilization Act of 2008. The act created a $700 billion Troubled Asset Relief Program (TARP) aimed at preventing a meltdown of the banking system. Some TARP funds were subsequently used for purposes outside the financial industry, but most were used to purchase preferred stock in banks to shore up bank capital as a buffer against bad assets.

These investments in preferred stock can be sold later under better circumstances and may even turn a profit for taxpayers.

Profit for Taxpayers. Former Treasury Secretary Henry Paulson originally proposed using government funds to purchase "troubled" assets (mainly mortgage-backed securities containing subprime mortgages). Secretary Paulson decided instead to purchase preferred stocks in banks because of rapidly deteriorating economic conditions and the inherent difficulties in pricing mortgage-backed securities. He required the banks to pay a healthy dividend (5 percent) to the Treasury (and thus the taxpayer) and give the Treasury warrants that could later be used to buy common stock at favorable prices. This approach to shoring up bank capital was easier to implement and probably more effective than purchasing toxic assets, but it gave subsequent critics in Congress pretext to charge Treasury with bait-and-switch tactics.

Profit for Taxpayers. Former Treasury Secretary Henry Paulson originally proposed using government funds to purchase "troubled" assets (mainly mortgage-backed securities containing subprime mortgages). Secretary Paulson decided instead to purchase preferred stocks in banks because of rapidly deteriorating economic conditions and the inherent difficulties in pricing mortgage-backed securities. He required the banks to pay a healthy dividend (5 percent) to the Treasury (and thus the taxpayer) and give the Treasury warrants that could later be used to buy common stock at favorable prices. This approach to shoring up bank capital was easier to implement and probably more effective than purchasing toxic assets, but it gave subsequent critics in Congress pretext to charge Treasury with bait-and-switch tactics.

Support of the banking system through TARP has been successful and cost effective. Unlike the savings and loan crisis in the late 1980s – when taxpayers ultimately lost $123.8 billion due to the closing of insolvent thrift institutions – government investment in preferred stock is proving to be profitable to the Treasury and taxpayer. In fact, the Treasury earned about 18 percent on the preferred stock and warrants of the larger banks that repaid ahead of schedule. That return has diminished as smaller banks repay, but remains positive:

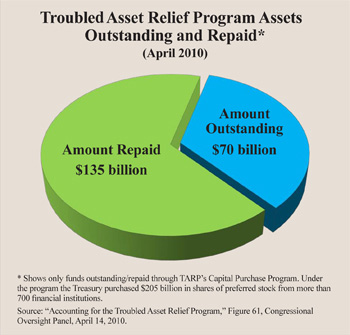

- Approximately $135 billion of $205 billion in preferred stock purchased by the Treasury has been repurchased by banks so far, the TARP Congressional Oversight Panel reported in April 2010 [see the figure].

- The government will likely net about $2 billion in profits, the Congressional Budget Office (CBO) estimated in March 2010.

- The government will net an additional $5 billion from the repayment of supplementary support to Citigroup and Bank of America, according to the CBO.

Banks were not the only organizations to receive financial assistance, however. Loans were also made to the American International Group, Inc. (AIG) and American car companies, General Motors and Chrysler. The CBO currently estimates that assistance to AIG and the automotive industry will result in a net cost to the government of $36 billion and $34 billion, respectively. But these losses are far from certain. The government owns almost 80 percent of the stock of AIG, which still has many assets and, given time, may well return to profitability. In addition, General Motors has already repaid its $6.7 billion loan. The federal government also owns about 60 percent of General Motors' shares, which the government will eventually be able to sell, potentially at a profit.

Investment versus Stimulus Spending. It is important to note the difference between TARP and the stimulus legislation enacted through the American Recovery and Reinvestment Act of 2009. Most TARP activities by the government are investments that have the potential to turn a profit for taxpayers. Moreover, TARP was necessary to prevent the collapse of the financial services industry, which no doubt would have tanked the economy as well.

The stimulus bill, on the other hand, featured not investments, but traditional government spending to promote job creation. Money spent on a given project, however, often involves more of a diversion or reallocation of employment than a net increase in employment. Such spending is like taking water from one end of the bathtub and pouring it into the other end, expecting the water level to rise.

The stimulus bill was probably more effective in saving state and local government jobs that might otherwise have been lost than in creating new private sector jobs. Modest job growth, however, must be weighed against the burden of expanded government debt in the future. This contrasts sharply with the Treasury's investments that will not impose a burden on future taxpayers.

Potential Moral Hazard. Critics of the so-called bank bailouts claim that by saving management and owners from the consequences of their excessive risk taking or bad decisions, it creates moral hazard and encourages similar behavior by others. In most cases, however, the decision-makers were not saved or rescued. Indeed, top management, directors and stockholders generally lost their jobs and much of their wealth, and were maligned in Congress and by the press. They did not benefit from a "heads I win, tails you lose" proposition – they won for a while, until they lost. Future decision-makers will remember both sides of that coin and will likely not want to go there.

Conclusion. The case for bailouts is usually systemic risk. It is not done for the bailout-ee, but to limit collateral damage to the whole system. The TARP program was successful in limiting the damage to the financial industry and will likely turn a profit for taxpayers. Let us hope financial reforms make such actions unnecessary in the future. That is, of course, unless the reforms preventing a crisis also prevent the innovation and creativity that make the American economy dynamic.

Robert McTeer is a distinguished fellow with the National Center for Policy Analysis.