American businesses pay billions of dollars in tariffs each year on exports to countries that are willing to eliminate those tariffs. Why? Because Congress has failed to ratify three key trade agreements already negotiated and signed by the United States.

Free trade agreements with Colombia, Panama and South Korea would eliminate taxes on American goods. The pacts were negotiated under President Bush, but have been put on hold since 2007, when the Democratic-controlled House refused to approve them.

Increasing U.S. exports could create jobs without cost to taxpayers. In his 2010 State of the Union address, President Obama said that doubling exports over the next five years is one of his primary goals. One of the easiest steps to reach that goal would be to approve and implement these pending trade agreements. According to the U.S. Department of Commerce:

- Exports of goods and services supported 10.3 million jobs in 2008.

- Those 10.3 million jobs represented 6.9 percent of total U.S. employment in 2008.

- In 2010, it is estimated, every $185,000 in exports supports one job.

Colombia Free Trade Agreement. Under the provisions of the Andean Trade Promotion and Drug Eradication Act, 90 percent of Colombian goods enter the United States duty-free. This means that a free trade agreement would have no major negative economic impact for American companies, since they already compete with Colombian goods domestically. In Colombia, however, American companies still pay tariffs for U.S. goods to enter. The agreement would eliminate this obstacle and immediately boost U.S. exports. According to the U.S. International Trade Commission, under the Colombia free trade agreement:

- More than 80 percent of U.S. manufacturing exports would immediately enter Colombia duty-free.

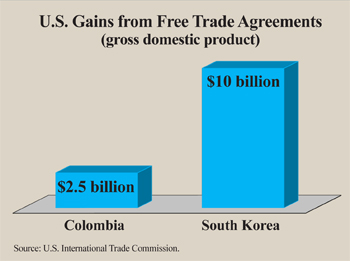

- U.S. gross domestic product (GDP) would increase roughly $2.5 billion.

- U.S. exports would rise $1.1 billion.

Most of the negative economic consequences of not ratifying the deal would fall on Colombia, a democratic U.S. ally. According to a study conducted by the University of Antioquia in Colombia:

- If the United States does not pass the trade agreement, foreign investment in Colombia would fall 4.5 percent.

- Colombia's economy would expand more slowly, with GDP growth falling from 4.97 percent to 4.16 percent a year.

- The country's unemployment rate would increase 1.8 percentage points, which means the loss of about 460,000 jobs.

- The poverty rate would rise 1.4 percentage points.

On the other hand, the United States would share in the economic benefits. For example, the United States would secure immediate duty-free access to the Colombian market for more than half of its agricultural exports. Since Colombian agriculture is protected by extensive tariffs, ratification of the agreement would represent an inevitable welfare gain for the United States.

However, not everything in the agreement would benefit Colombia. Under current provisions of the trade pact, the United States could continue to maintain its agricultural subsidies, whereas farmers in Colombia would not receive government aid.

South Korea Free Trade Agreement. Of the three countries with which the United States has a trade agreement pending, South Korea has the biggest market.

The U.S. International Trade Commission estimated that if the agreement with South Korea had been implemented in 2008, it would have provided annual benefits to U.S. consumers of $1.8 billion to $2.1 billion dollars that year. Additionally, the Trade Commission estimates that the agreement would increase U.S. gross domestic product by 0.1 percent, or about $10 billion. [See the figure.]

It has been argued that the South Korea free trade agreement is flawed, since it does not eliminate South Korea's nontariff barriers to American automobile imports. Specifically, South Korea's environmental regulations (low vehicle emission standards) make it difficult for American cars to enter the market. However, due to the elimination of tariff barriers, exports of passenger vehicles are expected to increase under the agreement, according to a 2007 Trade Commission report.

Panama Free Trade Agreement. The Panama free trade agreement would have a significantly smaller impact on the United States than the Colombia and South Korea free trade agreements. However, American exporters would gain more, because 96 percent of Panamanian imports already enter the United States duty-free.

According to a 2009 Congressional Research Service report:

- Duties would be eliminated on 88 percent of U.S. commercial and industrial exports to Panama.

- Profits from exports of U.S. agricultural products to Panama would rise 20 percent above the 2006 level – to $46 million.

Critics of the free trade agreement have argued that Panamanian labor regulations are not compatible with United Nations standards. For example, critics say that Panama requires a minimum of 40 workers to establish a union, whereas the standard of the International Labor Organization, a United Nations affiliate, is only 20 employees. Supporters of the pact say that Panama has taken a number of steps to secure workers' rights to organize, and the remaining issues are minor.

Conclusion. All three agreements will bring economic benefits to the United States – namely higher exports, greater GDP growth and increased job creation. Based on the estimate provided by the Commerce Department, the approval of all three agreements would boost exports and immediately create 68,000 new export-supported jobs. Congress should move to ratify the pacts as quickly as possible.

Rafael Gomes is a graduate student fellow with the National Center for Policy Analysis.