Beginning in 2014, most U.S. residents will be required to have health insurance coverage. However, provisions of the new Affordable Care Act (ACA) will limit the choice of health plans offered. Health insurance that does not cover preventive care, plans with deductibles above the statutory limit and plans that cap benefits at predetermined levels will ultimately disappear.

How Much Coverage Is Needed? Many public health advocates assume everyone needs comprehensive coverage. Yet, most people covered by health insurance actually experience very low claims – especially those under age 50. Consider:

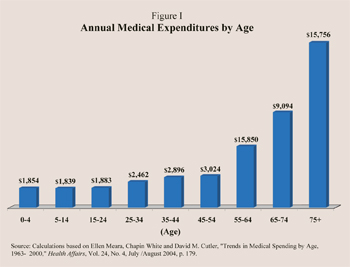

- High medical spenders tend to be older individuals.

- Annual medical spending per capita does not approach $3,000 per year until around 50 years of age [see Figure I].

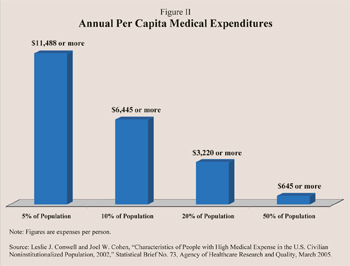

- In fact, 80 percent of the population consumes less than $3,220 annually in medical care [see Figure II].

Thus, a plan with modest benefits would meet the usual insurance needs of most Americans.

How New Regulations Will Undermine Affordable Coverage. High-deductible and limited benefit plans are less expensive than comprehensive coverage because the out-of-pocket costs associated with the plans could sometimes be high. High-deductible plans cover catastrophic costs, such as major surgery or illness, but typically require an individual to pay for the first few thousand dollars of care out of their own pockets. By contrast, limited benefit plans, sometimes called "mini-meds," cover only the first few thousand dollars of medical costs each year and do not cover catastrophic costs.

How New Regulations Will Undermine Affordable Coverage. High-deductible and limited benefit plans are less expensive than comprehensive coverage because the out-of-pocket costs associated with the plans could sometimes be high. High-deductible plans cover catastrophic costs, such as major surgery or illness, but typically require an individual to pay for the first few thousand dollars of care out of their own pockets. By contrast, limited benefit plans, sometimes called "mini-meds," cover only the first few thousand dollars of medical costs each year and do not cover catastrophic costs.

After the individual mandate goes into effect on January 1, 2014, the ACA limits the deductibles of most policies sold to no more than $5,950 per individual or $11,900 per family (adjusted annually for inflation). Health plans must also provide a costly essential benefit package that covers preventive services with no cost sharing.

Moreover, in 2014, all plans must, at a minimum, cover 60 percent of all medical costs with no lifetime or annual caps on benefits. Insurers selling coverage in the individual market will also be prevented from charging applicants with pre-existing conditions more than healthy applicants, and limits will be placed on how much premiums can differ between older applicants and younger ones.

New medical loss ratio regulations will also place constraints on insurers. These rules require health insurers to spend 80 percent to 85 percent of premium revenues on medical care (rather than, for example, administrative costs). However, the overhead costs to market and administer high-deductible or limited benefit insurance policies are likely to be a larger proportion of insurers' revenues than the ACA allows.

Neither limited benefit plans nor high-deductible plans can meet the new requirements without raising premiums to an unaffordable level. Without waivers that allow enrollees to retain their current plans, modestly-priced health insurance that caps benefits or only insures against catastrophic illness will be banned from the marketplace. As a result, many people will lose coverage and join the ranks of the uninsured.

Neither limited benefit plans nor high-deductible plans can meet the new requirements without raising premiums to an unaffordable level. Without waivers that allow enrollees to retain their current plans, modestly-priced health insurance that caps benefits or only insures against catastrophic illness will be banned from the marketplace. As a result, many people will lose coverage and join the ranks of the uninsured.

Burden on Workers. Workers ultimately bear the cost of their own health coverage through direct contributions and wage reductions in lieu of take-home pay. In addition, total employee compensation tends to equal the value of what a worker produces. If the minimum compensation required is higher than what workers are able to produce, they will be priced out of the labor market.

For example, the minimum benefit package required by the ACA will cost about $4,750 for individuals and $12,250 for families (in 2014). That translates into a minimum health benefit of $5.89 an hour for a fulltime worker with family coverage. Thus, the minimum cost of labor will be a $7.25 cash minimum wage plus $5.89 in family health benefits (assuming the employer bears the cost), for total labor costs of $13.14 an hour or about $27,331 a year. That is what an employee will have to produce in order to meet the cost of their compensation. If less productive workers are unable to access low-cost plans, they may not only lose their coverage, they may ultimately lose their jobs.

Conclusion. Insurance that features limited benefits in return for a lower premium is not for everyone. Indeed, limited-benefit plans are not intended to cover the costs of catastrophic illness. By contrast, high-deductible coverage only protects against a catastrophic illness and is not intended to pay day-to-day medical bills. But these plans are more affordable for many Americans and provide a level of benefits many Americans find sufficient. The ACA mandates plans that are likely to price those Americans out of health coverage altogether.

Devon M. Herrick is a senior fellow with the National Center for Policy Analysis.