Environmentalists have long cited the environmental harms caused by fossil fuels as evidence of the need to move to green sources of energy such as wind and solar power. Recently, some conservatives have joined their cause. Citing national security, those concerned about the United States’ freedom to act in its geopolitical interest have begun to embrace renewable energy as a means of reducing America’s reliance on foreign oil.

However, key components of renewable energy technologies are made from a small number of rare earth elements, and other rare minerals. Despite the name, these elements are relatively abundant in Earth’s crust, but they are rarely found in economically exploitable concentrations. The exception to this generality is the People’s Republic of China. Indeed, in China the minerals are concentrated in such abundance that the country has a de facto monopoly on their trade, representing around 96 percent of the global market.

China Uses Resources as a Tool of Foreign Policy. The intensifying push to adopt renewable energy technologies that require rare earths will require tradeoffs, including swapping one form of dependence for another, much more restrictive one. As America relies more on green technology, it will be increasingly dependent on China’s good will.

Indeed, in recent months China has instituted an unofficial embargo on these substances and has already proved willing to use them as a choke point to extract favorable political outcomes from foreign nations. For example, on September 7, 2010, a Chinese fishing boat in a disputed portion of the East China Sea collided with a Japanese coast guard vessel. The Japanese arrested the fishing boat captain. This sparked a heated diplomatic row between China and Japan, leading China to restrict exports of rare earth elements to Japan, its largest buyer, for several months. When Japan refused to release the captain, China retaliated by halting exports of rare earth elements to Japan altogether.

Indeed, in recent months China has instituted an unofficial embargo on these substances and has already proved willing to use them as a choke point to extract favorable political outcomes from foreign nations. For example, on September 7, 2010, a Chinese fishing boat in a disputed portion of the East China Sea collided with a Japanese coast guard vessel. The Japanese arrested the fishing boat captain. This sparked a heated diplomatic row between China and Japan, leading China to restrict exports of rare earth elements to Japan, its largest buyer, for several months. When Japan refused to release the captain, China retaliated by halting exports of rare earth elements to Japan altogether.

Green Technologies Come with Strings Attached. The Obama administration has touted solar panel manufacturing as a green-job growth sector. Production of photovoltaic cells for solar panels relies on the rare element tellurium. However, the world’s only tellurium mine is in China. As a result, China’s near monopoly has made it virtually impossible for American solar power companies to compete with Chinese-owned firms.

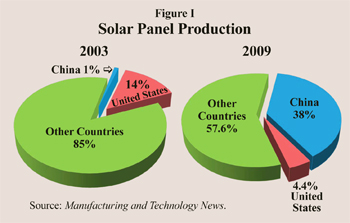

For instance, according to Manufacturing and Technology News [see Figure I]:

- In 2003, China produced only 1 percent of the world’s solar panels but by 2009 its share had grown to 38 percent.

- In 2003, U.S. production of solar panels accounted for 14 percent of the world total, but by 2009 the U.S. share had fallen to just 4 percent.

- Production in other counties fell from 85 percent of the world market in 2003 to 58 percent in 2009.

The boom in China’s solar panel production has driven down the prices of similar U.S. products by around 40 percent, which is good for consumers in the short-run but not good for U.S. manufacturing jobs.

Clean energy technologies currently account for an estimated 20 percent of global consumption of critical materials, and the proportion is likely to grow. As Figure II shows, rare earths are currently essential to a number of technologies. For example, the rare earths neodymium and lanthanum are essential components in the newest generation of electric motors and batteries, which are critical for hybrid and electric vehicles. Thus, the domestic manufacture of these vehicles is dependent on China’s willingness to export rare earth elements.

Clean energy technologies currently account for an estimated 20 percent of global consumption of critical materials, and the proportion is likely to grow. As Figure II shows, rare earths are currently essential to a number of technologies. For example, the rare earths neodymium and lanthanum are essential components in the newest generation of electric motors and batteries, which are critical for hybrid and electric vehicles. Thus, the domestic manufacture of these vehicles is dependent on China’s willingness to export rare earth elements.

Wind power is also promoted as a way to decrease American energy dependence; however, the magnets used in turbines that generate wind energy require the rare earth element neodymium. General Electric, one of the leading companies developing wind energy technologies, purchases its entire supply of neodymium from China.

Oil Supplies Diverse Compared to “Green” Technologies. Oil production for the world market is dispersed among dozens of countries. In 2009, the United States imported oil or derivative products from 90 countries. With such diverse supply, an embargo or price hike in one country could easily be offset by increasing the supply imported from another country. In contrast, there are no other suppliers of rare earth elements if China found it in its interest to withdraw from the market.

Indeed, this is already occurring. For example:

- China has eliminated export tax rebates for rare earth elements while increasing export taxes to rates as high as 25 percent.

- Further, China reduced its export quota 40 percent from 2009 to 2010.

- This comes just as the U.S. government is pushing technologies that rely on these elements.

Conclusion. China is increasing domestic consumption of rare earth elements and rare minerals, and has already demonstrated a willingness to use its near monopoly of the market for these critical resources to force geopolitical concessions from other countries. As a result, the push for green energy is likely to reduce U.S. economic and geopolitical security rather than enhance it.

Wesley Dwyer is a policy intern and H. Sterling Burnett is a senior fellow with the National Center for Policy Analysis.