With the price of oil more than $100 per barrel, higher gasoline prices are eating into Americans’ budgets. Consumers, however, are not the only ones losing out. Due to declining production at existing wells and bureaucratic delays on new wells in the Gulf of Mexico since the Deepwater Horizon oil rig blowout in 2010, the federal government is forfeiting revenues of more than $4.7 million per day.

The losses will grow significantly if the federal government does not sell new drilling leases in the Gulf of Mexico this year.

Oil supplies are increasingly uncertain due to political unrest in the oil-rich Middle East, and U.S. budget deficits and the national debt are at all time highs. Now is the time to expand domestic oil production.

Impact of the Deepwater Horizon Disaster. A year after the tragic April 20, 2010, explosion of the Deepwater Horizon oil drilling rig, the federal government is still slowing new offshore oil and gas exploration and production. As a result, the U.S. Energy Information Administration projects a decline of 240,000 barrels per day in oil production from the Gulf of Mexico this year. That represents billions of dollars in potential revenue that could help close the federal deficit.

The Obama administration issued a moratorium on offshore drilling on May 6, 2010, and then extended it to a six-month deepwater drilling ban by the U.S. Department of the Interior on May 30, 2010. This moratorium suspended work on 33 wells in various stages of construction. It also halted new lease sales and suspended permitting for leases already offered. Though the moratorium was overturned twice by a federal judge, the government did not lift it until October 12, 2010. Since then, oil companies have complained of a “permitorium,” claiming the government is deliberately slowing the process of issuing permits.

For example, Interior Secretary Ken Salazar canceled a Gulf lease sale last October and has postponed until 2012 an auction of leases in the central Gulf of Mexico originally scheduled for March 2011. Another auction planned for October 2011 in the western Gulf could also be delayed until 2012. That would make 2011 the first year since 1965 that the federal government did not sell leases in the Gulf.

The lack of new leases ultimately means the government will collect less rent. Offshore leases currently generate more than $200 million in rent payments per year.

Drilling Facts and Needs. President Obama appointed an oil spill commission in the midst of the Deepwater Horizon crisis. It did not support the administration’s moratorium, but suggested reforms and increased oversight and inspections.

The income from new lease sales, rents and royalties would be more than enough to pay for new offshore oil rig inspections. The inspection fee would apply to offshore drilling rigs, costing operators about $16,700 per inspection. President Obama’s 2012 budget proposal estimates the fees would generate about $65 million — significantly less than the amount the federal government could collect by simply boosting Gulf of Mexico production to last year’s levels.

In addition to lease payments, oil companies pay an 18.75 percent royalty to the federal government on the oil produced. With oil currently trading above $100 a barrel, that equals $4.7 million in lost revenue each day. If the government’s own projections are accurate, that would amount to $1.7 billion this year. The federal government could recoup the lost revenue almost immediately if it began issuing new permits for the Gulf of Mexico.

Royalties are not the only factor causing a sharp decline in federal revenue. The number grows even larger when coupled with a lack of Gulf lease sales and fewer rental payments. Those three components — royalties, leases and rent — make up a sizable amount of revenue each year. For example:

- In 2008, the offshore industry paid $237 million in rent, $8.3 billion in royalties and $9.4 billion for bids on new leases.

- By comparison, last year those numbers were $245 million in rent, $4 billion in royalties and just $979 million in lease bids.

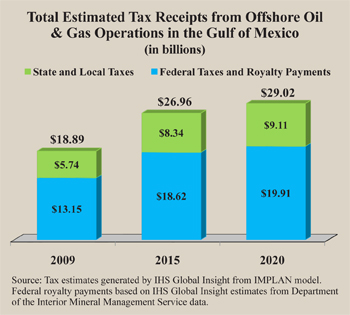

The Obama administration has dismissed the financial impact of less production, but the economic forecasting firm IHS Global Insight estimates that royalties, lease bids and rent payments amounted to more than $6 billion in 2009. Federal, state and local taxes related to the offshore oil and gas operations in the Gulf totaled $13 billion. That $19 billion pot of money could go a long way toward deficit reduction. [See the figure.]

Opening New Areas. Significant additional revenues would be generated if the federal government opened areas currently closed to exploration and production — such as the eastern Gulf of Mexico, portions of the Rocky Mountains, the Arctic National Wildlife Refuge, and the Atlantic and Pacific coasts. A recent study by Wood Mackenzie for the American Petroleum Institute estimates that increased access to those areas would bring $150 billion into federal coffers by 2025.

Opening New Areas. Significant additional revenues would be generated if the federal government opened areas currently closed to exploration and production — such as the eastern Gulf of Mexico, portions of the Rocky Mountains, the Arctic National Wildlife Refuge, and the Atlantic and Pacific coasts. A recent study by Wood Mackenzie for the American Petroleum Institute estimates that increased access to those areas would bring $150 billion into federal coffers by 2025.

Conclusion. At a time when voters are calling on the federal government to balance its budget, revenue from oil companies would be one way of helping out. The oil produced would reduce the price of gas at the pump, and oil company payments to the government could be used to reduce the deficit or the level of cuts legislators are considering, or both. The Obama administration should immediately begin to issue new permits for the Gulf of Mexico and explore other untapped domestic resources.

Rob Bluey is director of the Center for Media and Public Policy at the Heritage Foundation and an adjunct scholar with NCPA’s E-Team.