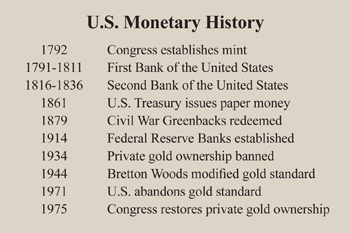

Congress established a mint in 1792 and defined the dollar in terms of a specific weight in both gold and silver. This put the new republic on a bimetallic standard, common at the time. Initially, the official ratio of gold to silver at the mint overvalued gold relative to silver, so silver became the de facto standard.

In 1834, the dollar was devalued in terms of gold — from $19.39 per troy ounce to $20.67, shifting the United States to a de facto gold standard. The official gold price remained $20.67 until President Franklin Roosevelt devalued the dollar to $35 an ounce a century later.

Paper Money in a Domestic Gold and Silver Standard. The federal government did not initially issue paper money. Private state-chartered banks issued bank notes that circulated as paper money until the Civil War. In addition, the federally chartered First and Second Banks of the United States issued notes during 1791-1811 and 1816-1836, respectively. Note-issuing banks were expected to redeem their notes on demand in gold or silver at the official prices.

Paper Money in a Domestic Gold and Silver Standard. The federal government did not initially issue paper money. Private state-chartered banks issued bank notes that circulated as paper money until the Civil War. In addition, the federally chartered First and Second Banks of the United States issued notes during 1791-1811 and 1816-1836, respectively. Note-issuing banks were expected to redeem their notes on demand in gold or silver at the official prices.

Banks were not required to hold 100 percent of their note and deposit liabilities as gold or silver reserves, but they were expected to hold enough specie reserves to be able to redeem them on demand at the official rates. This “convertibility” requirement was intended to prevent “over-issue” of notes or paper money.

The Return to Gold after the Civil War. During major economic disturbances creating inflation, especially wars, banks often became unable to redeem their notes at par, so they “suspended specie payments” and their notes traded at a discount. This happened early in the Civil War. In addition, for the first time in U.S. history, the government began issuing paper money in the form of U.S. Notes (greenbacks) to finance the Civil War. It also passed a legal tender law requiring people to accept greenbacks at their face value.

The Civil War ended with the market price of gold substantially above the old official price. Instead of returning to gold convertibility at a new price, the country went through severe deflation. The federal government ran budget surpluses and destroyed bank notes flowing into the Treasury as tax payments. The price level fell about 25 percent in 1865-1868. In 1868 the government decided to stop shrinking the money supply and instead let the economy “grow into” the existing money supply. Convertibility at the old parity was finally achieved in 1879, a date that many scholars regard as the beginning of the international gold standard.

Exchange Rates in an International Gold Standard. Two things fixed to the same thing are fixed to each other. Thus:

- Two currencies fixed to gold (or silver) at official prices have an implicit official exchange rate.

- If the official price of an ounce of gold is $20 in the United States and £2 in Britain, the implied exchange rate is $10 per pound or £1/10 per dollar.

- International arbitrage will keep the actual exchange rate as close to that price as the cost of shipping gold will allow.

An importer had the option of buying pounds in the foreign exchange market or shipping gold. An exporter had a similar choice in selling pounds. Therefore, no government action was necessary to peg the exchange rate.

Silver Populism. The deflation leading up to the return of gold convertibility was hard on debtors in general and farmers in particular. This contributed to a populist movement of debtors and silver interests demanding a return to a silver standard, which they perceived to be less harsh on debtors than the gold standard.

This populist movement culminated in the election campaign of 1896, made famous by presidential candidate William Jennings Bryan’s “Cross of Gold” speech favoring a silver standard over a gold standard. His speech, which put the crowd into frenzy and won him the Democratic nomination, concluded with: “You shall not press down upon the brow of labor this crown of thorns. You shall not crucify mankind on a cross of gold.”

After World War I, however, the gold standard was substantially restored. The Federal Reserve Act was passed in 1913, and the issue of paper money was transferred from national banks to the 12 Federal Reserve Banks. The Federal Reserve was expected to operate within the framework and rules of the gold standard.

The Depression, World War II and After. The boom of the 1920s gave way to depression in the 1930s. President Roosevelt devalued the dollar in terms of gold in 1934 by raising its price to $35 per ounce. He also abrogated the gold clause in contracts and prohibited the private ownership of gold, requiring citizens to sell their gold to the government at the new rate. Congress did not restore the ability of private citizens to own gold until 1975.

Following World War II the western nations set up a modified gold standard at a meeting in Bretton Woods, New Hampshire. Other countries pegged their currencies to the dollar and the United States converted dollars to gold for foreign central banks and governments. In the early postwar years, the world was hungry for dollars and there were few demands to redeem dollars for gold.

By the 1960s, however, the world dollar shortage was over and official U.S. gold reserves declined as dollars were redeemed. On a couple of occasions, Congress reduced the gold reserve requirement on outstanding Federal Reserve notes. In 1971 President Nixon took the dollar off the gold standard and announced that the United States would no longer redeem dollars for gold, removing the last vestiges of the gold standard. The dollar was officially a fiat currency.

Robert McTeer is a distinguished fellow with the National Center for Policy Analysis.