Just over one year ago, President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act into law. Dodd-Frank, a response to the 2008 financial collapse, was intended to increase oversight of massive financial institutions, such as large banks and stock brokers, and to monitor consumer transactions, such as payday loans and mortgages. It was meant to address the concern that U.S. financial institutions had grown “too big to fail” and would need to be “bailed out” by the government to prevent a banking system collapse.

However, Dodd-Frank gives the federal government increased power to control not only large banks, but also small banks and businesses. Ironically, financial-sector concentration has continued to increase. Rep. Ed Royce (R-Calif.), a member of the House Financial Services Committee, notes that before the banking crisis, the top 10 banks in the United States held 55 percent of banking sector total assets; today, they hold 77 percent.

Though Dodd-Frank is still in the implementation phase, it is becoming clearer that this complex legislation imposes regulatory burdens that will stifle efforts to grow businesses, but will not result in beneficial financial reforms.

What Does Dodd-Frank Do? At least 10 federal agencies will be tasked with ensuring compliance with roughly 300 new rules created by Dodd-Frank, says the Congressional Research Service. Several new agencies were created. One of them, the Consumer Financial Protection Bureau (CFPB), opened its doors recently. The head of the CFPB will be appointed for a five-year term. Once confirmed by the House and Senate, he or she will have free rein to spend $500 million without interference from Congress, since the CFPB is funded by the Federal Reserve, rather than congressional appropriations.

Costs to Financial Institutions. Banks will be required to file paperwork reporting their compliance with all mandates of Dodd-Frank to the various oversight agencies. For example, banks must confirm the ability of prospective borrowers to repay loans and report their confirmation to the monitoring agencies. This provision is designed to eliminate “no document” and “liar” loans, but it will increase paperwork costs. The cost will vary among firms, but David L. Schnadig, managing partner with the Cortec Group, estimates it will cost his firm $75,000 to $100,000 annually.

Dodd-Frank also limits bank debit card swipe fees. Banks previously charged merchants an average of $0.44 to process a debit card transaction. Banks will now be allowed to charge only $0.21 plus 0.05 percent of the transaction. They are expected to make up the lost revenue elsewhere, through increased fees for checking accounts or higher interest on loans.

The Orderly Liquidation Authority (OLA), located in the Federal Deposit Insurance Corporation (FDIC), will give the largest firms a comparative advantage. Rep. Royce notes that OLA intervention will be more likely for large banks that pose a threat to the economy, while small banks are likely to bear the burden of any crisis on their own. This means that larger institutions will benefit from implicit government support, while smaller institutions are perceived as “too small to save.”

Small financial services firms must also comply with Dodd-Frank. It requires recording of “all oral and written communications provided or received concerning quotes, solicitations, bids, offers, instructions, trading and prices, that lead to the execution of transactions in a commodity interest or cash commodity, whether communicated by telephone, voicemail, facsimile, instant messaging, chat rooms, electronic mail, mobile device or other digital or electronic media.” The Commodity Futures Trading Commission estimates that the cost of complying with Dodd-Frank will be $16,750 to $61,750 per firm initially, and $12,600 annually once they have records systems in place.

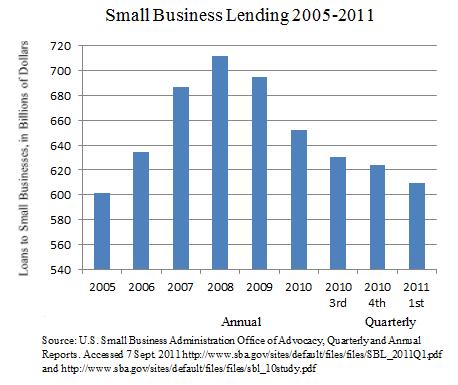

Costs to Small Businesses. A major concern is that small businesses will be unable to obtain financing as a result of Dodd-Frank. When there are more restrictions on the loans banks can make, fewer loans are made. In fact, loans to small businesses have tumbled to a five-year low [see the figure]:

- Lending to small businesses has decreased annually since 2008.

- Small business lending fell during the 2010 fiscal year.

- Loans to small businesses in 2011 are at the lowest level since 2006.

Because the law governs everything from traditional small business loans to personal credit cards and home equity loans, access to capital for small businesses will be restricted. As Rep. Jason Altmire (D-Pa.) notes:

- The last Federal Reserve Survey on Small Business Finance found nearly half of all small firms used personal credit cards to finance their enterprise.

- In another survey, one in five entrepreneurs reported using a home equity loan for business purposes.

These small businesses, which employ over half of private sector employees and are responsible for more than six out of 10 new jobs, will face increased costs and limited access to capital as a result of Dodd-Frank. Reform and regulation of powerful financial institutions may be needed, but Dodd Frank creates obstacles for small banks and businesses, while failing to actually provide checks against massive financial firms.

Karlyn Gorski is a research assistant with the National Center for Policy Analysis.