Housing affordability has steadily decreased in the United States and abroad over the past decade. This decrease is due in large part to strict land use regulations— known by a variety of names, such as compact city policy, growth management, smart growth and prescriptive land use.

Metropolitan areas such as Sydney, Australia, and Auckland, New Zealand, once defined by modestly priced, quality middle class housing, are now among the most unaffordable housing markets in the English-speaking world.

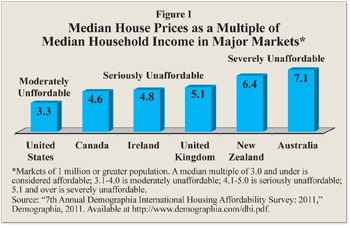

Measuring Affordability. A standard measure of housing affordability is the median multiple — the median house price divided by gross annual local median household income. The Demographia International Housing Affordability Survey uses the median multiple to rate hundreds of markets in seven nations for which sufficient current house prices and household income data were available. The Index includes 82 metropolitan areas with a population of more than 1 million. Among these major markets [see Figure I], 20 were considered affordable, with a median multiple of 3.0 or lower; 25 were moderately unaffordable, with a median multiple of 3.1 to 4.0; and 13 were seriously unaffordable, with a median multiple of 4.1 to 5.0.

Measuring Affordability. A standard measure of housing affordability is the median multiple — the median house price divided by gross annual local median household income. The Demographia International Housing Affordability Survey uses the median multiple to rate hundreds of markets in seven nations for which sufficient current house prices and household income data were available. The Index includes 82 metropolitan areas with a population of more than 1 million. Among these major markets [see Figure I], 20 were considered affordable, with a median multiple of 3.0 or lower; 25 were moderately unaffordable, with a median multiple of 3.1 to 4.0; and 13 were seriously unaffordable, with a median multiple of 4.1 to 5.0.

The affordable markets are characterized by less restrictive land use regulation that allows development to occur based upon market preferences consistent with fundamental environmental regulation. Each of the least affordable markets is characterized by restrictive land use regulation, such as smart growth or “livability” policies.

What Is Smart Growth? House prices in metropolitan areas with smart growth policies tend to be inordinately high because of higher land prices. Principal smart growth policies include urban containment (such as growth boundaries and restrictions on developable land), large-lot zoning in urban fringe and rural areas, house building moratoria or limits, high development fees and exactions, and mandatory regional or county planning. Severely limiting or prohibiting development on the urban fringe can make it difficult to meet the demand for new housing by building outside restricted areas. This decreases housing affordability.

Numerous studies have found an association between land use policies and house prices. Scarcity tends to raise prices (other things being equal). However, natural limits on the availability of land, such as the presence of a seacoast or mountains, is secondary to the scarcity caused by regulatory barriers. This artificial scarcity can increase house prices. Indeed, as building costs are about the same nationwide, land prices, not construction costs, account for the largest differences in median house prices among metropolitan areas within a country. In Australia, for example, 95 percent of the increase in inflation-adjusted new house costs from 1993 to 2006 is attributable to land prices, rather than construction costs.

Numerous studies have found an association between land use policies and house prices. Scarcity tends to raise prices (other things being equal). However, natural limits on the availability of land, such as the presence of a seacoast or mountains, is secondary to the scarcity caused by regulatory barriers. This artificial scarcity can increase house prices. Indeed, as building costs are about the same nationwide, land prices, not construction costs, account for the largest differences in median house prices among metropolitan areas within a country. In Australia, for example, 95 percent of the increase in inflation-adjusted new house costs from 1993 to 2006 is attributable to land prices, rather than construction costs.

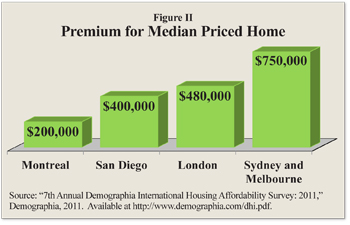

Smart Growth Makes Housing Less Affordable. The higher costs caused by prescriptive land use makes housing less affordable. Consider [see Figure II]:

- In Montreal, Canada, a median priced house, including additional mortgage interest, now costs a household at least $200,000 more than an affordable home in the past.

- In San Diego, California, the premium for a median priced home is $400,000.

- In London, England, the premium can be more than $480,000.

- In Sydney and Melbourne, Australia, the premium is more than $750,000.

Housing Bubble. Since 2008, housing affordability has improved in some markets, and remained constant or declined in others. In the United States and the United Kingdom, the “bubble” markets that “burst” generally reached a trough and began rising again. In the “boom” markets that did not experience a bubble, house prices generally declined in response to the intense economic disruption that occurred due to the collapse of the international market for securities collateralized by home mortgages.

Virtually all markets in Australia and New Zealand, and some markets in Canada, experienced house price increases of bubble proportions. However, Australia, New Zealand and Canada did not experience steep house price declines. These nations were more cautious in their mortgage loan policies and, as a result, had more credit-worthy mortgage loan portfolios.

In the United States and the United Kingdom, the bubble was fueled by a relaxation of loan policies, which compromised the integrity of mortgage portfolios and increased the demand for home ownership.

The demand for home mortgages affected markets very differently, depending upon their land use regulations. Generally, land prices in the non-bubble U.S. markets (such as Atlanta and Dallas-Fort Worth) remained low and, as a result, there was little or no upward movement of house prices relative to incomes. These markets generally have more responsive land use regulation. The higher demand that resulted from the easier money produced a boom in these markets, but not a bubble.

Conclusion. In a number of metropolitan areas around the world, house prices skyrocketed — principally because of more restrictive land use regulations that virtually prohibited new house construction on or beyond the urban fringe.

Wendell Cox, principal of the Wendell Cox Consultancy in metropolitan St. Louis, Missouri, is an adjunct scholar with the National Center for Policy Analysis.