The Patient Protection and Affordable Care Act (ACA) — the new health reform law — contains financial incentives for the states to establish health insurance exchanges where qualifying individuals and small businesses can purchase subsidized, individual health insurance, starting in 2014.

The structure of the exchange subsidies will encourage low-income workers to congregate in companies that do not provide insurance and high-income employees to work for firms that do provide it.

Qualifying for a Health Insurance Exchange Subsidy. Anyone will be allowed to purchase coverage in the exchange, but the subsidies will be available only to individuals and families with incomes from 133 percent to 400 percent of the federal poverty level — just over $30,000 to nearly $90,000 for a family of four. This represents nearly 40 percent of workers. Those who have access to an employer health plan are ineligible to buy exchange-based plans. Families with incomes below 133 percent will be required to enroll in Medicaid.

Subsidies for Employer Plans versus Exchange Plans. Health insurance premium payments by employers are not counted as taxable income to the employee and payroll taxes are not imposed on the value of the benefits. Thus, an employee receives an implicit tax subsidy equal to his or her marginal income tax rate (plus the payroll tax rate). As a result, high-income workers receive a tax subsidy through their employer plan that is far more generous than their low-income coworkers.

By contrast, low- and middle-income workers who buy health exchange policies will receive a much larger subsidy than the tax breaks they would receive with employer-provided health insurance. Because of this disparity, low- and middle-income people are likely to find ways to qualify for an exchange plan — even if it means leaving a job that provides health insurance.

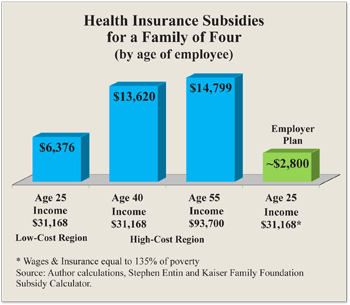

Buying insurance through the exchange instead of receiving it through an employer is a wise financial move for these families. Indeed, families earning 133 percent of the federal poverty level without access to an employer-provided plan will pay no more than 3 percent of their income in premiums, and a family earning 400 percent of the poverty level will pay no more than 9.5 percent. Because health care costs vary widely among regions, exchange policies in states with higher health care costs will be more heavily subsidized. Furthermore, older workers will receive larger subsidies than younger workers. Consider:

Buying insurance through the exchange instead of receiving it through an employer is a wise financial move for these families. Indeed, families earning 133 percent of the federal poverty level without access to an employer-provided plan will pay no more than 3 percent of their income in premiums, and a family earning 400 percent of the poverty level will pay no more than 9.5 percent. Because health care costs vary widely among regions, exchange policies in states with higher health care costs will be more heavily subsidized. Furthermore, older workers will receive larger subsidies than younger workers. Consider:

- In the exchange, a family headed by a 25-year-old worker earning $31,168 (133 percent of the federal poverty level) and living in a low-cost region would receive a health insurance subsidy worth $6,376.

- A family headed by a 40-year-old earning $31,168 and living in a high-cost region would receive a federal subsidy of $13,620, meaning he would be charged only $936 (about 3 percent of his income) for a health plan with a $14,500 annual premium.

- A family headed by a 55-year-old worker living in a high-cost region and earning $93,700 (400 percent of the poverty level) would get an exchange subsidy worth $14,799 and pay just $8,901 toward the premium annually.

- By contrast, a worker with employer-based insurance earning $31,168 would receive benefits equivalent to a tax subsidy of about $2,800, or $7,231 less than the same family in the exchange.

Employers Will Drop Health Plans. The ACA requires individuals to have insurance with certain mandated benefits likely costing $15,000 or more for family coverage in 2016. Economists generally agree employee benefits are a dollar-for-dollar substitute for wages. That implies the pay of a previously uninsured $30,000-a-year worker will be cut 50 percent to compensate for the cost of mandatory health insurance. Further, the only tax subsidy this worker will receive is the ability of his employer to pay the premiums with pretax dollars. That is worth about $3,000.

On the other hand, if this worker can get the same insurance through the newly created health insurance exchange, the federal government will pay a total subsidy potentially worth more than $15,000. It follows that every worker at this income level will want to work for a firm that does not offer health insurance and pays higher cash wages instead.

Thus, employers will have an incentive to drop their health plan in order to offer competitive wages. Employers with more than 50 workers who do not offer health insurance will have to pay a $2,000 fine for all but the first 30 workers — well worth the opportunity to obtain a $15,000 benefit for every employee. Many employers will organize in such a way as to take advantage of the subsidy. Low-income workers will congregate in companies that do not provide insurance; high-income employees will work for firms that do provide it. Firms that ignore these worker preferences will not be competitive.

Conclusion. The Congressional Budget Office (CBO) estimates that 19 million people will take advantage of subsidies in the exchanges. It assumes most individuals will continue to obtain coverage at work or through the newly expanded Medicaid program. However, former CBO director Douglas Holtz-Eakin estimates that the number of people who will take advantage of the exchange subsidies is close to 57 million. Indeed, in a survey of its clients, the consulting firm McKinsey & Company found that at least 30 percent of companies would be better off dropping employee health coverage. The potential loss of employer health coverage is just one of the unintended consequences of the ACA.

Devon M. Herrick is a senior fellow with the National Center for Policy Analysis.