Source: Forbes

In February, the U.S. Department of Health and Human Services issued a “guidance bulletin” regarding the compatibility of health savings accounts with Obamacare’s insurance regulations. According to HSA expert Roy Ramthun, the news isn’t good. “HSA plans will not be as affordable as they are today,” says Ramthun.

It all hinges around a technical term called “actuarial value.” Actuarial value is an insurance concept that defines, on average, the fraction of costs that a particular insurance plan will cover, versus requiring the beneficiary to pay directly. For example, a health insurance plan with an actuarial value of 70 percent would, on average, require its beneficiaries to directly pay 30 percent of the covered health expenses, through co-pays, deductibles, and the like. The rest would be paid indirectly, through the insurance premium.

The problem is that health savings accounts aren’t really compatible with conventional “actuarial value” calculations. If you have a consumer-driven health plan consisting of high-deductible insurance and a health savings account, and you don’t count the HSA as a “health expenditure,” the actuarial value of your plan could be extremely low. On the other hand, if HSA savings are counted as a form of health spending, the actuarial value of your plan could be quite high.

As usual, under our new health law, the government gets to decide these things on our behalf. Sections 1302 and 1402 of the Affordable Care Act regulate insurance plans offered in the individual and small-group markets (i.e., the markets for insurance for those who buy it on their own, and for small companies with less than 100 employees). Plans are required to have a minimum actuarial value of 60 percent (the “bronze plan”). I’ve written in the past about how this provision in the law will substantially drive up the cost of insurance, and damage the private insurance market through an adverse selection death spiral.

“The guidance is a mixed bag,” says Ramthun. The HHS guidance does allow employers to include the contributions they make to health savings accounts or health reimbursement accounts (HRAs). But contributions that individuals make into their own HSAs or HRAs won’t count. That’s particularly harmful to people who buy insurance for themselves on the individual market.

In the wonky language of the guidance bulletin: “In calculating the combined [high-deductible health plan] and HSA or combined employer health benefit plan and HRA, the [actuarial value] calculation would assume that the employer contribution to the HSA or HRA is used by the employee to pay for cost-sharing. Accordingly, these amounts would be credited to the numerator of the AV calculation…In the individual market; we intend to propose that HSA contributions paid directly by the individual would not count towards AV.”

“This will make it much more difficult for high deductible plans to meet the minimum actuarial value standard of 60 percent,” says Ramthun. “If they can’t, these plans will either not be available, or these plans will have to raise their values by covering additional benefit expenses. This in turns means the premiums will have to be increased to cover the additional expenses, meaning HSA plans will not be as affordable as they are today.”

The free-market approach to health care involves going in exactly the opposite direction: encouraging even more people to save money for their own health expenses using health savings accounts. It’s when you pay for something directly that you are most likely to make sure that you’re paying for value. When other people pay on your behalf—whether that third party is a private-sector insurer or the government—you’re not going to shop for value. The examples of Singapore and Switzerland show that paying directly for one’s own care makes a big difference. Obamacare’s central flaw is that the law makes it harder for us to do so.

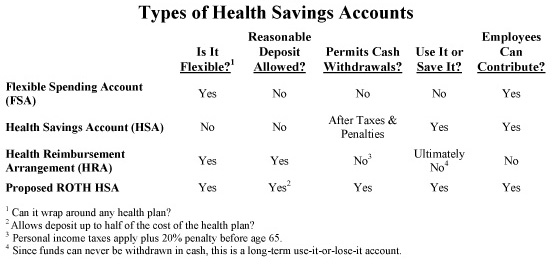

UPDATE: John Goodman, the “father of health savings accounts,” has posted an excellent primer on HSAs and related flexible spending accounts (FSAs), which includes a discussion of ways to improve the laws that regulate them.

Meanwhile, PBS’ NewsHour frets that health savings accounts might lead people to make their own decisions to forego marginal, but costly, care.