Environmentalists have long cited the harms caused by fossil fuels as evidence of the need to move to green energy sources, such as wind and solar power. Recently, some conservatives have joined their cause. Citing national security, those concerned about the United States’ freedom to act in its geopolitical interest have begun to embrace renewable energy as a means of reducing America’s reliance on foreign oil.

However, key components of renewable energy technologies are made from a small number of rare earth elements, and other rare minerals. Despite the name, these elements are relatively abundant in Earth’s crust, but they are rarely found in economically exploitable concentrations. The exception to this generality is the People’s Republic of China. Indeed, in China the minerals are concentrated in such abundance that the country has a de facto monopoly on their trade — around 97 percent of the global market.1

China Uses Resources as a Tool of Foreign Policy. As America relies more on green technology, it will be increasingly dependentf on China’s good will. Indeed, in recent months China has instituted an unofficial embargo on rare earths and has already proved willing to use them to extract favorable political concessions from other countries. For example, on September 7, 2010, a Chinese fishing boat in a disputed portion of the East China Sea collided with a Japanese coast guard vessel. The Japanese arrested the fishing boat captain. This sparked a heated diplomatic row, leading China to restrict exports of rare earth elements to Japan, its largest buyer, for several months. When Japan refused to release the captain, China retaliated by halting exports of rare earth elements to Japan altogether.2 Shortly after exports were halted, Japan relented and released the captain. China resumed rare earth exports to Japan.

Green Technologies Come with Strings Attached. The Obama administration has touted solar panel manufacturing as a green-job growth sector. Production of photovoltaic cells for solar panels relies on tellurium. However, the world’s only tellurium mine is in China. Tellurium is also produced as a by-product of copper purification, and a number of countries produce limited quantities this way. However, the decline in U.S. lead mining and movement to lower grades of copper ore, which require a different refining process, has reduced domestic tellurium recovery.

Demand has also increased due to government green energy subsidies and mandates to increase their use. As a result, imports of tellurium have soared along with its price. The U.S. Geological Survey notes that the price of tellurium increased 14-fold between 2002 and 2006.3 From 2003 to 2007 China supplied 13 percent of U.S. tellurium imports. However, by September 2010 China’s share of imports had grown to 43 percent and it is currently the single largest source of imported tellurium.4 China’s share of world tellurium production will likely grow since it has also become the world’s largest copper consumer and refiner. In 2009, China used approximately 40 percent of the world’s copper production. China now is the world’s largest purifier of tellurium from copper, lead and other ores where it is found as a trace element.

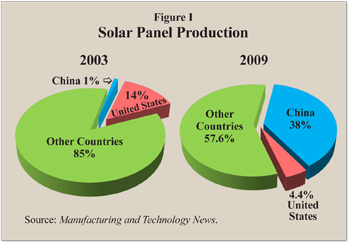

China’s near monopoly has made it virtually impossible for American solar power companies to compete with Chinese-owned firms. For instance, according to Manufacturing and Technology News [see Figure I]:5

- In 2003, China produced only 1 percent of the world’s solar panels but by 2009 its share had grown to 38 percent.

- In 2003, U.S. production of solar panels accounted for 14 percent of the world total, but by 2009 the U.S. share had fallen to just 4 percent.

- Production in countries other than China fell from 85 percent of the world market in 2003 to 58 percent in 2009.

The boom in China’s solar panel production has driven down the prices of similar U.S. products by around 50 percent, which is good for consumers in the short-run but not good for U.S. manufacturing jobs.6 Solar panel manufacturer Solyndra, Inc., for instance, despite more than $500 million in federal grants and loan guarantees, declared bankruptcy in September 2011, citing its inability to compete with cheaper Chinese solar panels.7

Currently, as Figure II shows, a number of technologies depend on rare earths. For example, neodymium and lanthanum are essential components in the newest generation of batteries used in hybrid and electric vehicles. Thus, domestic manufacture of these vehicles depends on China’s willingness to export rare earths.

Wind power is also promoted as a way to decrease American energy dependence; however, as with electric cars, the magnets in wind-powered electrical generators require neodymium. General Electric, one of the leading companies developing wind energy technologies, purchases its entire supply of neodymium from China. Indeed, the U.S. Department of Energy estimates that the magnets in wind turbines and electric cars alone account for as much as 40 percent of worldwide demand.8

Oil Supplies Diverse Compared to Green Technologies. Oil production for the world market is dispersed among dozens of countries. In 2009, the United States imported oil or derivative products from 90 countries. With such diverse supply, an embargo or price hike in one country could easily be offset by increasing imports from another country. In contrast, there are no other suppliers of rare earth elements besides China. But China has found it in its interest to partially withdraw from the market by eliminating export tax rebates for rare earth elements and increasing export taxes to rates as high as 25 percent. Further, China reduced its export quota 40 percent from 2009 to 2010.

Green Energy Demand Creates Jobs — in China! Partly to secure rare earths supplies, many companies are moving their manufacturing operations to China. For example, General Electric has closed its last U.S. light bulb factory and is opening a new factory in China making Compact Fluorescent Lights, which require rare earths.

Green Energy Demand Creates Jobs — in China! Partly to secure rare earths supplies, many companies are moving their manufacturing operations to China. For example, General Electric has closed its last U.S. light bulb factory and is opening a new factory in China making Compact Fluorescent Lights, which require rare earths.

Other companies are joining GE. For example, despite receiving more than $58 million in grants, loans and tax incentives in 2007 from the state (in addition to federal support), Evergreen Solar decided to close its solar panel plant in Massachusetts and start a joint venture in China.9 A U.S. specialty lighting manufacturer, Intematix, and Japanese manufacturers Showa Denko and Santoku, have also opened factories in China, specifically to secure access to affordable rare earths.10

In 2008, factories outside of China used nearly 60,000 tons of rare earths. In the past two years China has limited its exports to just 30,000 tons per year.11 Outside of China the price of rare earths is many times higher than they were just a few years ago or than they are within the country. For instance, cerium oxide, used as a catalyst and in glass manufacturing, cost $3,100 a ton in 2009. It now costs as much as $110,000 per ton outside of China — four times its price in China.

Needed Response: Increasing Supply by Mining. California’s Mountain Pass, the only mine in America dedicated to rare earths, closed in 2002 due to environmental problems and low prices. After spending an estimated $500 million on state-of-the-art equipment and significant environmental upgrades, it has reopened under new management.12 This mine won’t produce every rare earth (for instance, it won’t produce any economic amount of heavy rare earth elements) but it hoped to produce 20,000 tons per year of the rare earths it does contain by 2014. Molycorp ultimately failed to meet that goal, but even if it had, to put that into context, China produced 124,000 tons of rare earths in 2009. To put that in context, China produced 124,000 tons of rare earths in 2009.

The government can encourage exploration and production of rare earths by improving access to potential sources. As of 1994, more than 410 million acres or 62 percent of public lands were effectively off limits to mineral exploration and development. New wilderness areas and the Clinton administration’s ban on roads on 58 million additional acres of the national forestshave increased the amount of lands off limits to rare earth production.13 This includes some of the most highly mineralized areas in North America. The rare earth deposits in these areas should be inventoried and, with appropriate environmental safeguards, where potential commercial quantities are found, opened for bids on leases.

Needed Response: Increasing Supply by Recycling. Recycling could also increase the supply of rare earths. Achim Steiner, executive director of the United Nations Environment Program, has called for a global recycling drive, noting that less than 1 percent of rare earths are recycled, compared to 25 percent to 75 percent recycling of some metals.14

Needed Response: Increasing Supply by Recycling. Recycling could also increase the supply of rare earths. Achim Steiner, executive director of the United Nations Environment Program, has called for a global recycling drive, noting that less than 1 percent of rare earths are recycled, compared to 25 percent to 75 percent recycling of some metals.14

Japanese companies, with the encouragement of the government, have embarked on large-scale rare earths recycling.15 Japan is hoping that urban mining — combing through landfills and waste collection centers for precious metals and rare earths in used electronics (such as cell phones, computers and televisions) — will reduce its dependence on China. Japan’s National Institute for Materials Science estimates that there are 300,000 tons of rare earths in Japan’s used electronics.

There are a number of potential hurdles to recycling rare earths. First, some uses are dissipative, so there is little left to recycle. Second, many of the products that are the most intensive users of rare earths have long expected useful lives. Solar panels, wind turbines and even some cars have long useful lives, multiple decades even, thus they will not be entering the waste stream for some time. Third, it is costly and difficult to extract and recycle the rare earths contained in electronic waste. For many rare earths, the technology does not exist to extract them; for others it does exist, but because they are intermixed (literally fused sometimes) and in small amounts relative to the overall amount of waste, it is very expensive to separate and extract.16

What makes mining and recycling attractive to industry are the present high prices that make previously uneconomic sources of rare earths worth exploitation. In this sense, high prices will likely increase and diversify supplies. However, recycling and mining are very capital intensive. They only make sense when prices are high. At any time, China could flood the market with rare earths. Prices would fall and companies that had invested in recycling or new mines would go out of business if they couldn’t sustain losses or increase output and efficiency to match Chinese prices.

Needed Response: Reducing Demand by Finding Alternatives to Rare Earths. One way to reduce demand for rare earths is to discover or develop alternatives. For some rare earths this is unlikely. For instance, the europium used to create brilliant reds in televisions is likely irreplaceable since no other element emits light in the same way. However for some rare earths and for some uses, there are possible alternatives.

Researchers are attempting to develop powerful magnets that don’t rely on rare earths.17 The magnets used in hybrid cars and wind turbines are pound for pound the most powerful magnets on the planet. They are also critical for the speed and efficiency of computer hard drives and small electronics. They generate magnetic fields 10 times more powerful than common iron magnets. Unfortunately, the magnets in the average Toyota Prius require three pounds of an alloy made with rare earth elements. Researchers are trying to increase the power of magnets made from iron and alloys that combine aluminum, nickel and cobalt. So far the research has not been promising.

Needed Response: Reducing Demand by Ending Green Energy Subsidies and Mandates. The more the United States embraces green energy technologies, the worse off it will be geopolitically and economically. Demand for green energy would fall if there were not huge government subsidies, grants and mandates, because green energy is more expensive and less reliable than traditional energy production.

As the push to adopt rare earth-intensive energy technologies intensifies, those concerned about U. S. energy security could find that the tradeoff involves swapping one form of dependence for a much more perilous one. In addition, the diversion of scarce rare earths to green energy technologies means that there is less available for critical aerospace and military technologies.

The U.S. government should stop interfering in energy markets, and end all energy mandates and subsidies. China’s dominance of rare earths supplies would no longer be an issue because green energy technologies would largely fade from the scene without government support until entrepreneurs figure out a way to make them cost competitive and more reliable. Nor would environmentalists have reason for complaint, since fossil fuels would no longer receive subsidies either. This would be a win-win for both fiscal hawks and green doves.

H. Sterling Burnett is a senior fellow with the National Center for Policy Analysis.

1. Joe McDonald, “China Rare Earth Supplier Suspends Production,” Associated Press, October 20, 2011. Available at http://abcnews.go.com/Technology/wireStory/china-rare-earths-supplier-suspends-production-14775856.

2. Keith Bradsher, “Amid Tension, China Blocks Vital Exports to Japan,” New York Times, September 22, 2010. Available at http://www.nytimes.com/2010/09/23/business/global/23rare.html.

3. Michael W. George, “Tellurium,” U.S. Geological Survey, Minerals Commodity Summaries, January 2006. Available at http://minerals.usgs.gov/minerals/pubs/commodity/selenium/tellumcs06.pdf.

4. Michael W. George, “Tellurium,” U.S. Geological Survey, Minerals Commodity Summaries, January 2010. Available at http://minerals.usgs.gov/minerals/pubs/commodity/selenium/mcs-2010-tellu.pdf.

5. “U.S. Accounts for Less than 5 percent of Global Solar Production,” Manufacturing & Technology News, September 17, 2010.

6. Stuart Biggs, “Rutgers, Chinese Solar Panels Show Clean-Energy Shift,” Bloomberg, July 23, 2010. Available at http://www.bloomberg.com/news/2010-07-22/rutgers-chinese-connection-signals-solar-panels-coming-to-roof-near-you.html.

7. Zachary Tracer and Jim Snyder, “Solyndra Bankruptcy May Blunt Obama’s Renewable Energy Drive,” Bloomberg, September 13, 2011. Available at http://www.bloomberg.com/news/2011-09-13/solyndra-failure-is-seen-blunting-obama-drive-to-aid-clean-energy-startups.html.

8. Justin Rohrlich, “Precious Metals: is Tellurium the New Gold?” Minyanville, June 20, 2011. Available at http://www.minyanville.com/dailyfeed/2011/06/20/precious-metals-is-tellurium-the/.

9. “Overrun by Chinese Rivals, U.S. Solar Company Falters,” Wall Street Journal, August 17, 2011. Available at http://online.wsj.com/article/SB10001424053111904253204576512574160162128.html.

10. Keith Bradsher, “Chasing Rare Earths, Foreign Companies Expand in China,” New York Times, August 24, 2011. Available at http://www.nytimes.com/2011/08/25/business/global/chasing-rare-earths-foreign-companies-expand-in-china.html?pagewanted=all.

11. Ibid.

12. Julie Gordon, “Molycorp Speeds up Plan to Boost Rare Earth Supply,” Reuters, October 21, 2011. Available at http://in.reuters.com/article/2011/10/21/idINIndia-6003282011102.

13. Paul Driessen, “Greens Shackle National Security — and Renewable Energy,” Townhall.com, October 2, 2010. Available at http://townhall.com/columnists/pauldriessen/2010/10/02/greens_shackle_national_security_-_and_renewable_energy/page/full/.

14. “UN Environment Chief Urges Recycling of Rare Metals,” AFP, September 29, 2010. Available at http://www.google.com/hostednews/afp/article/ALeqM5hPmNzLawNUxSS8Zqu8GvRt_4E0Ag?docId=CNG.1febe8228fa30f6f19b4372cff6d07a5.711.

15. Hiroko Tabuchi, “Japan Recycles Minerals From Used Electronics,” New York Times, October 4, 2010. Available at http://www.nytimes.com/2010/10/05/business/global/05recycle.html?pagewanted=all.

16. Stuart Burns, “Recycling of Rare Earth Metals Faces Challenges,” Metal Miner, July 16, 2009, available at http://agmetalminer.com/2009/07/16/recycling-of-rare-earth-metals-faces-challenges/

17. Devin Powell, “Sparing the Rare Earths,” ScienceNews, August 27, 2011. Available at http://www.sciencenews.org/view/feature/id/333202/title/Sparing_the_rare_earths_.