The United States can create jobs, reduce reliance on foreign imports and improve national security by encouraging the domestic exploration and production of rare earth elements currently imported from other countries. While supplies of rare earths may not improve for several years, steps should be taken now to develop domestic mining and current policies should be changed to allow this growth.

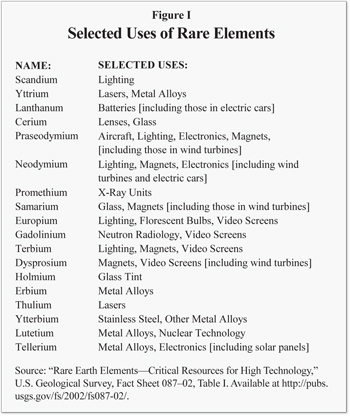

Key components of most modern electronics and green energy technologies, as well as defense systems, are made from a small number of elements and critical metals called rare earths. Indeed, rare earth elements are the basis for much of modern technology due to a range of relatively unique electronic, magnetic, optical and catalytic properties.1 From lighting to lasers, magnets to X-ray units, glass tints to electronics, these “rare” minerals are ubiquitous in modern technology. [See Figure I.]

Industrialization and China’s Rare Earth Monopoly. Despite the name, rare earths are relatively abundant in Earth’s crust. Unfortunately, these elements are seldom found in economically exploitable concentrations, except in the People’s Republic of China. There, rare earths are abundant and in relatively high concentrations. However, the Asian superpower has exercised strategic controls over their mining, use and export.2 Thus, China currently holds about 97 percent of the global market, a de facto monopoly on trade in rare earths.

In the last few years, China has withdrawn increasingly larger amounts of rare earths from the export market, claiming it was necessary to protect the environment and to satisfy growing domestic demand. However, China’s demand is not primarily due to increased domestic consumption of products that require rare earths; rather, it is because companies that require those elements have begun to shift operations there from other countries in order to gain less expensive access. Much of the output of these new factories is for export. For instance:

Partly to secure rare earth supplies, General Electric recently closed its last U.S. light bulb factory and is opening a new factory in China to make compact fluorescent lights.

Despite receiving more than $58 million in grants, loans and tax incentives in 2007 from the Commonwealth of Massachusetts (in addition to federal support), Evergreen Solar closed its solar panel plant in the state and began a joint venture in China.3

A U.S. specialty lighting manufacturer, Intematix, and Japanese manufacturers Showa Denko and Santoku, have also opened new factories in China — specifically to secure access to affordable rare earths.4

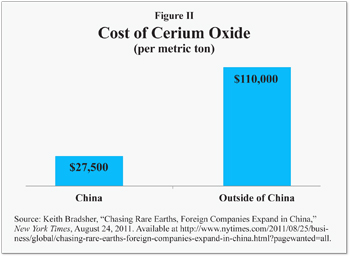

In 2008, factories outside of China used nearly 60,000 tons of rare earths. In the past two years, however, the Chinese government has limited exports to just 30,000 tons per year, driving up global prices. Outside China, the prices of rare earths are much higher than just a few years ago. For instance, in 2009, cerium oxide, used as a catalyst and in glass manufacturing, cost $3,100 a ton. It now costs as much as $110,000 per ton outside of China — four times its domestic price.5 [See Figure II.] In addition, China has begun to consolidate rare earths production into a single state-owned company that currently controls 60 percent of Chinese production. This firm sells primarily to domestic companies recommended by the government.6

China’s Geopolitical Influence Due to Rare Earths. China has already proved willing to use rare earths to extract favorable political concessions from other countries. For example, on September 7, 2010, a Chinese fishing boat in a disputed portion of the East China Sea collided with a Japanese coast guard vessel. The Japanese arrested the fishing boat captain. The incident sparked a heated diplomatic row, leading China to restrict rare earth exports to Japan, its largest buyer, for several months. When Japanese authorities refused to release the captain, China retaliated by halting rare earth exports to Japan altogether.7 Japan soon relented and released the captain, and China resumed rare earth exports — at reduced levels.

Increasing Supply by Mining. Due to rising prices and the unreliability of China as a supplier, many countries and international companies have begun to seek alternative supplies, including new mines.

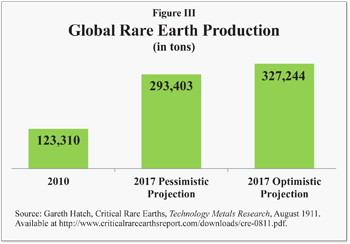

For example, Gareth Hatch of Technology Metals Research has comprehensively examined estimates of future supplies of and demand for five rare earths critical to green energy technologies. As shown in Figure III: 8

Under the most pessimistic projection in the study, total global rare earths production will grow from 123,310 tons per year to 293,403 tons per year in 2017.

Under the most pessimistic projection in the study, total global rare earths production will grow from 123,310 tons per year to 293,403 tons per year in 2017.

By contrast, under the most optimistic projection in the study, 327,244 tons of rare earths would be produced worldwide in 2017.

Supply and demand vary for different rare earth elements. A few rare earths are available worldwide, but for several of the most critical ones, industries receive only 50 percent to 74 percent of the quantity demanded. By 2014 (at the earliest), supply of only one of the most important rare earths will meet or exceed demand, and for two of those top five, supply won’t match demand until 2016.

How and where will supply increase? Hatch projects China will remain the largest single source for rare earths through 2017. However, its dominance will wane sharply for some rare earths as early as 2013 and it will supply less than half of each rare earth element by 2017. New supplies are on the horizon.

Though reliable data for rare earth operations outside of China are lacking, the most likely sources include: Lovozero (located in the Kola Peninsula of the Russian Federation), Buena Norte (located in eastern Brazil), Orissa-Kerala (located in India) and Mountain Pass (located in California).

Mountain Pass: An American Rare Earth Mine. California’s Mountain Pass, the only mine in America dedicated to rare earths, closed in 2002 due to environmental problems and low prices. After spending an estimated $500 million on state-of-the-art equipment and significant environmental upgrades, it has reopened under new management.9 Molycorp, the owner, will mine only a handful of rare earth minerals, but it hopes to produce 20,000 tons per year by 2012. By contrast, China produced 124,000 tons of rare earths in 2009.

Mountain Pass formerly produced rare earths from the tailings of historical rare earth operations. Molycorp previously estimated Mountain Pass contained more than 2.24 billion pounds of rare oxides. However, based on mining fresh ore and new exploratory drilling, Molycorp now estimates there are 36 percent more reserves — a total of 2.94 billion pounds. The company says it hopes to increase production to 40,000 tons of rare earths per year in the near future.10

Globally, the number of new projects to explore for and develop rare earths has exploded in recent years. As of April 2012, Hatch found that 429 rare earth projects outside of China and India were being developed by 261 different companies in 37 different countries.11

Clearly, not all projects are equal. Some are being developed based on a handful of samples, while others have proven mineral reserves. There will never be mineral-resource estimates for most of these projects, and even fewer will become profitable ventures. The number and diversity, however, indicates that the so-called “rare earths crisis” is theoretically solvable.

Absent government ownership or funding, potential mineral resources must be estimated before these projects can be funded. Of the 429 projects mentioned above, as of April 2012, 36 projects have been either been formally defined as a mineral resource or reserve under standard industry guidelines, or were previously mined.12 These rare earth projects are most likely to become productive. The 36 projects include 12 operations in Canada, seven in Sub-Saharan Africa, six in Australia, four in the United States, three in Greenland, and one each in Sweden, Kyrgyzstan, Turkey and Brazil.

These operations, plus new mines in China and India, will provide the new supplies of rare earths needed for critical industries.

U.S. Policies Limit Domestic Production. By 1994, more than 410 million acres of public lands in the United States — 62 percent of all public lands — were effectively placed off limits to mineral exploration and development. The Clinton administration’s ban on roads on 58 million additional acres of the national forests placed these acres off limits as well.13 Except for national park acreage, all of these areas would potentially be open to exploitation if congressional and presidential actions were reversed to allow exploration and production. These lands include some of the most highly mineralized areas in North America.

The rare earth deposits in these inaccessible areas should be inventoried and, where potential commercial quantities are found, with appropriate environmental safeguards, opened for bids on leases. Furthermore, the regulatory approval process should be streamlined, simplified and shortened. In Australia and Canada, approval of new mines take two years on average, but in the United States the same process takes 10 years on average.

Conclusion. The United States can create jobs, reduce dependence on foreign resources, and improve national security by encouraging the domestic exploration and production of rare earths. The first step is to improve access to potential sources.

References and sources can be found online at www.ncpathinktank.org/pub/ib108.

- H. Sterling Burnett, “Will Green Energy Make the United States Less Secure,” National Center for Policy Analysis, Issue Brief No. 103, November 1, 2011. Available at http://www.ncpathinktank.org/pdfs/ib103.pdf.

- Joe McDonald, “China Rare Earth Supplier Suspends Production,” Associated Press, October 20, 2011. Available at http://abcnews.go.com/Technology/wireStory/china-rare-earths-supplier-suspends-production-14775856.

- “Overrun by Chinese Rivals, U.S. Solar Company Falters,” Wall Street Journal, August 17, 2011. Available at http://online.wsj.com/article/SB10001424053111904253204576512574160162128.html.

- Keith Bradsher, “Chasing Rare Earths, Foreign Companies Expand in China,” New York Times, August 24, 2011. Available at http://www.nytimes.com/2011/08/25/business/global/chasing-rare-earths-foreign-companies-expand-in-china.html.

- Ibid.

- Jason Mick, “China Cuts Off World’s Rare Earth Metal Supply,” DailyTech.Com, found at http://www.dailytech.com/China+Cuts+Off+Worlds+Rare+Earth+Metal+Supply/article23069.htm.

- Keith Bradsher, “Amid Tension, China Blocks Vital Exports to Japan,” New York Times, September 22, 2010. Available at http://www.nytimes.com/2010/09/23/business/global/23rare.html.

- Gareth Hatch, “Critical Rare Earths,” Technology Metals Research, August 2011. Available at http://www.criticalrareearthsreport.com.

- Julie Gordon, “Molycorp Speeds up Plan to Boost Rare Earth Supply,” Reuters, October 21, 2011. Available at http://in.reuters.com/article/2011/10/21/idINIndia-6003282011102.

- Manuel Quinones, “U.S. mine boosts reserve estimate by 36%,” Energy & Environment News, Heartland Institute, April 10, 2012.

- Gareth Hatch, “April 2012 Updates to TMR Advanced Rare Earths Project Index,” Technology Metals Research, May 1, 2012. Available at http://www.techmetalsresearch.com/2012/05/april-202-updates-to-the-tmr-advanced-rare-earth-projects-index/.

- Standard classifications of mineral resources and reserves include Canada’s NI 43-101 and Australia’s JORC Code.

- Paul Driessen, “Greens Shackle National Security — and Renewable Energy,” Townhall.com, October 2, 2010. Available at http://townhall.com/columnists/pauldriessen/2010/10/02/greens_shackle_national_security_-_and_renewable_energy.