Testimony of Donald L. Westerfield, Ph.D.

Professor, Webster University

Senior Fellow, National Center for Policy Analysis

Testimony Before the Committee On Health, Education, Labor, & Pensions

United States Senate

Small Business and Health Insurance: Easing Costs and Expanding Access

Mister Chairman, and Members of the Committee:

I am honored to submit this prepared statement to discuss with you " Small Business andHealth Insurance: Easing Costs and Expanding Access." The theme of this Hearing is so very appropriate for the state of the small business health care market that we face today. With approximately 41.2 million persons uninsured, we must admit that the current health care system needs urgent national attention. These hearings that you are conducting in this Committee will help to focus attention and resources on this grave national health care crisis.

I have written three scholarly works on health care issues: 1 1) Mandated Health Care: Issues and Strategies, 2) National Health Care: Law, Policy, Strategy, and 3) Insuring America's Uninsured: Association Health Plans and Their Impact on the Uninsured. The latter work specifically addresses issues this Committee is discussing today.

One solution to a major portion of the crisis of the uninsured in America is contained in the proposed legislation creating Association Health Plans as outlined in 109 th Congress, 1 st Session, S. 406 and H.R. 525, both entitled: "Small Business Health Fairness Act of 2005."

The Small Business Administration estimates that only about 47 percent of small businesses (with less than 50 employees) offer health plans as contrasted with about 97 percent of large firms (with more than 50 employees). This gap between coverage in large versus small employers is unacceptable. The contrast is even greater between large employers and those with less than 5 employees.

As I review that arguments for and against the formation of AHPs, I see that the issue is divided into two major camps. Among those in the opposition camp, we typically find a combination of large insurers which stand to lose market share if the AHP becomes a national reality, a combination of state regulators who would impose unfunded mandates on AHPs and who risk losing administrative power and control at the state level, a combination of special interests, representing literally hundreds of narrow causes, who lobby states to have their benefits made mandatory in the employer plans, and a spectrum of those who know of abuses and plan frauds by non-AHP entities that resemble AHPs.

In the other camp are those who support AHPs – typically a spectrum of small employers who have businesses that range in size from 1 to 50 employees and have been subjected to skyrocketing rates and who have been abandoned by insurers no longer writing business in the small group market.

Market Concentration And Market Power – A number of economists have suggested that large insurer opposition to Association Health Plans, among other things, stems from their desire to retain their market position without the threat of competition from newly formed Association Health Plans. The large insurers have networks at the insurer level and at the provider level, enabling them to wield enormous market power in the small group market. Through establishment of national networks and contractual agreements with provider networks, large insurers have accumulated disproportionate market shares and power in given geographical and market areas.

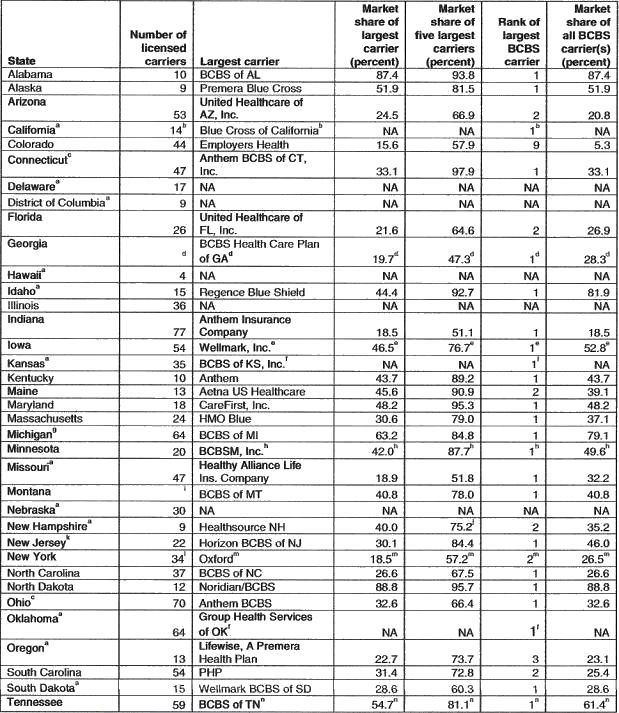

The General Accounting Office (GAO) 2 derived a table (attached), Table 1: Number of Carriers, Largest Carrier, and Market Share Data for Small Group Health Insurance, GAO-02-5236R State Small Group Health Insurance Markets (March 25,2002), presenting the number of carriers, largest carrier, and market share data for small group health insurance for 37 states. It is interesting to observe from the table that Blue Cross and Blue Shield (BCBS) was the largest carrier in 25 of the 37 states, and that BCBS was among the top 5 largest carriers in all but 1 of the remaining 12 states. Additionally, the "five-firm concentration ratio" for the largest carriers represented 75 percent or more of the market in 19 of the 34 states supplying that data, and they represented greater than 90 percent of the market in 7 of those states. Their market shares have given them significant market/monopoly power in the small group market.

The concentration of market power can adversely affect the market for health plans. A review of the development of health plans in the State of New York is an eye opener for those who are not aware of the degree to which large insurers, those who typically oppose Association Health Plans, dominate the market. The 2001 study by Gerard Conway, 3 for the Medical Society of the State of New York is an education in market concentration. In Section IV of that study, Conway explains how "barriers to entry" such as regulatory barriers, advertising, exclusive contracts, networks, etc. are used to prevent or slow down the entry into a highly concentrated market. He states:

"All of these factors can operate as formidable barriers to entry for a new health insurance company trying to establish a foothold in a concentrated market, and even more so in the highly concentrated markets identified in this study."

Impact of State Mandates – The record of witness testimony before the U.S. Senate and before the U.S. House of Representatives indicates that insurers have practically abandoned the small group health plan market, due largely to the administrative hassle and financial burdens of state mandates such as "guaranteed issue" and "community rating." While these two state mandates, unfunded by the states, were designed with good intentions, they mandate coverage and rating that is contrary to sound business risk management. The mandates artificially superimpose a social welfare function upon small employers that causes them to pay for benefits that they do not want. Additionally, they are a major reason for small insurers to abandon whole markets in several states. Ray Keating 4, Economist for the Small Business Survival Committee, states: "For example, New Jersey imposed guaranteed issue in the individual market in legislation passed in 1994. From December 1994 to January 2002, among four insurers offering family coverage during this period, monthly premiums increased by 556% (Aetna), 344% (Blue Cross Blue Shield NJ), 612% (Metropolitan Life), and 471% (National Health Insurance).

In Kentucky, after the state adopted guaranteed issue and community rating in 1994, 45 insurers fled the state and premiums skyrocketed. Also in 1994, a similar scenario played out in New Hampshire in response to passing guaranteed issue and community rating. In a November 1995 column, SBSC chairman Karen Kerrigan explained what happened in New York after it imposed guaranteed issue and community rating in 1992: "Since then, several major insurers simply stopped serving the market altogether …"

Large insurers with large market shares, national networks, and excessive market power argue that AHPs should be subject to these state mandates. It is clear that the giant insurers have a vested interest in placing as many restrictions on the AHPs as is possible because the mandates are a form of "barriers to entry," that are designed to discourage the formation and development of AHPs. Additionally, as the size of the AHP increases, the giant insurer's relative market power decreases.

Community Rating Bands and Minimum Loss Ratios State Mandates – A January 2003 Small Business Administration study 5, "Study of the Administrative and Actuarial Values of Small Health Plans" (page 20) describes the community rating bands as "Twelve states have community or modified community rating which does not allow premiums to vary by health status and only allows differences in premiums for geographic area or family size or in the case of modified community rating, also (GAO 2001). In 35 states, there are rating bands that allow premiums to vary by health status and age but the variation is limited (e.g., plus or minus 10% or plus or minus 25% of a projected average rate)."

In commenting on the loss ratio mandate, the Small Business Administration study, just cited, states 6:

"Loss ratios (ratio of medical expenses to premiums) are used by state insurance departments to assess solvency and document the need for rate increases. Several states require a minimum level of loss ratio for small group insurance. The minimum ratios are 65% for Florida, 50% for Minnesota, 75% for New Jersey, 75% for New York, 60% in Oklahoma, and 73% for West Virginia …"

The Association Health Plans are preempted through ERISA from being subject to these mandates. Testimony from witnesses before the U.S. House of Representatives and before the U.S. Senate substantiate that these mandates contributed to small insurers' decisions to stop conducting business in the given states.

The Myth of "Cherry Picking" The old myth of "cherry picking" is presented by the large insurers in almost every Congressional venue. That argument is essentially that AHPs will admit only healthy groups and discourage unhealthy groups in the association. As a matter of policy, the Department of Labor would not permit this practice. Additionally, Sections 804 and 805 of the of the proposed "Small Business Health Fairness Act of 2005" regulate this type activity.

This "cherry picking" term could equally be applied to the underwriting practices of the large insurers themselves. For years, they have excluded whole segments of the small group market or geographical areas where their underwriters determined it was not profitable to underwrite business. Just because they have done so, they should not claim that AHPs will follow their practices.

Innovative Health Plan Options – With approximately half of small employers not offering health plans, it is clear that something is wrong with the health care system. It is also clear that insurers are not offering plans that are affordable, or that the plans that they offer are not appropriate with respect to composition of benefits desired by employers, or both.

One of the main cost and desirability features of AHP plans is that the plans can be specially tailored to fit the specific needs and desires of the given workforce. Plans that must arbitrarily contain benefits and features that the employers and employees do not want and do not want to pay for often are the reason for "take up" rates to be low and for employees to prefer cash or no plan rather than be forced to take what they do not want.

Dr. Merrill Matthews 7 from the Council for Affordable Health Insurance, in his testimony before the Small Business Committee of the House of Representatives, asks for less regulations so that more options may be made available. He states: "I think if you were to remove some of those regulations, give them a little more freedom out there, you would find them creating policies that are very affordable in a lot of areas."

The AHP will allow employers to respond to the needs of the workplace, insuring more of the uninsured with health plans specifically designed to fit the needs of the workplace.

Cross-Subsidization In its testimony on February 6, 2002, Blue Cross and Blue Shield 8 argued that the AHPs should have to subsidize sick, high-cost groups while over-charging healthy, low cost groups across all products offered by the Association Health Plans. Not only does this not make sense from a risk management point of view, but it also requires the employer to bear the brunt of welfare functions that are more appropriately the responsibility of the state. Additionally, these mandatory subsidies are a form of indirect taxation and a monopoly barrier to entry.

There is a significant "social welfare loss" associated with charging a higher price than the value of the product in one market and providing an unearned subsidy to another part of the market or another market altogether. The Association Health Plans should not have to bear the financial and social burden of individuals that are not members of the employer's workforce and are not a member of a given AHP. Under the cross-subsidization scheme, the AHP would be forced to cover less healthy groups that do not join the AHP.

The argument, used by large insurers, to subject Association Health Plans to any arbitrary cross-subsidization scheme is another form of the "monopoly barriers to entry" encouraged by those insurers with excessive market power.

Uniform Regulation Under the Department of Labor – Perhaps the greatest argument for Association Health Plans is that they will be regulated by the Department of Labor and preempted from mandates of the 50 states. The Department of Labor will be a watchdog to carefully enforce regulations under which the Association Health Plans will operate. By preempting state mandates, the AHPs will be able to form national organizations and not be whip-lashed by conflicting mandates from the 50 different state insurance commissions.

Solvency, Fraud, and Abuse – Section 806 of the proposed "Small Business Health Fairness Act of 2005" outlines the Department of Labor provisions for regulating the solvency and financial activities of the AHPs. The Honorable Elaine L. Chao, Secretary Of Labor, in her testimony before this Committee 9 stated:

"Let me take this opportunity to focus on the Department's current efforts to combat health insurance fraud. AHP legislation will help address this serious problem by providing an attractive, cost-effective alternative to fraudulent health plans.

The Department combats health insurance fraud through both education and enforcement. By educating small employers, we can alert them to ways they can protect themselves and their employees from fraudulent health insurance schemes. The Department also devotes significant resources to enforcement efforts. Our efforts have been effective in closing down fraudulent health plans and, in some cases, recovering money for their victims.

The Department of Labor has firsthand experience dealing with group health plan regulation, as well as combating insurance fraud. The Department of Labor currently administers Employee Retirement Income Security Act (ERISA) protections covering approximately 2.5 million private, job-based health plans and 131 million workers, retirees and their families."

Dangers of the Status Quo – The Committee On Small Business & Entrepreneurship is commended for conducting this hearing on a matter so vital to the health of this nation. The testimony of witnesses for Association Health Plans have given the Committee insights regarding the plight of small employers trying to offer a quality product at a reasonable price, while trying to provide health care coverage for their employees. It is evident from their testimony that we are in the middle of a health care crisis. Our health care system, with its patchwork of regulations in the various states is increasingly causing insurers to abandon segments of the small business market and, in some cases, abandon whole states due to state mandates.

Gerard Conway, 10 of the Medical Society of the State of New York, said it best when he argued that it would take years to build a network, especially in view of existing exclusive contracts (which are themselves monopoly barriers to entry) between existing insurers and providers. The large insurers got their start in a climate conducive to start-up and expansion because there were millions who were uninsured and that seemed to be a solution. We are now in an acute health care crisis that begs for immediate attention and action. The Association Health Plan will not be a total cure for the problem, but millions of the uninsured desperate for small group insurance need relief. From the news releases and testimony before hearings it seems that those who have such strong opposition to the AHPs are those who typically stand to lose political control or market share. Similarly, it seems that those who are pleading for relief via the AHP are those throughout the small group market who have been disenfranchised in one way or another from coverage through an employer health plan.

The status quo is not working now. Our health care crisis will continue unless Congress is willing to take the bold step and help Association Health Plans cover millions of the uninsured, who urgently need help.

Perhaps the most important advantage of the Association Health Plan, in the eyes of the small employer, is that the AHP would allow them to be able to match the economies of scale and market power of the larger entities. The result would be greater affordability and greater availability of health plans to the uninsured.

Thank you for giving me this opportunity to present testimony regarding this health care issue that so gravely affects our nation.

References

- Westerfield, Donald L. Mandated Health Care: Issues and Strategies (New York: Praeger Publishers, 1991); Westerfield, Donald L. National Health Care:Law, Policy, Strategy (New York: Praeger Publishers, 1993); Westerfield, Donald L. Insuring America's Uninsured: Association Health Plans and Their Impact on the Uninsured ( Washington, D.C.: National Center for Policy Analysis).

- Bond, Hon. Christopher "Kit". Private communication from Director , Health Care – Medicaid and Private Health Insurance Issues, transmitting GAO-02-536R State Small Group Health Insurance Markets [Table 1. Number of Carriers, Largest Carrier, and Market Share Data for Small Group Health Insurance Carriers, by State], March 25, 2002.

- Conway, Gerard. (2001) "Competition In The Managed Care Health Insurance Market In New York State: A Regional Analysis" Medical Society of the State of New York.

- Keating, Raymond, Small Business Survival Committee. Discussing "The Small Business Health Market: Bad Reforms, Higher Prices, and Fewer Choices" Testimony Before the Committee on Small Business, U.S. House of Representatives , 107 Cong. 2nd Sess., (July 11, 2002), Washington, D.C.

- Small Business Administration, Office of Advocacy. Study of the Administrative Costs and Actuarial Values of Small Health Plans, (January 2003), Washington, D.C.

- Small Business Administration, op. cit.

- Matthews, Merrill. "The Small Business Health Market: Bad Reforms, Higher Prices, and Fewer Choices" Testimony Before the Committee on Small Business, U.S. House of Representatives , 107 Cong. 2nd Sess., (July 11, 2002), Washington, D.C.

- Lehnhard, Mary. "Small Business Access to Health Care." Serial No. 107-41. Hearing Before the Committee on Small Business, U.S. House of Representatives, 107 Cong. 2 nd Sess., February 6, 2002. Washington, D.C.

- Chao, The Honorable Elaine L., Secretary of Labor, Testifying before the U.S. Senate Committee on Small Business & Entrepreneurship, "The Small Business Health Care Crisis: Possible Solutions," February 5, 2003. Washington, D.C.

Table 1. Number of Carriers, Largest Carrier, and Market Share Data for Small Group Health Insurance Carriers, by State – December, 2000