Source: Forbes.com

Should a business buy its own building in this market? A small business owner recently asked me that very question. I think it’s a great idea to consider in many areas, given the weak real estate market, but it’s not a slam dunk decision.

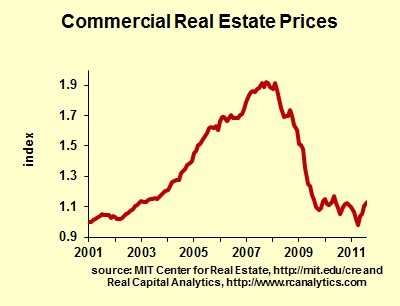

Prices for real estate are soft in most parts of the country, and that’s true for commercial and industrial properties as well as houses (as of December 2011). The non-residential real estate sector was not overbuilt as housing was. When the recession came, however, businesses cut production, laid off staff, and in some cases plain went out of business. That clobbered occupancy of non-residential properties. With higher vacancy, the landlords cut rents to attract tenants. The result has been lousy operating earnings for property owners and thus falling prices.

Last January (2011) I offered this advice:

If you are in strong financial position, consider buying the property you now rent. Purchase prices are relatively low and financing costs are cheap—for those companies with sound financials. If you’re skating on thin ice in terms of equity, forget this plan. But if you have solid capital and your long-term plan involves your current property, then buying could be a great deal. (11 Business Challenges in 2011: Real Estate Markets Tightening).

Since then, vacancy rates have dropped a little in most markets and rents have stabilized. However, very little new construction has been completed, and what has been built is almost all owner-occupied or build-to-suit. Almost no speculative real estate has been constructed this past year. Thus when the economy improves, rents will rise immediately. Normally developers see this coming and put up new buildings in anticipation of better conditions, but that isn’t happening. Developers are as gloomy as everybody else right now, few have much equity left, and lending standards are very tight.

That’s the argument for our small business owner buying his own building, but there’s another side to consider. This fellow has almost his entire net worth tied up in his company. Like many other entrepreneurs, he’s thinking about buying a building as a personal asset or through a separate company. Then his business would sign a long-term lease for the property.

Many business owners have succeeded with this approach, but there’s a large risk. This owner is thinking about retiring in a few years, selling his business at that time. Many small businesses are sold with seller financing, meaning he would get a portion of the price up front, and then the buyer would pay the rest of the purchase price from company earnings over the next few years. Now suppose that the buyer fails at running the business. The original owner gets a double whammy: he is not getting paid for his business, and his building just lost its only tenant. Ouch. The original owner still has to make mortgage payments on his building, only now those payments come out of his own pocket.

(If you are a small business owner thinking about selling, read my article, “Selling A Business on a Note.”)

This isn’t to say that buying the building is a bad idea, but it heavily increases the business owner’s risk. Real estate has an important role to play in a diversified investment portfolio, but many small business owners are not adequately diversified. Having most of one’s net worth in a small business exposes the owner to risk. Then adding real estate related to the business, and further related to the general health of the local economy, increases risk. I encouraged the business owner to think about a financial planner who can advise on stock and bond investments.

My advice would have been different for a business owner in different circumstances. Say the owner was mid-40s, anticipating running the business for at least another 20 years. She had found the ideal building for her business, and it was for sale at an attractive price. Assuming that she could afford the payments, I’d say go for it—this is a great time to buy real estate, so long as the risk issues don’t weigh too heavily against it.