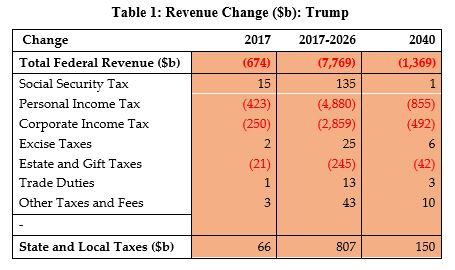

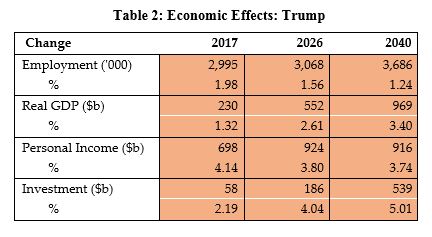

The Trump Tax Proposal

- Overall calls for a federal tax schedule with four brackets:

- 0%

- 10%

- 20%

- 25%

- It would also eliminate the marriage penalty and the Alternative Minimum Tax (AMT)

- The charitable giving and mortgage interest deductions would remain in the tax code.

- Eliminates the death tax.

- Calls for offsets to “pay for the tax cuts.”

- Eliminate loopholes for the exceptionally high income earners and phase out itemized deductions and end the tax exemption for life insurance interest.

- Ends tax treatment of carried interest for speculative partnerships.

- Reforms corporate taxation with a 10 % repatriation tax on overseas holdings.

- He would also reduce or eliminate loopholes and enact a cap on business interest expenses.

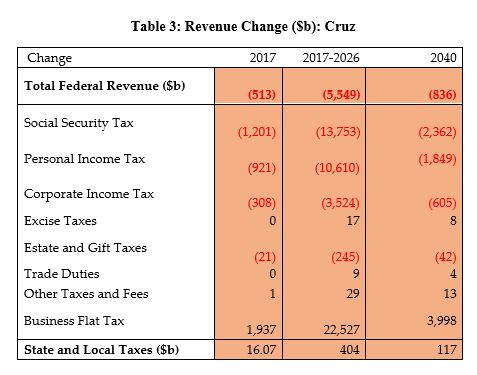

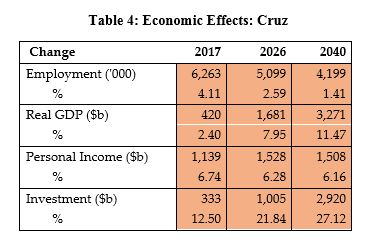

The Cruz Tax Proposal

- Reforms by consolidating existing brackets into single rate of 10% on the following:

- Wages, salaries, interest, capital gains, dividends and business income.

- Increases standard deduction.

- Expands

- the Earned Income Tax Credit.

- the Child Care Credit.

- Eliminates most deductions except for

- Charitable Tax Credit.

- Home Mortgage Deduction, capped at principal value of $500,000.

- Establishes

- Universal Savings Accounts.

- Eliminates

- Death Tax.

- Overseas Profits Tax.

- Alternative Minimum Tax (AMT).

- Affordable Care Act Taxes.

- Corporate Tax.

- Establishes a Business Transfer Tax or Value Added Tax at a 16% rate.